Again, CBN Raises Interest Rates, Banks To Adjust Savings Accounts and Loans

- As part of its efforts to tackle rising inflation, the CBN has announced another interest rate increase

- This development means Nigerians will have to pay more to borrow from their banks, and existing loans will also be subject to review

- Additionally, Nigerian banks will adjust the interest rates on customers' savings accounts, increasing the returns on deposits

The Central Bank of Nigeria's Monetary Policy Committee (MPC) has increased the monetary policy rate (MPR), the benchmark for interest rates, to 27.50%.

The new rate is a 25 basis points rise compared to the previous level of 27.25% in September

Source: Getty Images

The MPC unanimously agreed to the hike in a bid to address the rising inflation in the country.

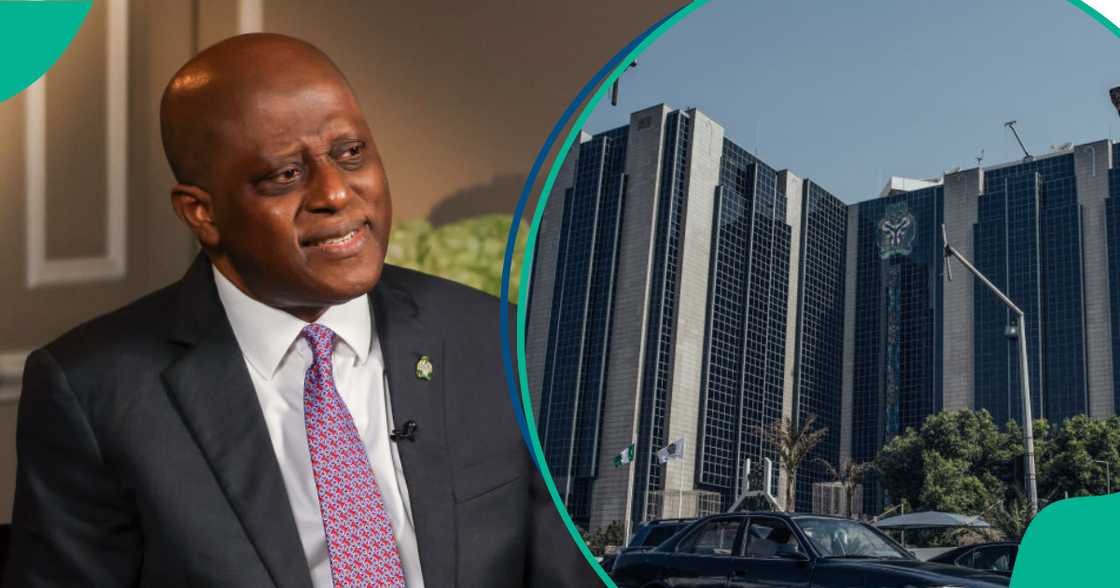

This decision was announced by Yemi Cardoso, the Governor of the CBN, who also serves as the Chairman of the Monetary Policy Committee (MPC), on Tuesday, November 26.

Other decisions reached at the MPC meeting

The Committee retained the Monetary Policy Reserve Ratio (CRR) at 50% for Deposit Money Banks and 16% for Merchant Banks.

The Liquidity Ratio (LR) remains unchanged at 30%, alongside the Asymmetric Corridor, which stays at +500/-100 basis points around the Monetary Policy Rate (MPR).

The CBN has been raising interest rates to combat inflationary pressures, but the impact has yet to be felt.

Impact of the new interests rate

One negative impact of the new rate is that the cost of borrowing will increase.

Financial institutions use the CBN benchmark interest rate to determine what customers will pay when applying for a loan.

Also, Nigerians with outstanding loans will receive a rate review to match the CBN's latest interest rate decision.

On the other hand, the new interest rate means Nigerians will earn more from their bank savings.

Explaining the dynamics of the new interest rate, economist Kelvin Umeni noted that the CBN’s decision was expected.

He said:

"With rising inflation, it was anticipated that the CBN would raise the interest rate further. However, the impact is that borrowing becomes more expensive. High interest rate means people and businesses tend to spend less., loans will get more expensive."

Experts predict as CBN meets to decide on interest rate

Earlier, Legit. ,ng reported that the National Bureau of Statistics announced that in October 2024, the inflation rate was 33.88% relative to the September 2024 headline inflation rate of 32.70%.

While food inflation in October 2024 was 39.16% on a year-on-year basis, 7.64% points higher than the rate recorded in October 2023 (31.52%).

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng