Expert Speaks on Real Impact As CBN Increases Interest Rate

- The Central Bank of Nigeria Monetary Policy Committee (MPC) has once again increased the benchmark interest rate

- The new interest rate means getting loans banks and also paying exisiting credit will become more expensive

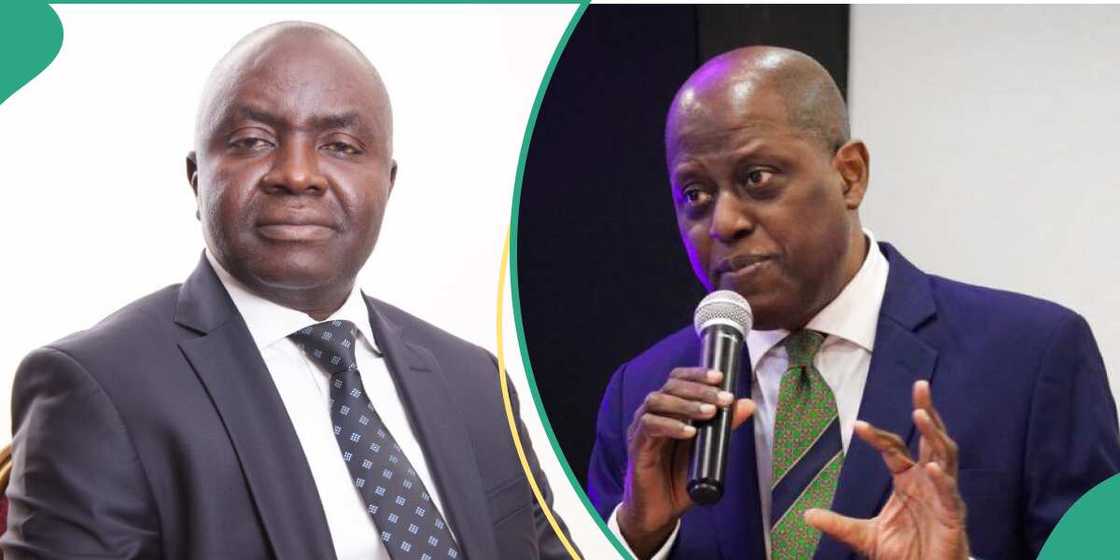

- Nigerian economist Muda Yusuf, who is also the CEO of the CPPE, shared with Legit.ng the impact of CBN's new rate

Legit.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

Muda Yusuf, the CEO of the Centre for the Promotion of Private Enterprise (CPPE), has reacted to the Central Bank of Nigeria's (CBN) decision to increase the Monetary Policy Rate (MPR) to 26.75%% from 26.25%.

Source: Facebook

The new rate was announced by Yemi Cardoso, the governor of the CBN, at the end of the two-day Monetary Policy Committee (MPC) meeting in Abuja on Tuesday, July 23, 2024.

Read also

Expert speaks on CBN’s decision to raise interest rate by 50 basis points, asks important questions

Other decisions carried out in the meeting include setting the asymmetric corridor around the MPR from +100 to -300 to +500 to -100 basis points and also retaining the Cash Reserve Ratio (CRR) of deposit money banks at 45% and merchant banks at 14% and retained the Liquidity Ratio at 30%.

The new interest rate means loans will become more expensive, while banks must increase the interest rates customers can earn from savings.

Expert speaks on new CBN interest rate

Speaking on the changes, Yusuf told Legit.ng that he expected the CBN to make adjustments but would prefer no changes.

He, however, emphasised that the government accelerate the implementation of fiscal policy measures to curb inflation.

His words:

"Expectedly, the CBN hiked interest rate by 50 basis points. This appears to be a moderation in its aggressive tightening stance. It is perhaps a reflection of some responsiveness to the clamour by stakeholders in the real economy for the apex bank to effect a deceleration in its rate hikes.

"Although my preference was for a pause on the rate increases because of the enormity of the headwinds that businesses are grappling with. But the marginal increase marks a softening of the tightening stance. It is tolerable.

"I believe we should now accelerate the implementation of the fiscal policy measures to tackle inflation. Already the economic Stabilisation plan contains a number of laudable fiscal policy measures that could reduce production costs in the economy.

"It is also important and urgent for the government to adopt and quickly implement the recommendation of the Presidential Committee on Fiscal and Tax Reforms on the Customs duty exchange rate which proposed N800/dollar.

"The adoption of this recommendation would have a considerable impact on cost of goods and services in the country."

CBN releases new BDC operational guidelines

Earlier, Legit.ng reported that the Central Bank of Nigeria (CBN) has announced rules that will see the end of the sale of dollars on the street in Nigeria.

Read also

House of Reps approves FG’s plans to remove N2trn from access, UBA, Zenith, other banks’ accounts

The new guidelines issued for BDC operators aim to streamline their operations and enhance regulatory oversight.

CBN hopes these measures will help stabilise the naira and transparency of the foreign exchange market.

Proofreading by Nkem Ikeke, journalist and copy editor at Legit.ng.

PAY ATTENTION: Stay Informed and follow us on Google News!

Source: Legit.ng