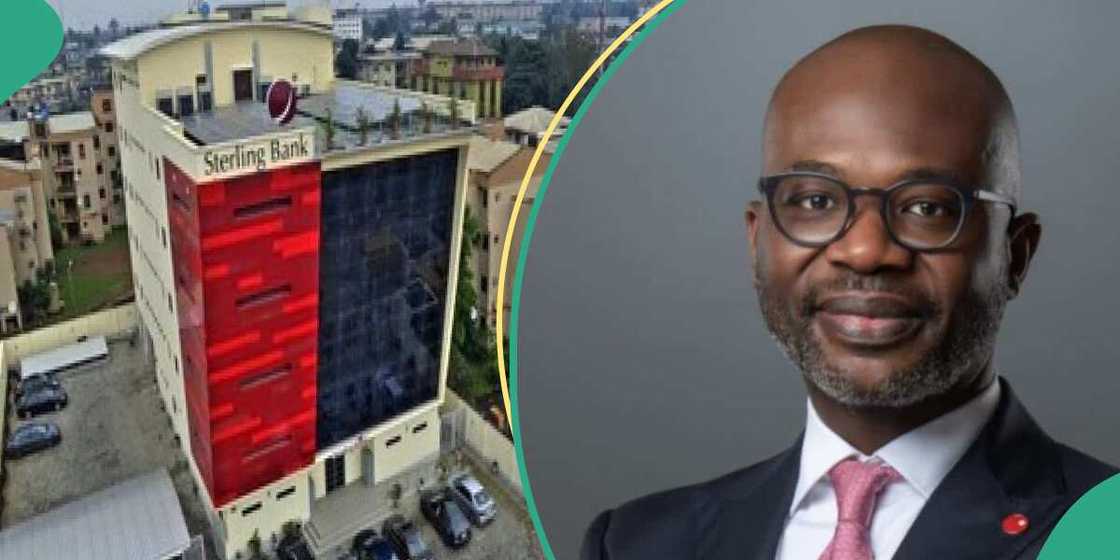

Sterling Bank Secures $75m Deal to Solve Nigeria’s Forex Challenge, Others

- Sterling Bank recently secured a $75 million deal to address forex issues in the country

- The deal was signed with the African Export-Import Bank to foster non-oil exports in Nigeria

- It is expected that the deal would help to bolster the trade finance capabilities of Africans

Legit.ng journalist Zainab Iwayemi has over three years of experience covering the Economy, Technology, and Capital Market.

Sterling Bank Plc has secured a $75 million deal with the African Export-Import Bank to foster non-oil exports in Nigeria.

The bank said the funding secured during the just concluded Intra-Africa Trade Fair in Cairo, Egypt, would help address forex issues.

Source: UGC

Deal to boost trade financing

According to the bank, the deal would boost trade financing in the country through facilitating intra-Africa trade, Punch reports.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Read also

“A difficult day”: Paystack sacks 33 workers, CEO explains decision, unveils 4-month pay-off package

It stated:

“The facility is expected to make a substantial contribution to the growth of Nigeria’s financial sector by improving the capacity of Africans in trade finance. Moreover, it aims to (address) foreign currency liquidity constraints.”

In addition to intra-Africa trade, the bank noted that the developmental impact of the financing arrangement was essential to foster growth in extra-African trade as well.

It noted:

“It achieves this by enabling Sterling Bank to secure funds from lenders who in turn support their customer’s import and export trade finance operations. It is a guarantee facility for $75m.”

Recall that Sterling Bank earlier announced that it had completed an essential step in its ongoing efforts to shift from a financial institution to a holding company.

Legit.ng also reported that Yemi Odubiyi, the newly-appointed group managing director/chief executive officer of Sterling Financial Holdings Company Plc, recently increased his stake in the holding company.

Read also

Unity Bank’s shareholders make over N1bn in 4 hours as Providus Bank moves to acquire majority stake

Access leads, UBA 3rd: Top Nigerian banks with highest loan amounts to customers in 2023

In another report by Legit.ng, Nigerian banks listed on the Nigerian Exchange significantly increased their lending to customers during the first half of 2023.

According to data obtained by Legit.ng, eleven banks, as of the end of June 2023, disbursed N26.83 trillion to their customers.

The banks surveyed were Access Holding Company, First Bank Holding Company, Guaranty Trust Holding Company (GTCO), Zenith Bank, United Bank for Africa (UBA), First City Monument Bank (FCMB), Fidelity Bank, Stanbic IBTC Bank, Sterling Bank, Unity Bank, and Wema Bank.

PAY ATTENTION: Donate to Legit Charity on Patreon. Your support matters!

Source: Legit.ng