“My Prayer Was for the MPC To Pause the Rate Hikes” Expert Reacts to CBN’s New Interest Rate

- The CBN has announced new interest rates, further tightening monetary conditions in the economy.

- This decision is aimed at fighting inflation, which has been a major concern in the last few months

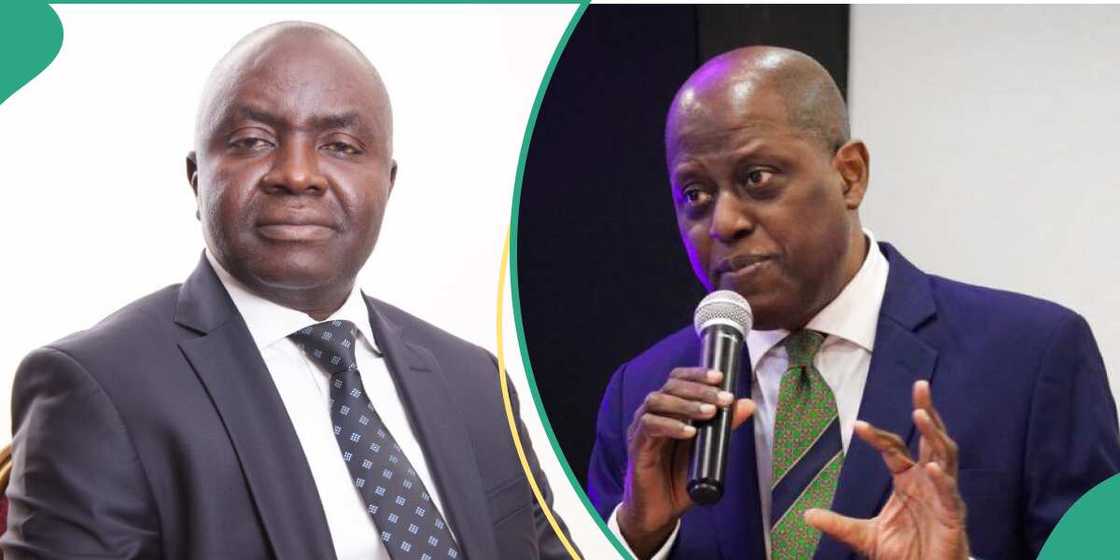

- Muda Yusuf, Muda Yusuf, the CEO of the Centre for the Promotion of Private Enterprise, has expressed concerns about the new interest rate

PAY ATTENTION: The 2024 Business Leaders Awards Present Entrepreneurs that Change Nigeria for the Better. Check out their Stories!

Legit.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

The Central Bank of Nigeria (CBN) has announced a new interest rate increase to 26.25%, the third consecutive increase in 2024.

The new rate was announced after a 2-day Monetary Policy Committee (MPC) meeting in Abuja.

Source: Facebook

Expert reacts to CBN interest rate

The CBN's decision to increase interest rates has drawn reactions from economic experts, such as Muda Yusuf Muda, the CEO of the Centre for the Promotion of Private Enterprise (CPPE).

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

In an exclusive interview with Legit.ng, Yusuf expressed concerns about the new rate and highlighted its expected impact on businesses.

He noted that the CBN's decision to go aggressive on interest rates negatively impacts real sector investments.

He stressed that many economic operators with credit exposures to banks have yet to recover from previous hikes, especially as interest rates were already near the 30% threshold.

His words:

"My prayer was for the MPC to pause the rate hikes for a number of reasons. First, previous rate hikes have been quite aggressive, hurting output and real sector investments.

"Most economic operators with credit exposures to the banks have not recovered from previous hikes. Interest rates were already around 30% threshold.

"Secondly, extant CRR of 45% has profound liquidity effects on the financial system. Both measures have dampening effects on financial intermediation, which is the primary role of banks in an economy.

"Thirdly, the monetary policy transmission channels are still very weak, given the level of financial inclusion in the economy. This limits the prospects of monetary policy effectiveness."

The CPPE boss further expressed concern for investors with exposure to bank credit facilities, as they now have to bear an additional burden.

He acknowledged the CBN's rigid monetarist stance but urged consideration of the costs to the economy.

Yusuf added:

"Meanwhile, the new rate hike is an additional burden on investors who have exposures to bank credit facilities. Naturally, the central bank is expected to adopt a rigid monetarist disposition. But we need to consider the economic costs.

"Hopefully, with the positive outlook for domestic refining of petroleum products, we may begin to see a moderation in energy costs and a pass-through effect on the general price level.

"This is one silver lining that is on the horizon at the moment. Necessary fiscal policy support is urgently needed to compensate for the adverse impact of extreme monetarism on the economy."

CBN stops daily CRR debits of Access, others

Earlier, Legit.ng reported that the Central Bank of Nigeria announced stopping daily Cash Reserve Requirement (CRR) debits for banks.

The apex bank said it would adopt an updated CRR mechanism to facilitate banks' capacity for planning, monitoring and aligning with records with the CBN.

This was disclosed in a letter addressed to all banks and signed by Adetona Adedeji, the acting director of the banking supervision department, on Friday, February 2, 2024.

PAY ATTENTION: Stay Informed and follow us on Google News!

Source: Legit.ng