Mastercard Announces Plans to Help Banks Offer Crypto Trading

- Mastercard card said it had concluded plans to offer crypto trading to people and make it easier for banks to be involved

- The payments giant said the programme would help banks offer crypto trading by acting as a bridge

- The company stated that those surveyed stated desire and willingness to get involved in crypto trading but said they would do so via their banks

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

The largest payment processing company in the world, Mastercard, is looking to offer crypto trading to the masses to make it easier for banks to be involved.

CNBC reports that the company plans to announce a programme that will help financial institutions like banks offer cryptocurrency trading by acting as a bridge between banks and a crypto trading company, Paxos, which PayPal uses to offer a similar service.

Source: Getty Images

Mastercard will handle regulatory compliance and security; the two main reasons banks cite for circumventing the asset class.

There has been scepticism by some consumers. Cryptos like bitcoin are prone to volatility as it has lost more than half their value this year.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

Since this year, the crypto industry has suffered billions of dollars in hacks, including bankruptcies that have plagued some exchanges.

How Mastercard will roll out the services

Mastercard’s chief digital officer, Jorn Lambert, said that the survey still indicates demand for cryptos, but about 60 per cent said they would rather test the platforms of their banks first.

Lambert stated that many consumers are really keen and delighted with crypto trading but would feel more confident and comfortable if their banks offered the services.

Huge investment banks like Goldman Sachs, Morgan Stanley and JP Morgan have special crypto teams but do not offer them to consumers.

The CEO of JP Morgan, Jamie Dimon, had recently called crypto trading decentralised Ponzis at an event.

Analysts say if banks embrace the move by Mastercard, it will amount to serious competition for Coinbase and other exchanges worldwide.

The payment giants said their role is to help banks on the right side of regulation by following compliance rules, verifying transactions and providing anti-laundering and identity monitoring services.

No information about participating banks

The company will pilot the product in the first quarter of 2023 and expand it to more geographies.

The company has not said which banks have signed on to the pilot programme.

Mastercard, like Visacard, has been in partnership romps in the crypto market.

Mastercard has partnered with Coinbase on NFTs and Bakkt to allow banks and traders in its network to offer crypto services.

Visa collaborated with FTX to offer debit cards in 40 countries and has more than 70 crypto partnerships.

Read also

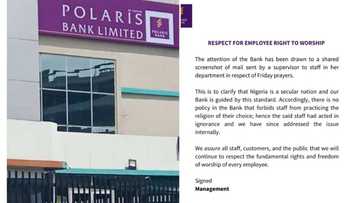

Polaris Bank's mail to staff Banning Friday prayers by Muslims draws backlash, bank clarifies statement

Cryptocurrencies were supposed to disrupt banks and intermediaries like payment companies, Mastercard and Visa.

Their blockchain technology allows transactions to move without intermediaries.

Cryptocurrency adoption overshadows interest in e-Naira

Recall that Legit.ng reported that the free-fall of the Nigerian currency, the Naira, at both the official and parallel markets, coupled with the Central Bank of Nigeria’s failure to pay adequate attention to Africa’s first CBDC, the e-naira, has led to a majority of Nigerians abandoning the nascent digital currency.

Nairametrics report from Google Trends and corroborated by Legit.ng indicates that the interest of Nigerians in the e-Naira has waned over time since it was launched on October 25, 2021.

From the date of the launch to the end of October last year, interest in e-Naira grew massively, overshadowing desires for cryptocurrencies.

Source: Legit.ng