“No More N900/$”: BDC Operators Send Important Message to CBN As Naira Records Massive Gain Against US Dollar

- ABCON has sent a passionate appeal to the Central Bank of Nigeria (CBN) in regards to the depreciation of the naira

- This comes after the naira recorded an impressive improvement against the US dollar in the unofficial markets

- The President of ABCON spoke to Legit.ng, outlining measures that must be taken to recover the loss of value of the naira

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

The Association of Bureau de Change Operators of Nigeria (ABCON) has asked the Central Bank of Nigeria to sell forex to them to improve dollar liquidity in the country.

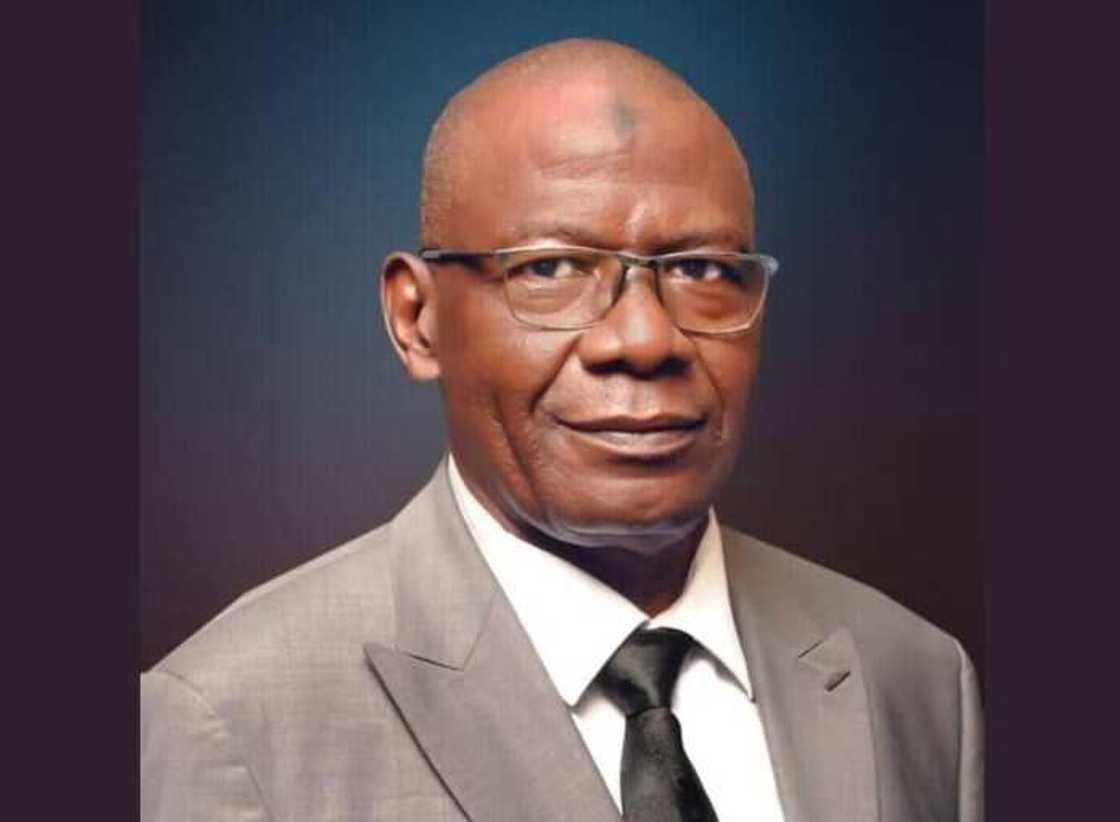

ABCON President Aminu Gwadebe in a telephone interview with Legit.ng said that such a decision will help ease the pressure on the naira.

He stressed that BDCs can go a long way in helping the CBN monetary policies and efforts to create stability in the forex market.

Source: Facebook

Legit.ng, in an earlier report, revealed that the CBN had excluded BDCs from accessing foreign exchange at the Investors and Exporters(I&E) window, which is the official forex market.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Aminu stressed that his members remain a critical component in the forex exchange markets, and should CBN reverse its decision; it will help reduce speculators' power.

"The volatility of the naira is not because of purchase of dollars it is because of corruption, some people are benefiting from the distortions in the forex markets."

Naira to dollar exchange rate

BDCs operators' appeals come when the Nigerian currency, the naira, recorded an impressive recovery against the US dollar at the unofficial markets.

The peer-to-peer markets are primarily utilised by cryptocurrency traders, while the black market refers to street-level transactions.

Read also

“Please disregard”: CBN sends message to Nigerians on reported new FX policy as one dollar sells for N740

On Monday, August 14, 2023 the acting Governor of the Central Bank of Nigeria (CBN), Folashodun Shonubi, warned speculators that they would regret hoarding the US dollar to create artificial scarcity.

The warning proved effective, as evidenced by panic selling observed on Wednesday from customers who had stored foreign currency in anticipation of further weakening of the Naira.

Checks by Legit.ng show that the naira, which exchanged as high as N950 a dollar on Tuesday, was sold at low as N850/$ at the black market on Wednesday afternoon.

Similarly, in the P2P market, one dollar was sold below N900 a dollar.

BDCs operators in Nigeria

There are currently 5,691 approved BDC operators by the Central Bank of Nigeria.

These operators independently source for foreign exchange from the streets to mee the needs of importers, companies of 43 non-eligible items banned from accessing forex at the official window by the CBN.

Read also

“No more tricks to buy cheap dollar”: CBN introduces forex price verification portal as naira recovers

According to a breakdown from StatiSense, a data-driven company, Lagos is home to the highest number of BDC operators, accounting for 52% of the total in the country.

This is followed by the Federal Capital Territory (Abuja), with 20.7% of the total BDCs, and Kano comes next with 17.2%."

Here is a breakdown of the top 10 states with the highest number of CBN'S approved Bureau de Change Operators in Nigeria.

- Lagos: 2,958

- FCT: 1,179

- Kano: 981

- Anambra: 259

- Kaduna: 55

- Abia: 50

- Oyo: 32

- Enugu: 25

- Rivers: 24

Over N29bn spent printing new naira notes and throwing away old ones

Meanwhile, in another report, Legit.ng revealed that the CBN had provided a breakdown of its financial performance and expenses undertaken during the 12 months of 2022.

Part of the expenses recorded is the over N29 billion spent on printing naira notes and disposing of the bad ones.

Read also

Black market operators in pains as dollar crashes to N880 amid CBN's threats to clamp down on speculators

The CBN destroys unfit banknotes regularly under strict security and with the authorisation of Section 18(d) of the CBN Act 2007.

Source: Legit.ng