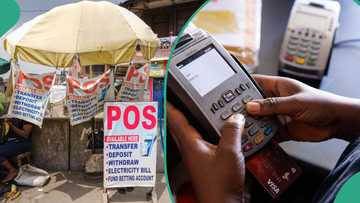

PoS Operators Raise Withdrawal, Deposit Fees After CBN’s Decision

- PoS operators have adjusted their withdrawal and deposit charges following the CBN's new guidelines

- The CBN's new directive on PoS operations in Nigeria limits daily cash withdrawals to N100,000

- Additionally, the federal government's decision to impose a new N50 Electronic Money Transfer Levy (EMTL) on every N10,000 transfer has contributed to these changes

Don't miss out! Join Legit.ng's Sports News channel on WhatsApp now!

Legit.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

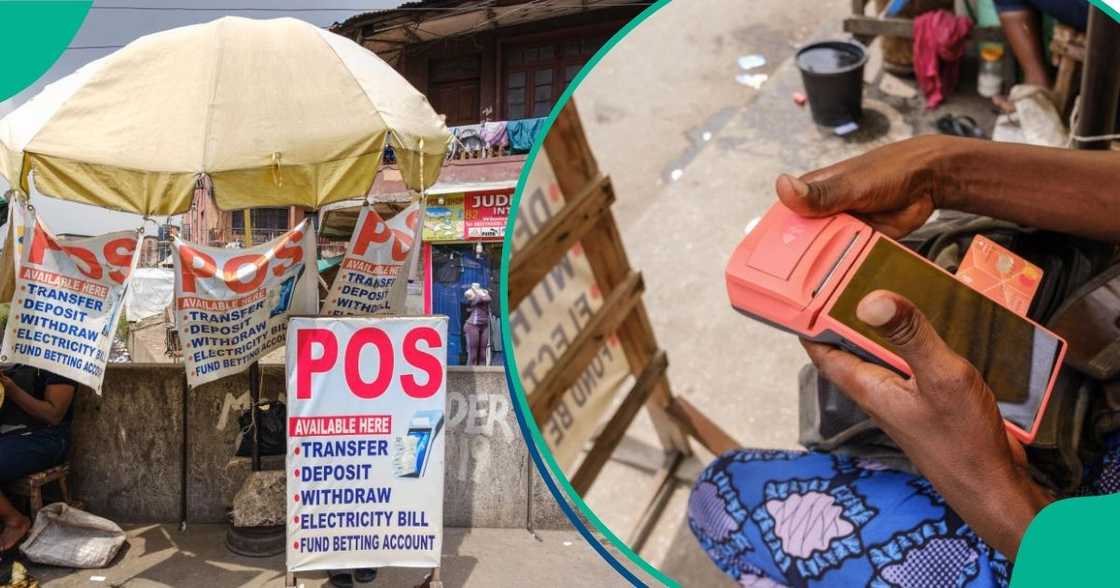

Point of Sale (PoS) operators across Nigeria have started implementing new withdrawal and deposit fees.

Some operators who spoke to Legit.ng said the changes are a response to current cash scarcity and the decision by the Central Bank of Nigeria decision to limit PoS operators' cash withdrawals to only N100,000 daily.

Source: Getty Images

Another reason given is that there is now an N50 Electronic Money Transfer Levy (EMTL) charge on every N10,000 deposit in their customers' accounts.

PoS operators charge

Previously, PoS attendants charged N100 for transactions below N5,000 and N200 for transactions exceeding that amount.

However, Kunle Adeleye, a PoS operator in the Iyana Ipaja area of Lagos, told Legit.ng that he has increased all charges by 100%.

He said:

"Before the CBN changes and the challenges of getting cash, my fee for withdrawals and deposits of N5,000 and below was N100.

"For amounts above N5,000, I charged N200, and for amounts above N10,000, the charge was N300. The charges applied to every N5,000 increment.

"Due to the operational changes, my fees are now N200 for N5,000 withdrawals and N400 for N10,000 withdrawals.

Another POS attendant, Helen Duru, said I have to adjust my charges due to the difficulty of getting cash.

"I buy cash daily, and it is not easy. If not for the fact that I have three registered PoS machines, I don’t know how I would be able to satisfy my customers.

I don’t think there is any need for the Central Bank to restrict cash withdrawals to only N100,000. The decision took us by surprise."

Bidemi,d another PoS attendant, also said:

"My fee is slightly different from others because I have a husband who works at a filling station, so cash is relatively easy for me to obtain.

"For a N5,000 withdrawal, I charge N150, and N300 for a N10,000 withdrawal. For every additional N5,000, my fee increases."

CBN confirms circulation of old naira notes is valid

In a related development, Legit.ng previously reported that the Central Bank of Nigeria clarified that all old N200, N500, and N1,000 banknotes will remain legal tender in Nigeria alongside the new naira notes in circulation.

The apex bank has reassured Nigerians not to worry about transacting with the old naira banknotes and has cautioned against spreading fake news.

The clarification was provided by Sidi Hakama, the CBN's acting director of corporate communications, in a statement published on its website.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng