How to Open a Dollar Account in Nigeria and Convert USD to Naira Easily

In Nigeria, having access to foreign currency is no longer just a preference, it is now a necessity owing to the constant depreciation of the Naira. In the pursuit of financial stability, it has become important to have access to hard currency to secure the value of your money and protect it from devaluation.

Accessing payments from clients as a freelancer and gig worker, paying for subscriptions on platforms like Spotify, Apple, etc, paying for foreign goods, funding foreign education and more are some of the numerous reasons Nigerians need access to dollar accounts. However, many of them have faced roadblocks caused by the stress required to access and fund the account.

A US dollar account is a type of bank account that enables users to make and receive payments in foreign currencies, particularly in dollars. This is where Cleva comes in.

What you need to set up a US dollar account in Nigeria

Opening a dollar account in Nigeria can be a cumbersome process for some due to the stringent requirements under some financial institutions. Users would be required to provide utility bills, bank statements and more documentation. However, on Cleva, users can sign up in under two minutes and get a US-dollar account.

Cleva requires only BVN, email address, government-issued means of identification (NIN, Voters Card, International passport, or driver's licence) and a selfie holding your ID next to your face.

How to Set Up a US Dollar Account on Cleva

- Download the Cleva app on the iOS store or Play Store

- Click on ‘Create Account’ and fill in your name and other information

- Verify your email address and set a password

- Fill in KYC verification details including valid ID. Any one of these will do: NIN, Permanent Driver’s License, International Passport, Voter’s Card

- Get started

How to fund your Cleva USD account

Cleva USD accounts can be funded by Wire or ACH transfer from US banks, and payments from platforms such as Payoneer, Upwork, Amazon, Deel, Paypal, Remitly, etc.

Benefits of having a Cleva USD account:

A lot of Nigerian youths supplement their income with foreign currency to hedge against the Naira depreciation. With Cleva, freelancers and other gig workers can receive payments from platforms like Fiverr, Paypal, Upwork, etc.

Getting juicy deals including $5 for each referral when they receive up to $300 in deposits.

On Cleva, users get the prevailing exchange rate for the day to withdraw funds into their naira account.

Users can make transfers to Nigerian accounts and other Cleva users at no extra charge.

How to Convert USD to Naira on Cleva

Many Nigerians struggle with determining the conversion rate for the day and Cleva provides an easy way for users to calculate how much they will receive before carrying out transactions on the platform. On the app, You can easily exchange your USD for Naira for FREE and withdraw into your bank account for FREE.

Read also

NDIC gives update on payment to customers as bank competing with Access, Zenith, others shut down

Follow the easy steps below for currency conversion on the Cleva app:

Step 1: Create a Cleva Account

Download the Cleva app on the iOS store or Play Store and follow the prompt to set up an account. If you already have an account, log in with your email address and password.

Step 2: Fund your dollar account

Fund your USD account on the Cleva app before carrying out a transaction.

