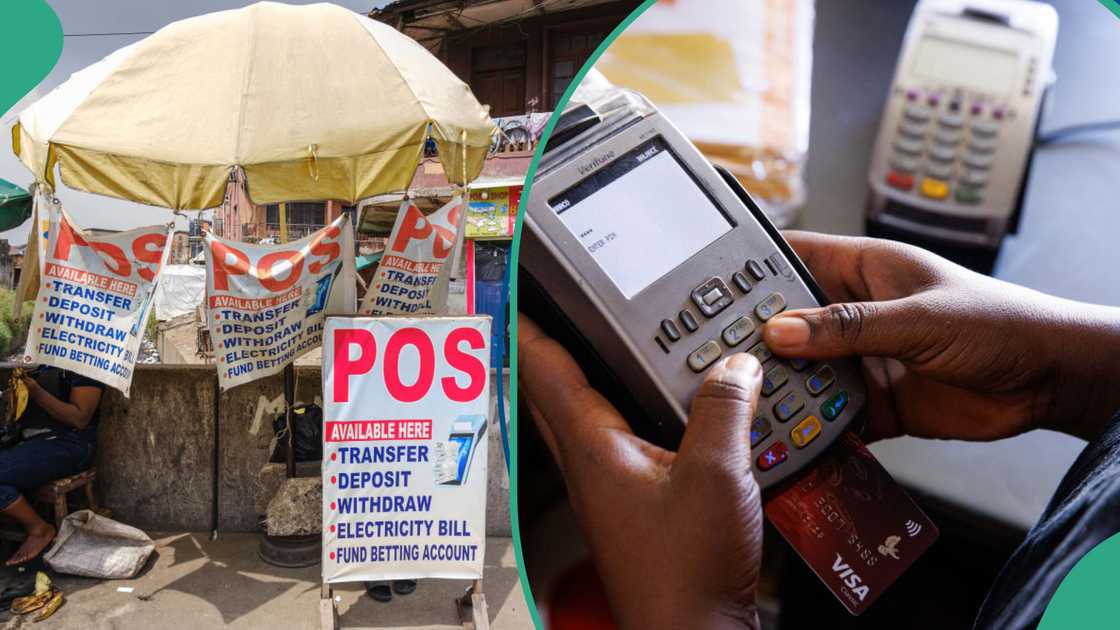

PoS Operators Increase Withdrawal, Deposit Fees as Fintechs Begin N50 EMTL Charges

- PoS operators have adjusted their withdrawal and deposit charges following new EMTL charges

- The federal government ordered Moniepoint, Palmpay, and other fintech companies to charge N50 on customers' accounts for every N10,000 deposit

- The fintech sector processed transactions worth N46.91 trillion in 2023, and the amount has been growing every year

Legit.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

Point of Sale (PoS) operators across Nigeria have increased their withdrawal and deposit fees following the introduction of a new N50 Electronic Money Transfer Levy (EMTL) on their transactions by fintech companies.

Source: Getty Images

Legit.ng reported that the federal government ordered Opay, Moniepoint, and other fintech companies to begin charging a N50 EMTL fee on every N10,000 deposit in their customers' accounts.

Read also

“Nigeria’s money has finished": Governor Soludo blasts NNPC for failing to remit oil funds to FG

This is part of the Nigerian government's drive to generate additional revenue from digital financial services.

Previously, only traditional bank customers paid the N50 EMTL charge.

PoS operators charge

POS attendants charge N100 on transactions less than N5,000 and N200 on transactions above.

However, some POS operators told Legit.ng they have started reviewing their fees with the newly introduced levy.

A POS attendant, Chinedu Alozie, who uses Moniepoint in Lagos, expressed concern that the new EMTL levy has reduced his profit.

“I charge N100 on every below N5,000 transaction. I have adjusted my fee to N150 for deposit made on transfer.

Another PoS operator, who gave his name as Segun, said:

"For me, I have started charging an extra N50 for transfers, in addition to my normal charge. For customers sending funds via transfer of up to N10,000, I collect an extra N50 to cover the EMTL levy."

CAC moves to shutdown POS operators

Legit.ng earlier reported that the Corporate Affairs Commission (CAC) had announced that it would begin taking stringent actions, including the potential shutdown of Point of Sale (PoS) businesses, following the expiration of its September 5 registration deadline.

This decision came due to non-compliance with the CAC's registration directives.

In a public notice released on Friday, September 6, 2024, the CAC expressed that businesses failed to register, suggesting that they may be involved in “unwholesome activities"

Proofread by Kola Muhammed, journalist and copyeditor at Legit.ng

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng