Electronic Banking Services Customers Prefer in Nigeria As Cashless Transactions Hit N345.04trn

- The Central Bank of Nigeria(CBN) is exploring various options to boost cashless transactions by introducing limits on cash withdrawals

- The new CBN's policy which will kick off in January is set to increase the number of Nigerians using electronic means for transactions.

- Data from NIBSS shows that Nigerians between in 11 months completed N345.04tn worth of transactions electronically

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

From January 9, 2023, the Central Bank of Nigeria (CBN) has limited the maximum cash withdrawal Nigeria can initiate over the counter, Automatic Teller Machine (ATM).

The CBN's goal is to lower the amount of cash in circulation and eliminate Nigeria's overwhelming preference for cash transactions, resulting in a cashless economy.

The move by CBN is expected to see many Nigerians do their business via electronic payment systems.

Read also

CBN bows to pressure, increases weekly cash withdrawal limit for individuals, corporate organisations

Source: Facebook

These payment systems include the internet (web), point-of-sale (PoS), mobile money, NEFT, USSD, mobile app transfers, and ATMs would acquire popularity.

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

Nigeria's electronic transaction trend

Data obtained from Nigeria Inter-Bank Settlement Systems (NIBSS), shows that Nigerians recorded cashless transactions worth N345.04 trillion in 11 months of 2022(January to November).

This payment was executed via NIBSS instant payment service(NIP) which includes Bank Branches, Internet Banking, Mobile, ATM, POS, and USSD.

NIP is an account-number-based, online real-time inter-bank payment solution developed in 2011 by NIBSS.

Value of electronic transactions according to payment system

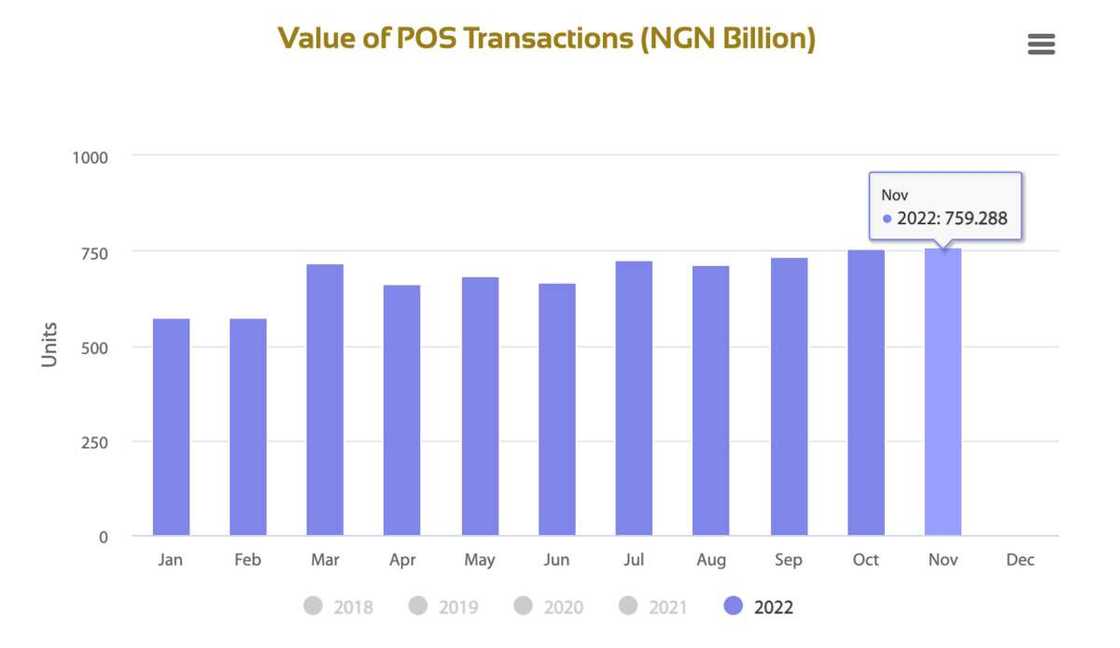

- POS- N7.56 trillion

- Mobile Transaction- N16.9trn

Volume of transactions by payment system

- POS- N1.06 billion

- Mobile Transaction- N609.4 million

- Cheque-3.72 million

- NIP- 4.57 billion

- e-BillsPay- 8.4million

Odinkalu: Nigeria's public debt profile has tripled in 7 years

In other news, rights activist, Chidi Odinkalu,has said Nigeria’s debt profile has increased three times in the last seven years since Muhammadu Buhari mounted the saddle as Nigeria’s president.

Read also

Lagos borrows over N658bn in seven years, debt stock now more than what states in four regions owe combined

Odinkalu said this in a tweet but did not expatiate as he only provided an undated chat from the Nigeria Bureau of Statistics (NBS).

Odinkalu further quoted data from Debt Management Office (DMO) that says Nigeria’s debt profile is increasing under Buhari.

Source: Legit.ng