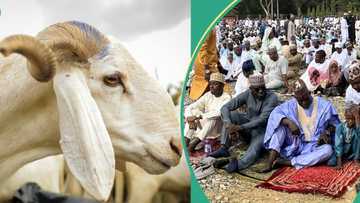

Nigerian Bank Offers Ram Loan to Muslims ahead of Sallah Celebration, Gives Conditions

- Yobe Microfinance Bank is offering Nigerian Muslims a chance to buy a ram on credit ahead of the Sallah celebration

- The ram loan scheme offers flexible repayment options, ensuring affordability for those interested

- The bank said it is mainly designed for civil servants and is ready for quick approval to ensure timely disbursement ahead of Sallah

PAY ATTENTION: Legit.ng Entertainment Awards 2024 Voting Is Alive. Choose the best entertainer in 15 categories for FREE.

The Yobe Microfinance Bank has introduced a ram loan scheme for Muslims ahead of Sallah celebrations.

The financial institution is a state-licensed microfinance bank.

Source: Getty Images

Sheriff Almuhajir, the bank's chief executive officer (CEO), who announced the scheme on Thursday, June 7, said it is aimed at helping Muslims purchase animals for sacrifice during the Eid el-Adha celebration, slated for June 16.

What is Eid el-Adha?

Eid el-Adha, also known as the "Feast of Sacrifice," is the second of Islam's two main holidays.

It commemorates Prophet Ibrahim's devotion to sacrificing his son in obedience to God's command. Muslims worldwide celebrate the day by performing the symbolic ritual of sacrificing animals such as rams, sheep, cattle, and goats.

Yobe ram loan scheme

NAN reports that Almuhajir said the bank has earmarked N150 million for the scheme.

His words

“This loan scheme is designed to support civil servants in Yobe, especially those working with state and local councils during the festive season

"The facility would be carried out under the Sallah ram loans scheme and divided into categories A and B for disbursement.

"Customers in category A would receive N150,000, while those in category B would receive N75,000.

"The loan would be repaid monthly, with customers in category A paying N6,000; while those in the second group would pay N3,300."

Read also

Nigerians react as bank launches ram loans scheme for Sallah celebrations: “Clap for APC govt”

Conditions to benefit from ram loan scheme

Regarding the conditions for obtaining the loan, Almuhajir stated that applicants must maintain a bank account with a minimum balance of N2,500 to access ATM cards and other services.

Additionally, applicants need to purchase a form from the banking hall for N1,000 and must be civil servants on the payroll of the state or local government councils.

Other requirements include submitting two passport photographs, a national identification number (NIN), a payment slip, and other relevant documents.

Almuhajir explained that this initiative aims to immediately assist individuals and families who cannot afford a ram for the festivities.

Man helps debtors to pay off loans

Meanwhile, Legit.ng previously reported that a PDP chieftain, Oke Umurhohwo, was hailed on social media for helping people repay the money they owed loan apps.

In a tweet on X on December 31, Oke announced his N1 million loan repayment plan, adding that he was doing it in the spirit of the season.

Proofreading by James Ojo Adakole, journalist and copy editor at Legit.ng.

PAY ATTENTION: Donate to Legit Charity on Patreon. Your support matters!

Source: Legit.ng