Kuda Bank Launches SofPoS, Lets Users Accept Card Payments From Their Phones, Ends Free Transfers

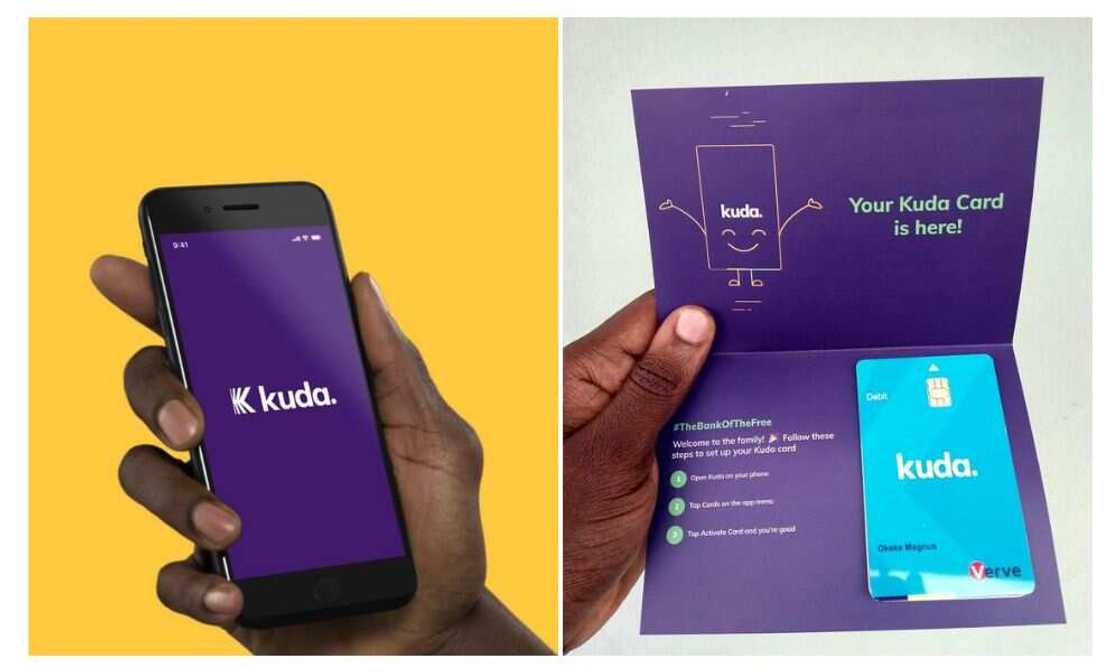

- Kuda Bank has launched a new feature that turns users’ smartphones into a PoS machine

- The new feature allows customers to accept contactless cards and use their phones and tablets as terminals

- However, the bank announced that it is ending its iconic 25 free monthly transfers to every bank on March 17, 2023

PAY ATTENTION: See you at Legit.ng Media Literacy Webinar! Register for free now!

Nigeria’s first digital bank, Kuda, has added a new feature to its Kuda Business app, which includes Sales Mode, Kuda Payroll, and business registration.

TechPoint reported that the Nigerian neo bank would launch a SoftPoS feature, enabling users to accept smartphone card payments.

Source: UGC

Customers to use plastic or virtual cards

SoftPoS permits customers to accept contactless cards and turn their smartphones or tablets into a secure payment terminal or Point of Sale (PoS).

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

The feature runs on Android version 8.0 or higher with an NFC module, while payments can be made using plastic or virtual cards.

The bank also stated that it is ending its free monthly interbank transfers for Business Account holders, effective March 17, 2023.

The bank said it would charge a flat rate of N10 per transfer to any bank, allowing customers to save about N15,000 yearly.

Kuda ends 25 free monthly transfers to other banks

Kuda Bank introduced 25 free month transfers to any bank in 2019.

Last year, it announced it would start to charge N50 Stamp Duty on all deposits above N10,000 weekly.

In November last year, the bank raised about $10 million, touted as the most prominent seed round by an African startup.

The funding comes as Babs Ogudeyi, the bank’s CEO said they are positioning Kuda Bank to become the go-to bank for Africans both at home and abroad, TechCrunch reports.

He said:

“We want to bank every African on the planet, wherever you are in the world,” he said in an interview. It’s starting first in its home market: since launching in September 2019, it has picked up around 300,000 customers — first consumers and now also small businesses — and, on average, processes over $500 million of monthly transactions.

Nigerians report being locked out of Their Kuda Bank Accounts

Legit.ng reported earlier that Kuda Bank customers in their thousands are crying after allegedly being locked out of their accounts on Saturday,

November 12, 2022. Social media reports show most Kuda Bank users lamenting that they can either not log in or have access to their accounts.

Others say their accounts were deactivated without their consent.

Source: Legit.ng