Wema Bank Targets New Branches To Rival Access, UBA, others, Moves to meet CBN's Capital Requirement

- Wema Bank has big plans for the future as it seeks to attract more Nigerians to become its customers

- The latest move is the plan to open new physical branches in the south-east region of the country

- Shareholders have also approved a significant capital raise during the bank's annual general meeting

PAY ATTENTION: Legit.ng Entertainment Awards 2024 Voting Is Alive. Choose the best entertainer in 15 categories for FREE.

Legit.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

Wema Bank PLC, one of Nigeria’s leading financial institutions, is set to expand its branch network to south east region.

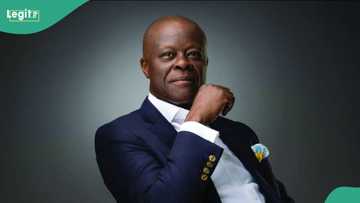

Moruf Osen, managing director/CEO of Wema Bank Plc, disclosed this at the bank's annual general meeting (AGM) on Monday, May 27, 2024.

Source: Facebook

During the meeting, Wema's boss also declared that the bank will retain its national banking license and will not go back to its regional banking license.

Wema Bank's capital base

To achieve this, Oseni noted that the bank will ensure that it raises the necessary capital and beats the recapitalisation deadline in 2026.

The CBN recently raised the minimum capital requirements for banks in a bid to to ensure banks have a robust capital base to absorb unexpected losses and capacity, Punch reports.

To ensure that Wema Bank retains its status as a national bank, shareholders have endorsed a plan to raise N200 billion and a 50 kobo per share dividend for 2023 to meet recapitalisation directives.

The bank intends to raise N200 billion or more through various means such as public offers, rights issues, and private placements to meet the Central Bank of Nigeria’s recapitalisation directives for a nationally licensed bank and achieve its business needs.

Oseni said:

“Capital raise is a major one in front of us, but please be rest assured that your bank will do all we can to get the funds in. And in two years’ time, come 2026, Wema Bank will remain a national bank. We have no plans of going back to regional banking.”

FG directs banks to deduct stamp duty

In related news, Legit.ng earlier reported that the Nigerian government directed commercial banks to immediately deduct a 0.375% stamp duty charge on all mortgage-backed loans and bonds.

Mortgaged-backed loans are facilities given by financial institutions to individuals who are entitled to acquire a home and repay them over time with interest.

The commercial banks sent messages to customers informing them of the new directive, saying that the Federal Inland Revenue Service would make the deduction.

Proofreading by James Ojo Adakole, journalist and copy editor at Legit.ng.

PAY ATTENTION: Unlock the best of Legit.ng on Pinterest! Subscribe now and get your daily inspiration!

Source: Legit.ng