Buhari Hands Over $35bn Foreign Reserves to Tinubu, Lowest in 20 Months

- Nigeria's foreign reserves reached their lowest in 20 months as Muhammadu Buhari concluded his tenure

- The decline in foreign reserves could pose a concern as it is essential in determining the stability of the naira's value

- Several external factors might have contributed to the decline in the volume of Nigeria's foreign reserves

Nigeria's new president, Bola Ahmed Tinubu, has kicked off his tenure with the country's reserves at its lowest in 20 months.

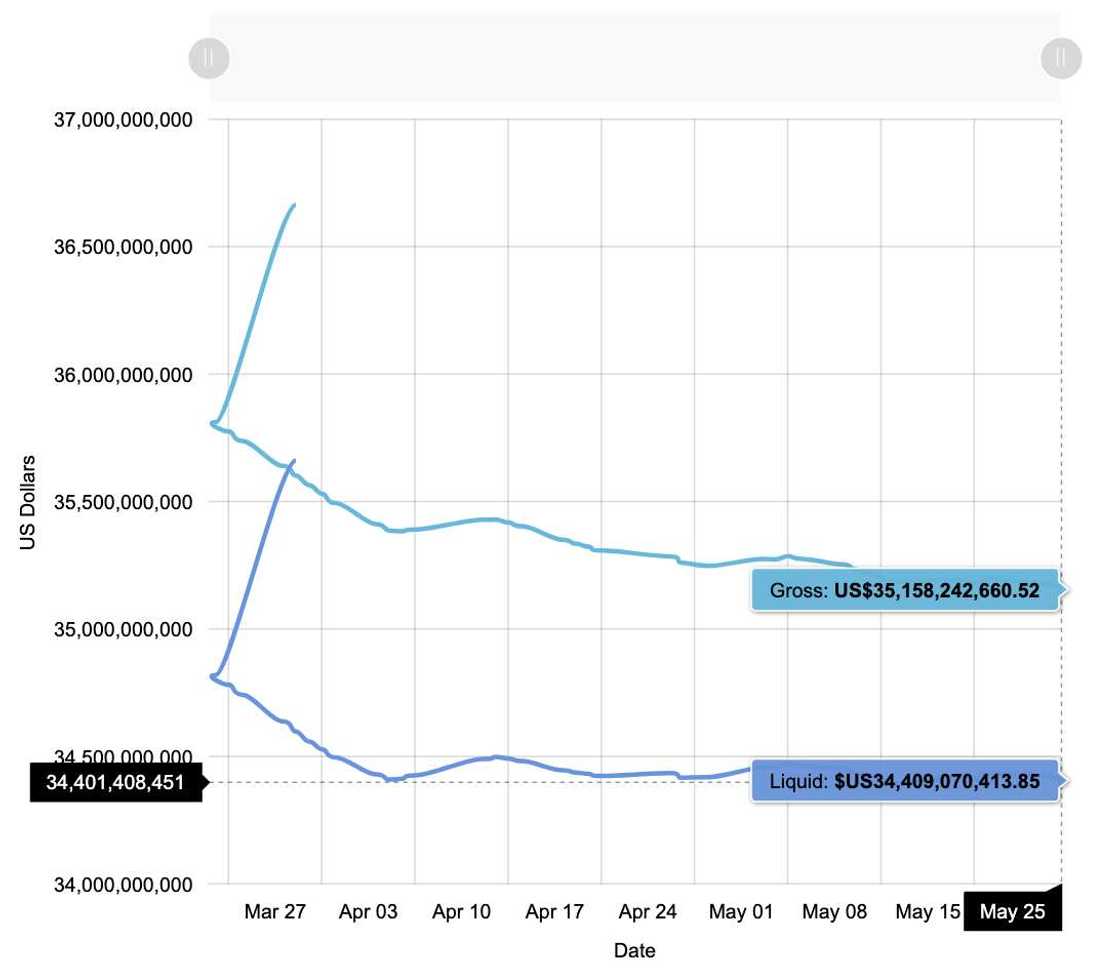

According to data from the Central Bank of Nigeria (CBN), as of Thursday, 25 May 2023, Nigeria's foreign reserves stood at $35.15 billion.

Source: Facebook

The last time Nigeria's foreign reserves were at this level was on the 13th of September 2021, 20 months and a week ago, when the funds were at $35.10 billion.

However, it is important to note that among the various key economic metrics used to measure the Buhari administration's performance, foreign reserves performed well.

Read also

Lagos to London One Way Ticket no more N800k as airline adjust prices to match naira depreciation

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

When Buhari assumed office in 2015, Nigeria's foreign reserves were at $29.59 billion on May 28.

This indicates that during his 8-year tenure, Nigeria's foreign reserves grew by 18.79%.

Monthly breakdown of Nigeria's foreign reserves in 2023

Legit.ng's further analysis of CBN's foreign reserves data showed that from January 1, 2023, to May 25, 2023, $1.9 billion has been taken from the foreign reserves.

- April 28: $35.25 billion

- March 31: $35.49 billion

- February 27: $36.67 billion

- January 31: $36.99 billion

What are foreign exchange reserves, and why are they important?

Foreign exchange reserves are assets denominated in other currencies, like dollars. The reserves are utilised to back up liabilities and influence monetary policy.

Foreign reserves serve as a buffer to support the stability of the Nigerian currency in the international foreign exchange market.

Read also

FG set to implement new tariff rate in July as Nigerians pay over N247bn for electricity in 3 months

When the CBN intervenes in the foreign exchange market, it uses its foreign reserves to influence the supply and demand of the naira.

The foreign reserves also serve as a means to protect against external shocks and ensure the country's ability to meet its international obligations.

Nigerian banks send messages to customers on tax clearance for FX transactions

In another report, Nigerian banks now require customers to present a valid Tax Clearance Certificate for purchasing dollars and other foreign currencies.

The regulation covers a wide range of transactions, including Personal Travel Allowance and Business Travel Allowance.

Banks have started informing customers who want foreign currencies at the official rate compared to the easy buy more expensive black market rate.

Source: Legit.ng