Step 3: Check the current conversion rate

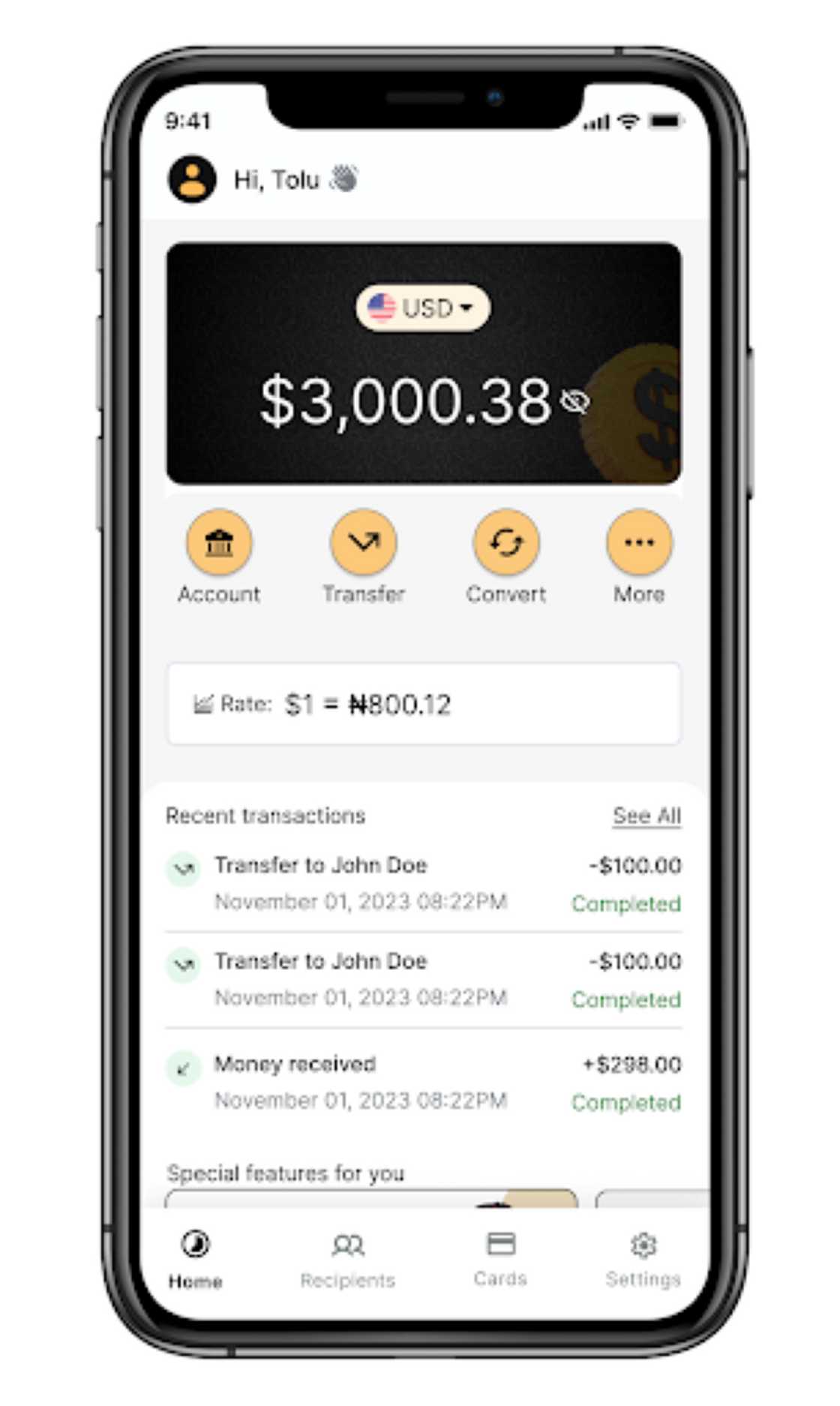

After logging in on the Cleva app, select the “Home” option on the dashboard to check your account overview and the current exchange rate.

