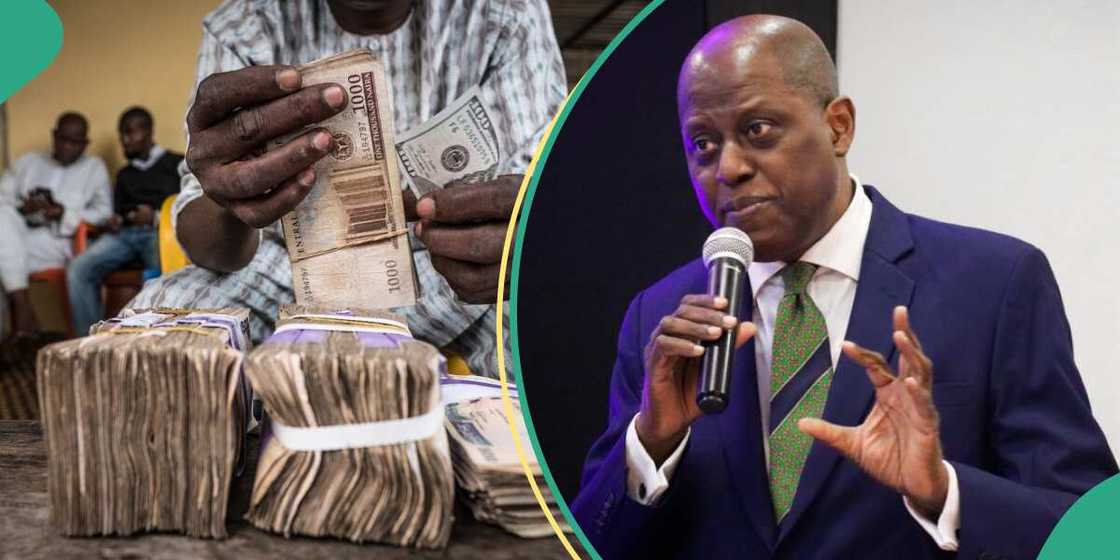

Naira Redesign: Tension As Cash Scarcity Returns to 2 States Ahead of December Deadline

- Nigeria might witness another cash crunch in a couple of weeks, as it has already begun in northern Nigeria

- This reoccurrence comes after the Supreme Court order that ruled that December 31 would be the deadline for the use of old N200, N500, and N1000 banknote approaches

- It has been confirmed that Kano and Borno states have begun to experience cash shortages

PAY ATTENTION: Unlock the best of Legit.ng on Pinterest! Subscribe now and get your daily inspiration!

Legit.ng journalist Segun Adeyemi has over 9 years of experience covering political events, civil society, courts and metro

Emerging reports have confirmed that a cash shortage has been observed in Kano and Borno states as the December 31 deadline for using the old N200, N500, and N1000 banknotes approaches.

In March, the Central Bank of Nigeria (CBN) announced that, following a Supreme Court order, the old banknotes would remain legal tender alongside the redesigned ones until December 31.

Source: UGC

Former CBN Governor Godwin Emefiele had revealed plans to redesign the N200, N500, and N1000 notes in October of the previous year, advising citizens to deposit their old notes before January 31, 2023, as they would no longer be considered legal tender after that date.

PAY ATTENTION: Donate to Legit Charity on Patreon. Your support matters!

This led to a nationwide cash shortage in February, causing difficulties for citizens and even resulting in protests and attacks on banks in some cities nationwide.

However, on March 3, the Supreme Court extended the legal tender status of the old N200, N500, and N1000 notes until December 31.

Two months before the deadline, businesses in Kano and Borno states are reporting that they are struggling to access sufficient cash.

PoS operators recount ordeal

An anonymous CBN official stated that there were no plans to phase out the old notes, and a Point of Sales (PoS) operator in Kano, Abdullahi Usman, mentioned that banks were allowing limited daily withdrawals for individuals and corporate entities, leading him to source cash from market transactions.

As reported by Daily Trust, he said:

“As a PoS operator, I can’t give more than N20,000 to individuals because most banks only allow us to have N40,000 to N50,000 daily. I learnt that only owners of corporate accounts can get N150,000 to N200,000.

"If you go around town, you will find out that most of the PoS centres now have less cash compared to some weeks ago”

Bello Shehu, another PoS operator, has opted to obtain cash from fuel stations instead of banks because they often need more cash for customers.

He said:

“I get my cash from fuel stations because the cash we get from the banks nowadays is limited and can’t cater for our customers’ demands.”

Challenges of cash withdrawal at ATMs

Muhammed Gambo, a shop owner in Hotoro, Kano's Nassarawa Local Government Area, reported his inability to access cash from ATMs recently.

Similarly, a Kano State Government civil servant recounted his failed attempts to withdraw his October salary from six ATMs and resorted to PoS, where he could only obtain half of what he needed.

In Maiduguri, Borno State, the cash crunch is biting hard on residents, traders and banks, as most transactions can only be done with limited cash.

In Maiduguri, Borno State, residents, traders, and banks are grappling with a severe cash shortage, making it necessary to conduct most transactions online. Cash was in short supply at ATMs and PoS terminals, with cash withdrawal limits imposed on customers.

A bank employee in Maiduguri disclosed that their bank had set a withdrawal limit of N20,000 for customers due to the scarcity of naira notes. He also noted that customers had ceased depositing money in the bank.

“Surprisingly, you will give customers cash every day, but no cash deposit is coming. We learnt that some agents mop up cash from traders and filling stations in town,” he said.

BDC operators react

A currency exchange agent (Bureau de Change) working at the well-known Sheraton Road in Wuse Zone 4, Abuja, named Bala Gidado, has affirmed that the Nigerian naira has been in short supply in recent days.

Gidado said:

“Banks have started mopping up cash, and it could be because of the December deadline for the expiration of the old notes.

“I went to the bank today to get cash; I couldn’t get what I wanted. Naira is now very scarce, and we don’t understand what is happening again.”

Another individual involved in the Bureau de Change business, Ibrahim Hayatu, pointed out that the shortage of the naira commenced last week but has become even more pronounced this week.

“The issue of naira scarcity started last week, but this week, we can’t see it even if you go to the bank; it’s a problem. Today, I had to ask my colleagues before I got N500,000,” he said.

Naira flow in southern Nigeria

Meanwhile, observations indicate that there is an ample supply of cash in Lagos and other southern regions.

Upon inspecting various ATMs, it became evident that cash is readily accessible, and economic activities proceed without hindrance.

Numerous entrepreneurs in the southern states affirmed that they had yet to encounter any deficiency in paper currency.

James Usoro, a public affairs analyst in Akwa Ibom, emphasized that the Central Bank of Nigeria (CBN) should clarify the legal status of the old banknotes to dispel any misconceptions.

He said:

“The judgement was explicit that both bank notes should coexist until December 31. However, the CBN has the final say on this and should come out with a position."

CBN finally speaks on redenominating Naira by January 2024

In another report, the CBN has opened up to the claims that it plans to redenominate the naira by January 2024.

Read also

“I only need 6 months”: Pastor Olumide says he can stop naira depreciation, gives 2 simple solutions

According to the apex bank, the claim is false as it was sponsored to incite fear in Nigerians.

It noted that the bank would follow the CBN plan, such as established protocols.

Source: Legit.ng