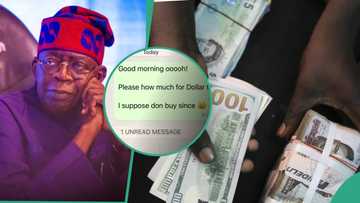

Students, Businesses Struggle to Get Dollars From Banks Amid Forex Shortage

- Banks are struggling to meet the demand for PTA and BTA requests by students and businesses

- Nigerian students are rushing to buy foreign exchange from dealers before classes resume abroad

- Meanwhile, there are indications that commercial banks are finding it hard to meet the increasing demand

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

Foreign university students, businesses and manufacturers are struggling to get foreign exchange (FX) as more pressure is being mounted on the parallel market.

Legit.ng observed that as Deposit Money Banks (DMBs) struggle to fulfil the enormous FX demand from their customers, Nigeria's chronic shortage is straining their resources to the breaking point.

Source: Getty Images

This is amid speculation that the naira will eventually surpass N1,000 as it continues to face pressure.

Recall that the Central Bank of Nigeria (CBN) abolished the country's multiple exchange rate system and effectively floated the naira in response to President Bola Ahmed Tinubu's bid to revamp the country's monetary policies.

Read also

“We rebuke and bind”: Leaked chat shows naira exchanges at N1,000 per dollar, CBN ready to fight back

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

International students rush to buy Forex

According to a report many students applying for admission to universities in the United Kingdom, Scotland, and other European countries are hurrying to buy foreign exchange from dealers before classes resume.

To control the foreign exchange market, the CBN promised banks would continue to offer Personal Travel Allowance (PTA) and other transactions at the current I&E window rate.

A recent survey, however, revealed that many commercial banks in Lagos are finding it difficult to meet the demand for foreign exchange, with some frequently having nothing to offer.

PTA, BTA available once in two quaters

According to the Daily Sun, customers of Nigerian banks were told that they may only receive PTAs and Business Travel Allowances (BTA) once every two quarters.

Banks approved PTA and BTA for travelers who applied once every quarter before this new development.

According to observers, the issue is made worse by the enormous disparity between official and black market values, which has grown to N200/$1 in just a few months since the announcement of the unification of the exchange rates markets.

Meanwhile, there are indications that forex volatility may persist as more young Nigerians leave the country in search of better opportunities.

CBN declares highest profit in 5 years as naira exchange rate gets closer to N1000 per dollar

The Central Bank of Nigeria (CBN) declared a massive profit of N103.85 billion after-tax payment obligation in 2022, as disclosed in its latest financial statements on its website obtained by Legit.ng.

This represents a 38.24% increase in profit compared to the N75.12 billion recorded the previous year.

Source: Legit.ng