BDC Operators Blow Hot, Send Message to CBN Over New Capital Base

- Currency traders have expressed their dissatisfaction with the new capital base of N2 billion for tier-1 and N500 million for tier-2 operators

- The BDC president said the new capital requirement is too much and beyond the standard best practices worldwide

- He suggested that the amount be brought down to N500 million, N100 million and N35 million for tier-1, tier-2 and tier-3 respectively

PAY ATTENTION: Legit.ng Entertainment Awards 2024 Voting Is Alive. Choose the best entertainer in 15 categories for FREE.

Legit.ng journalist Zainab Iwayemi has over three years of experience covering the Economy, Technology, and Capital Market.

Bureau De Change operators have rejected the Central Bank of Nigeria's (CBN) new regulatory guidelines, which set a minimum capital base at N2 billion for tier-1 and N500 million for tier-2 operators.

Source: UGC

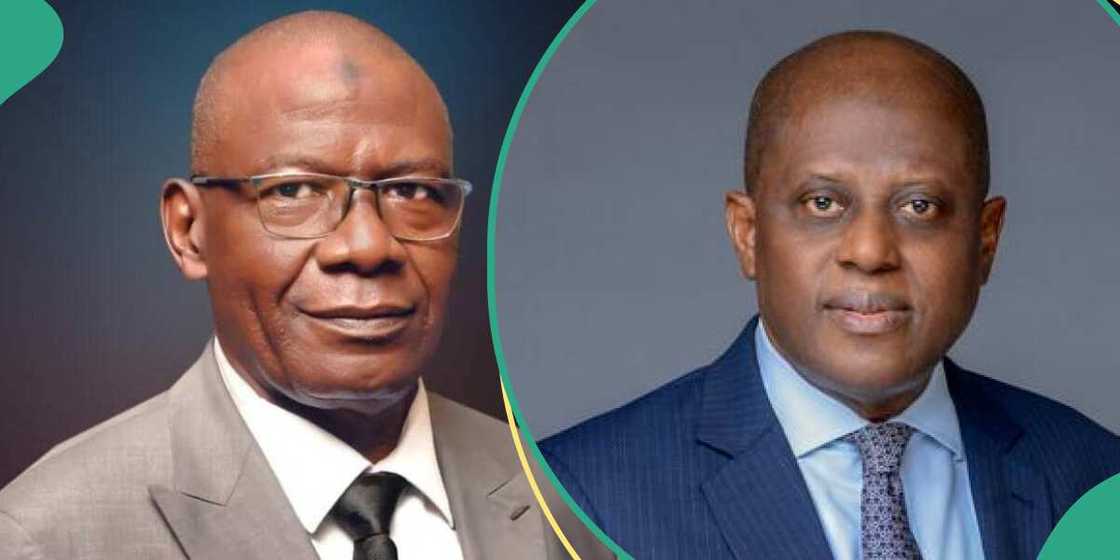

Dr. Aminu Gwadabe, president of the Association of Bureaux De Change Operators of Nigeria (ABCON), stated that the capital requirement established by the CBN is enormous and significantly more than best practices worldwide.

As cited in The Nation report, he demanded that the capital base plan be immediately reversed, with N500 million going to Tier-1 BDCs, N100 million to Tier-2 BDCs, and N35 million to Tier-3 BDCs.

BDCs give new demands

ABCON president stated that rather than reapplying for a new license, the CBN should permit the current owners of both revoked and qualified BDCs to recapitalise.

In his opinion, recapitalisation ought to acknowledge and incorporate the current N35 million in capital requirements.

He said:

“We observed the minimum financial requirements of N2 billion and N500 million for Tier-1 and Tier-2 BDCs, respectively is discriminatory and higher than what is obtainable in other jurisdictions.

“In the United Kingdom, the capital base for a BDC is £50,000; Kenya $50,000; India $67,000; Uganda $13,000 among others which are far lower than what has been pegged for Nigeria operators.”

Read also

Zenith Bank to distribute N126 billion to shareholders after reporting big profit in Q1 2024

Gwadabe also said the one per cent transaction margin required by the new BDC criteria is insufficient to cover labour overhead and operational costs, making it extremely difficult to turn a profit on the transactions.

He advocated for a two-year schedule, saying that the six-month compliance timeline, which starts on June 3, is insufficient to gather such sums.

He said:

“Even BDC operators with landed properties or other assets for sale to raise the funds, will not be able to accomplish such within the time frame. Other sectors including banks have two years timeline. Such timeline should also be granted to BDCs."

According to him, the proposed large capital base would push legitimate BDC firms into the black market and depress exchange rates.

In order to assure policy uniformity, Gwadabe suggested extending the compliance period to two years, with grants of indemnification and guarantee.

He added:

“Existing BDCs to be allowed to use their generic names as against registration of a new names at the Corporate Affairs Commission. The terms of engagement for mergers and acquisitions should be properly explained to allow for inclusion. The allocation of 75 per cent to cards and 25 per cent cash in forex transactions should be reversed inversely to encourage smooth take-off.”

CBN removes list of approved BDCs

Legit.ng earlier reported that the CBN removed the list of approved Bureau de Change (BDC) operators from its website following a new directive requiring BDCs to re-apply for operational licenses.

The development comes as the bank clarified the tier-based classification of BDCs, saying that the new rule followed an earlier circular for public input this year, which it has now incorporated and posted on its site on Wednesday, May 22, 2024.

Proofreading by James Ojo Adakole, journalist and copy editor at Legit.ng.

PAY ATTENTION: Donate to Legit Charity on Patreon. Your support matters!

Source: Legit.ng