Extreme Measures Employed by Lending Apps to Recover Loans Baffle Nigerians, Experts

- The activities of loan apps have left many people disturbed as they to the extent of threatening the lives of creditors

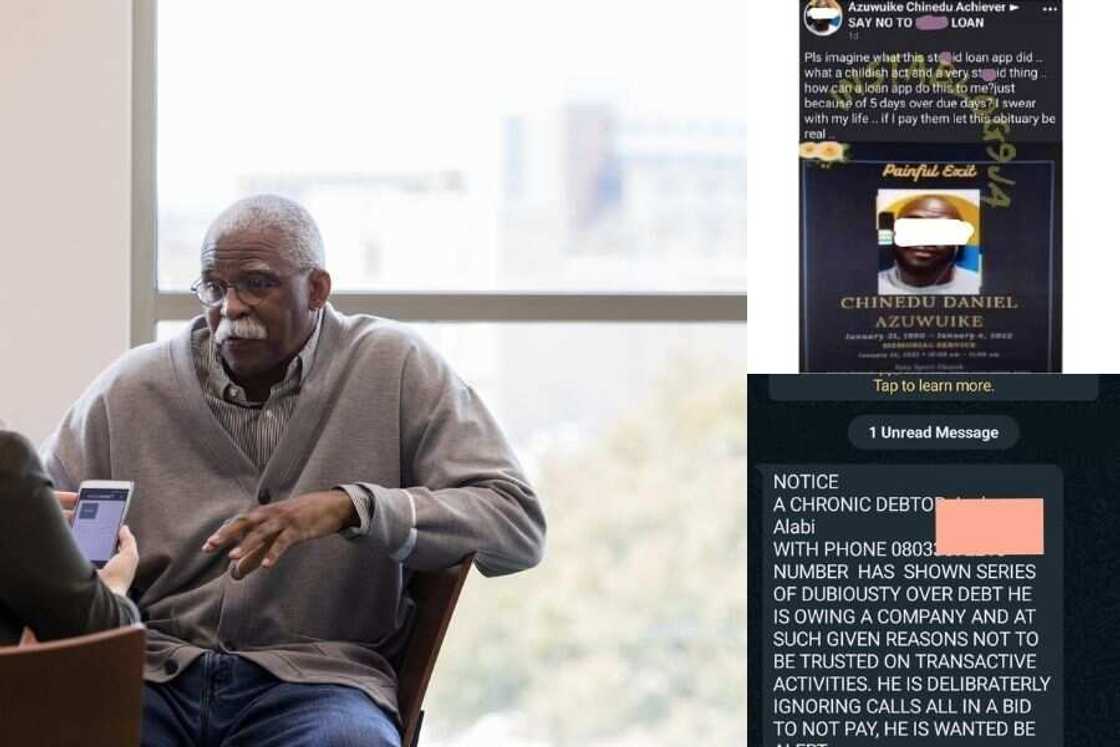

- In one extreme measure, one of the apps planned the obituary of one creditor and circulated on social media

- The Nigerian lawmakers are making serious moves to curtail their activities and bring sanity to the industry

The activities of loan sharks masquerading as lending apps in Nigeria have left the majority in the country worried as the apps use crazy methods in chasing and recovering their loans.

In a Facebook post by one Onyinye Mmoh, one of the loan apps went to the extreme measures of designing the obituary of its creditor, one Azubuike Chinedu.

Source: UGC

Declaring a creditor wanted

Another measure unlawful measure employed by another is declaring a creditor wanted and harassing contacts of those who owe them.

Do you have a groundbreaking story you would like us to publish? Please reach us through info@corp.legit.ng!

The activities of the loan apps have drawn the attention of lawmakers in Nigeria who are making moves to curtail their activities and bring regulation to the industry which has been left rudderless over the years.

Obtaining data without authorization

These apps, in the absence of a well-structured eco-system, rely on phone records of customers to ascertain their creditworthiness. They do this by scouring smartphone data including call logs, contact lists, GPS data, and texts, users can look beyond traditional banks to access credit.

But there’s just one problem. There’s growing evidence that the ease of access to quick, digital loans is leading to a growth in personal debt.

And as lending apps jostle for market share and revenue from interest payments, there are fears they will inadvertently nudge users towards indebtedness and poor spending choices.

Rate of defaults skyrocket

Meanwhile, Legit.ng reports that operators of lending apps in Nigeria are not having it easy. The rates of defaults by customers have more than doubled in the industry in the last two years.

Exacerbated by the COVID-19 pandemic and the torrid economic situations in Nigeria, lending apps are finding it hard to get their monies back from defaulting customers.

Experts who have monitored the operations of the novel credit givers say their casual approach to loan facilitation exposes them to more risk, especially in countries like Nigeria where identification is a challenge.

Source: Legit.ng