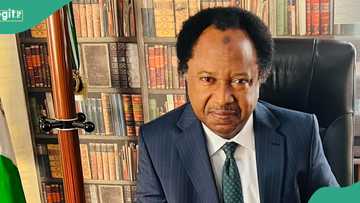

“Wicked Arrangement”: Pensioners Send Save Our Soul Message to Lagos Govt as Sanwo Olu Pays Retirees

- Governor Babajide Sanwo-Olu said he brought succour to former civil servants in Lagos state by paying all their outstanding unremitted pension contributions to date

- However, speaking to Legit.ng, pensioners alleged that they are being short-changed

- The retirees narrated how the PenCom-powered CPS arrangement is allegedly a “greedy business set-up”

Legit.ng journalist Ridwan Adeola Yusuf has over 9 years of experience covering public journalism and governance.

Ikeja, Lagos state - Some pensioners in Lagos have faulted the implementation of the contributory pension scheme (CPS) reform act 2007 in the state.

It would be recalled that recently, Governor Babajide Sanwo-Olu disclosed that Lagos state has cleared all pension backlogs with the payment of N4.46 billion to 2,000 retirees.

Source: Getty Images

Contributory pension: Retirees lament

Sanwo-Olu who stated this at the 105th batch retirement bond certificate ceremony in Ikeja, Lagos, described the event as a historic milestone.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

The governor also revealed that since the inception of the CPS, the state government had paid N141,242,852,606.49 to 35,191 retirees.

According to him, under his administration alone, N59,701,420,500.22 was paid to 17,039 retirees, making Lagos state a top performer in pension payments.

Sanwo Olu said:

“Today (Thursday, July 4, 2024), I am pleased to announce that another 2,000 retirees will receive bond certificates worth a total of N4,461,659,536.82. These funds and their monthly contributions have already been remitted into their respective retirement savings accounts with the pension fund administrators (PFAs).”

Following the announcement by Sanwo-Olu, some members of the Lagos chapter of the Nigeria Union of Pensioners (NUP), under the CPS, have shared their agony. According to them, the payment made to the CPS pensioners is paltry. They alleged “exploitation” under the guise of managing their benefits and entitlement.

Back in 2004, pensioners were compulsorily asked to join Retirement Annuities operated by Cornerstone Insurance Plc, or programmed withdrawals under the CPS operated by PFAs and managed by the National Pension Commission (PenCom). However, some stakeholders have argued that by virtue of the 2014 amended act, the narrative of retirees’ plights under CPS does not change the situation any better.

Describing the CPS as “obnoxious”, the retirees said it denies them having a greater share of the lump sum after retirement, and dispenses a meagre monthly pension to them across the board.

Taoheed Akinkunmi, a former Lagos civil servant under the ministry of education who retired in 2023, told Legit.ng:

“The N4.4 billion naira that they are saying they paid is just propaganda. It is pensioners’ bond. When some people collected the outstanding bonds, they were disappointed. Some people collected N1.9 million. So they were like even if they had been paid the N1.9 million since 2007 and they still put it under PFA, there is no way they can collect N1.9 million with the interest accrued.”

Read also

Jubilation as Lagos Gov Sanwo-Olu gifts corpers N100,000, pledges N5bn for NYSC site, video trends

He continued:

“Then, as at (sic) 2007, if someone was given that N1.9 million, is the money the same value as the realities of today?”

“The worst part of it is that we are only given 25 percent of the bond and our contributions up to the time we retire. The remaining will be given bit by bit monthly based on the annuities withdrawal.”

Akinkunmi questioned why the retirees are not allowed to manage their money themselves.

Furthermore, the disgruntled pensioner stated that retirees should have been paid their entitlements at once, or at least 75 percent.

He reasoned:

“If someone is given say N10 million now, he or she will know what to do with the money.”

In the same vein, another disappointed retiree who preferred anonymity narrated her ordeal.

She explained:

“I served the government from July 15, 1981, and retired on July 15, 2016, on salary grade level 14, having worked for a mandatory period of 35 years and attained the maximum age of 60 years.

“For all the years I put in, the total balance standing to my credit was N6,745,823.34. Out of this, I was paid a meagre 25% which amounted to N1,686,455.84 while the balance of 75% was greedily retained by PFA for their selfish investment in capital market and other large institutions with high returns which is never added to retirees' paltry monthly payment while still alive.

“I received N26,703.15 every month since 2016 till now despite the huge profits declared every year under CPS which can barely buy a loaf of bread at the price of N1,000 currently per day for 30 days. The same applies to all our colleagues under this wicked and unfair arrangement.

“The N6,745,823.34, if given to me as a whole, will earn me a yearly income of N674,582.33 at 10% and N56,215.19 monthly as against the N26,703.15 which I have been receiving as monthly pension for the past eight years without increase.”

Contributory pension scheme: LASPEC DG makes clarification

Meanwhile, Babalola Obilana, the director-general (DG) of the Lagos State Pension Commission (LASPEC), stressed that as of March 31, 2007, gender, birthdate, grade level, date of appointment, among others, are the key factors for the computation of the accrued right. The salary earned as of 2007 was also considered, he said.

As a result, from April 2007, Obilana said Lagos state has been remitting contributions into individual retirement savings accounts (RSAs) of all employees to date.

He told Legit.ng exclusively:

"These pension contributions from April 2007 remitted to their RSAs are being invested by the PFAs and the gains/interest are reflected in their pension balances."

On the allegation that Lagos is averse to paying pensioners on a lump sum basis, the LASPEC DG explained that it is not correct.

He said:

"Under the CPS, lumpsum payments are mandatory, payable after sufficient provision for monthly pension is made and it is reflective of the individual circumstances of each pensioner as determined by the template approved by PENCOM."

Furthermore, Obilana stated that the RSAs are established as a function of pension laws and a key objective is to ensure the safeguard of the welfare of employees by ensuring that they have adequate financial resources "to sustain themselves after leaving the workforce and not for individual management."

Read more Lagos state-related news

- “Why Nigerians should be patient with Tinubu”: Oba of Lagos explains amid first lady’s visit

- Jubilation as Lagos governor, Sanwo-Olu gifts corpers N100k pledges N5bn for NYSC site, video trends

- Flooding: Lagos state govt demolishes illegal structures blocking drainage channel, video emerges

Sanwo-Olu promises to transform Lagos

Earlier, Legit.ng reported that Sanwo-Olu celebrated his birthday with a heartfelt message of gratitude and renewed commitment to Lagos' residents.

In a statement marking his special day, Governor Sanwo-Olu reflected on his journey and expressed appreciation for the support that has propelled him forward in his role as the leader of Nigeria’s economic powerhouse.

PAY ATTENTION: Unlock the best of Legit.ng on Pinterest! Subscribe now and get your daily inspiration!

Source: Legit.ng