Step 4: Convert and transfer your USD into your Naira bank account

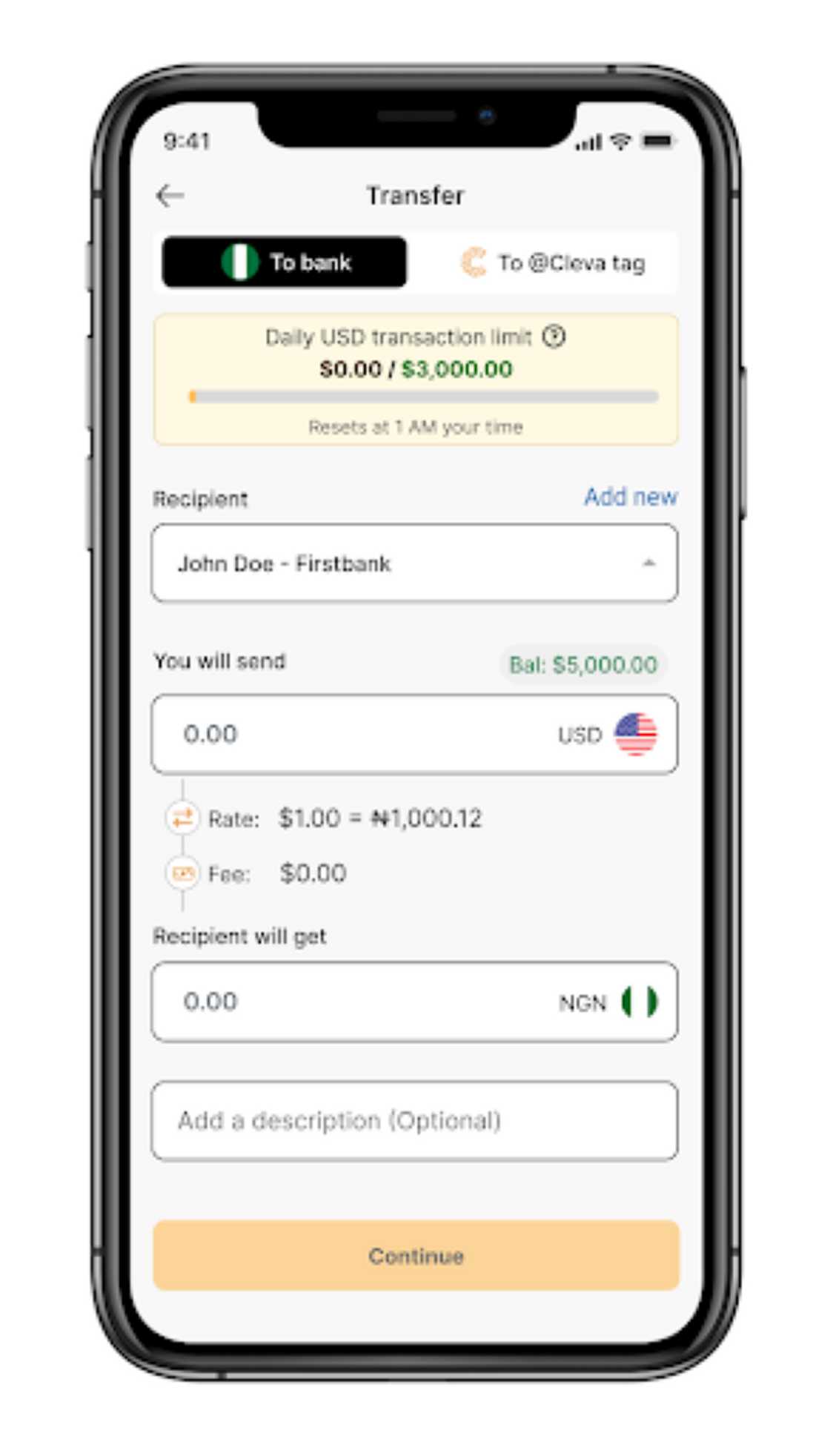

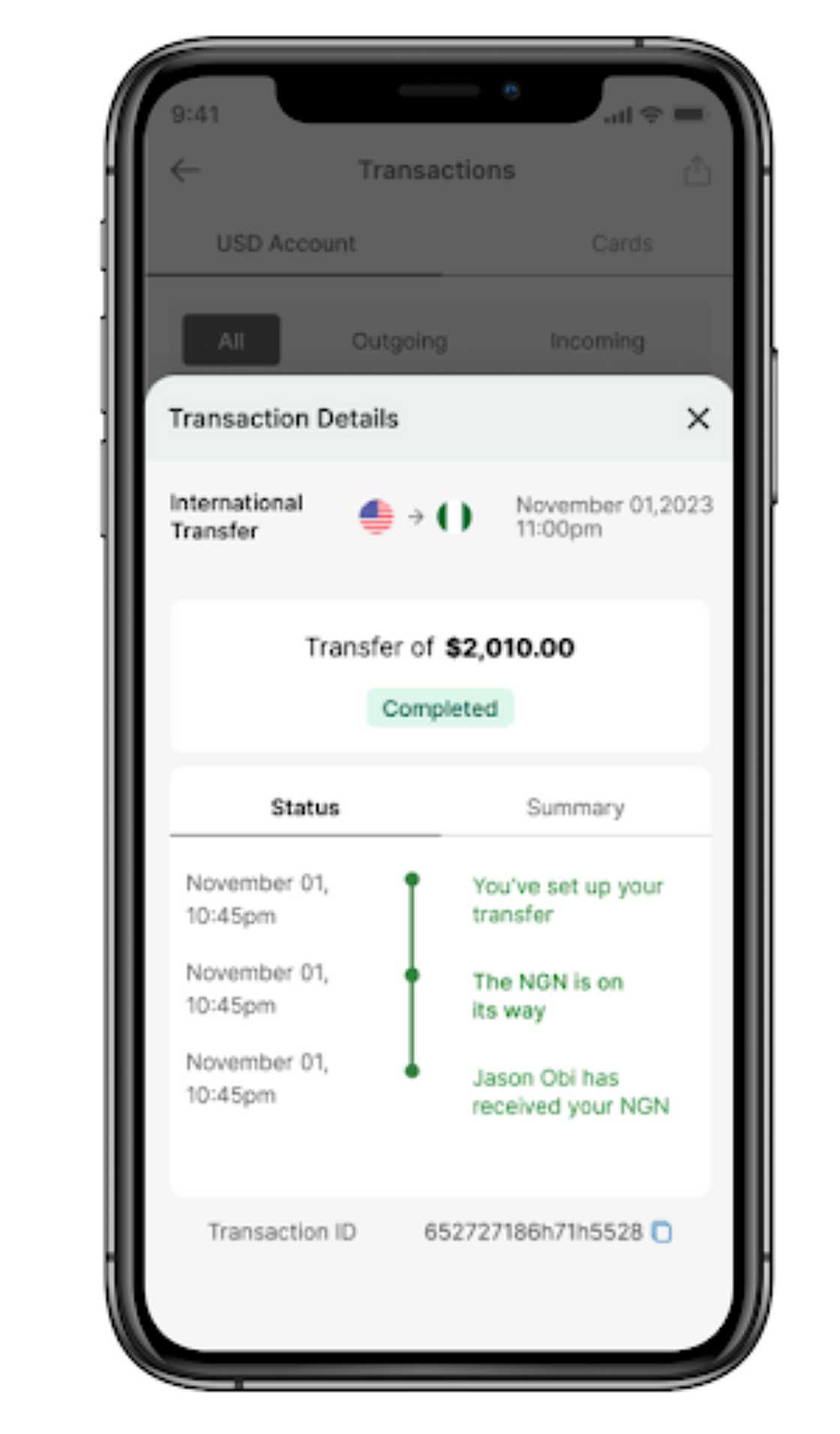

On the Cleva app dashboard, go to the “Transfer” tab and add the recipient, select the country and add the bank name. Input the recipient’s account number and save. Input the USD amount you want to transfer and the Naira box below will reveal the amount that would be sent based on the current rate, confirm details, and input your PIN to complete the transaction.

Read also

Aviation experts speak on airline ticket sales in dollars as Air Peace, other increase fare

Life as a Nigerian living in Nigeria will be so much easier with having a Cleva USD account.

Step 5: Viola! Receive your payments successfully in your local bank account!

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

Adunni Amodeni (Content Editor) Adunni Amodeni is a journalist with ten years of working experience in the media industry. She graduated from Babcock University in 2012 with a Bachelor’s Degree in Mass Communication. Adunni previously worked with Encomium Magazine (2012-2015). Email: shoyemi.adedolapo@corp.legit.ng

Taiwo Owolawi (Entertainment Editor) Taiwo Owolawi is an entertainment and lifestyle journalist with four years of work experience at Legit.ng. She graduated from Osun State University with a degree in English and International Studies in 2016. She has also moved on to pursue courses in Public Relations and Copywriting. Taiwo emerged as Legit.ng's Best Entertainment Editor in 2022. Contact: taiwo.owolawi@corp.legit.ng.