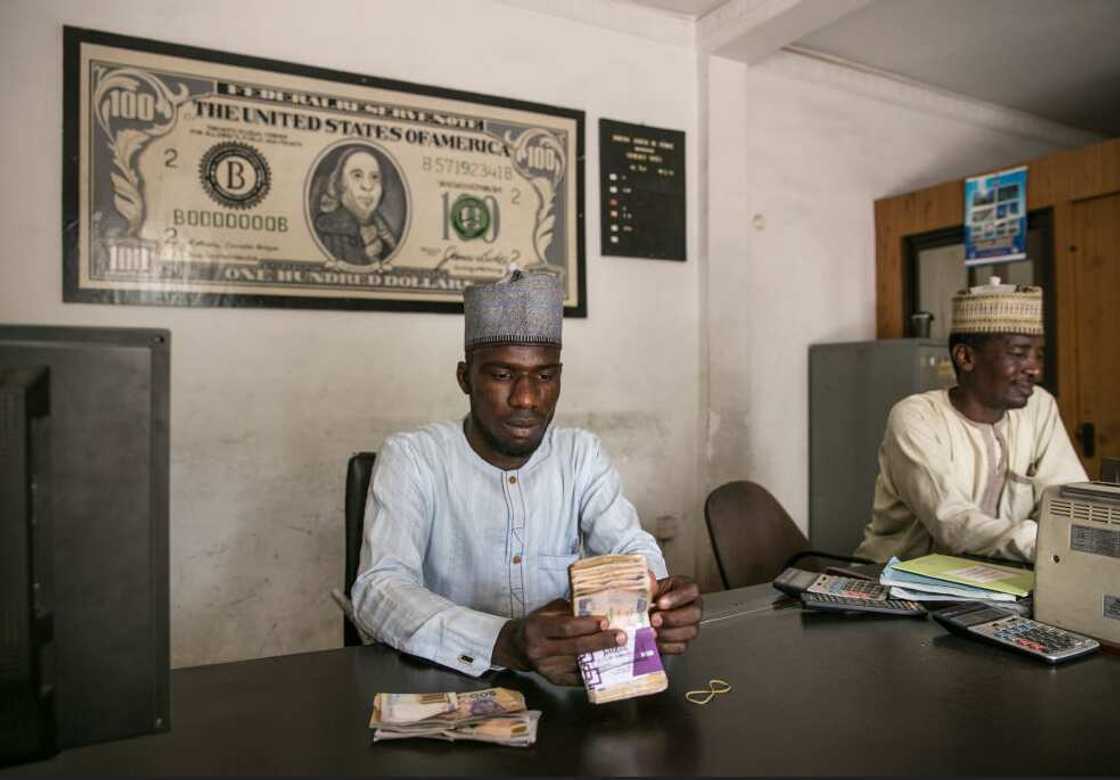

BDCs Explains Role of Politicians, Wealthy Nigerians in Naira Fall As Exchange Rate Hits N860/$ at P2P Market

- Nigerian currency, the naira, continues to face intense pressure at both the official and unofficial foreign exchange markets

- The Central Bank of Nigeria also admitted the challenges facing the naira in the forex market but offers hope

- The President of the ABCON spoke to Legit.ng to explain what is happening in the forex market

Association of Bureaux De Change Operators of Nigeria(ABCON) has identify politicians and wealthy Nigerians as the driving force for the poor performance of Naira at forex exchange markets.

Aminu Gwadabe, the president of ABCON told Legit.ng that the the pressure in the forex market is driven by speculators who are benefiting from the high exchange rate.

Source: Getty Images

He therefore called on the Central Bank of Nigeria to show more interest and interrogate the demands in the market.

Gwadabe said:

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

"Volatility of naira is not because of purchase of dollars it is because of corruption.

"Some politicians, wealth Nigerians including foreign investors are attacking the market to keep dollar rate high.

"To do this they mop up dollars to keep the pressure high, with the challenge of Liquidity the market has less to satisfy the demands of customers"

CBN admits forex liquidity challenges

The comments from ABCON president comes as the CBN admits the challenge of liquidity in the forex markets.

Speaking after chairing its first Monetary Policy Committee meeting, Folashodun Shonubi, CBN's acting governor on Tuesday, July 25 said:

"We agreed that one of the key challenges now was liquidity overhang, and we needed to look at various tools.

"The reality is that there's pent-up demand, which the current supply may not be sufficient for.

"As we ease and satisfy the pent-up demand, we begin to see more efficient markets that run smoothly.

Naira, dollar exchange rate

Meanwhile at the forex market, the Naira closed at N791.42 a dollar at the official market on Tuesday, July 26, 2023.

While the closing rate is 0.07% slight improvement when compared to N792.04/$1 it closed on Monday, July 25.

The naira was sold at a high of N845 almost at the same level in the black market where traders sold one dollar at N860.

At the Peer to Peer Market, used by cryptocurrency traders, Legit.ng checks shows the naira traded at high as N861 to a dollar.

CBN speaks on license status of 2,698 BDCs as Naira falls again

The Central Bank of Nigeria has responded to reports that it withdrew over 2,000 Bureau de Change operators licenses

The reports of withdrawal comes amid the continue depreciation of the naira at the official and black markets

The CBN and the Bureau De Change Operators of Nigeria spoke with Legit.ng to set the records straight

Source: Legit.ng