CBN Sets Penalties for Banks Supporting Unlicensed Foreign Companies

- The CBN has issued a warning to banks against providing financial services to unlicensed foreign companies

- The apex bank warned that commercial banks violating the rules would attract sanctions

- CBN also introduced guidelines for foreign banks' representative offices in Nigeria

The Central Bank of Nigeria (CBN) has warned commercial banks against providing financial services to unlicensed foreign companies.

According to CBN, violating the rules would lead to sanctions.

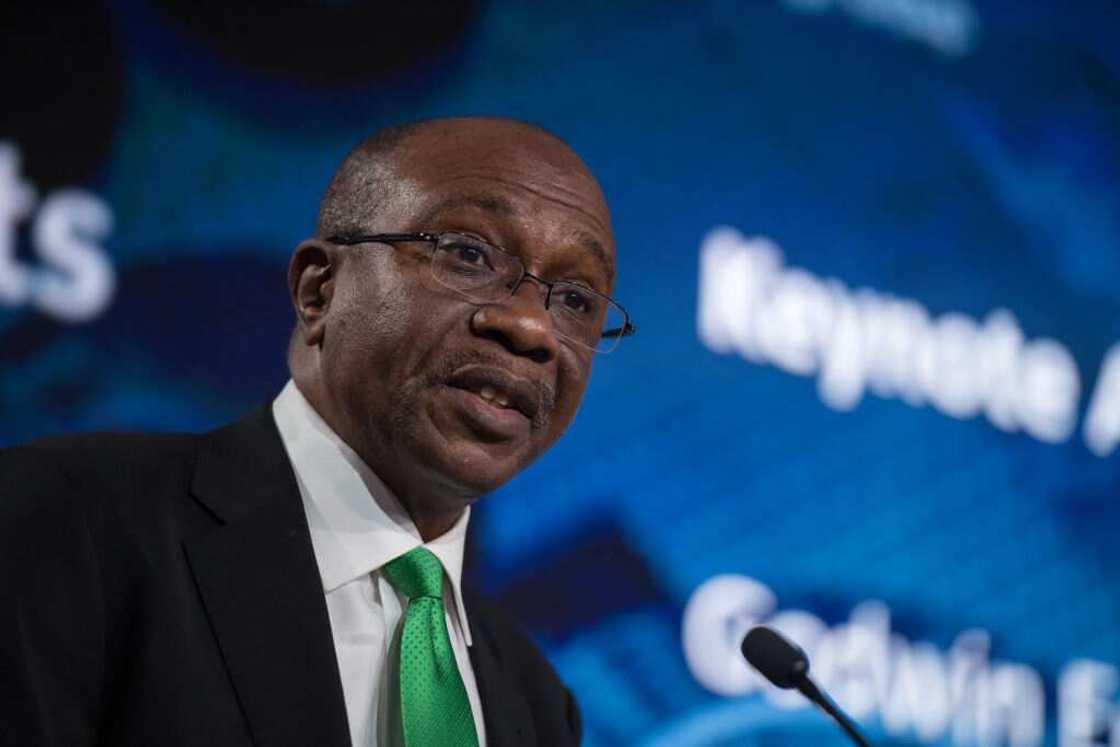

Source: Getty Images

The apex bank disclosed this in its ‘Guidelines for the regulation of representative offices of foreign banks in Nigeria’, signed by the Director Financial Policy and Regulation Department, Muhammad Musa.

CBN sets sanctions for banks

The Punch reports that the CBN stated that any regulated entity found to be assisting, supporting, harbouring or facilitating the presence and operations of an unlicensed international financial institution in Nigeria would be liable to severe sanctions, including suspension or revocation of banking license.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

Part of the guideline reads:

‘Any CBN regulated entity found to be assisting, supporting, harbouring or facilitating the presence and/or operations of an unlicensed international financial institution in Nigeria shall be liable to severe sanctions including suspension or revocation of their banking licence."

CBN to foreign banks

Also, the CBN laid down new directives for foreign banks with representative offices in the country.

The directive pertains to both representative offices of foreign banks in Nigeria and any financial institution operating under foreign regulations whose primary activities involve receiving deposits, providing loans, and offering current and savings accounts.

Non-permissible activities for foreign banks in Nigeria

- Provision of services designated in Nigeria as banking business.

- Provision of any commercial or trading activity that may lead to the issuance of invoices for services rendered.

- Engage directly in any financial transaction.

Access Bank CEO Wigwe buys over N11.3bn new shares

Meanwhile, in another report, Access Holdings CEO Herbert Wigwe has cemented his place as one of the most significant shareholders

The bank revealed that he paid over N11 billion to buy more shares in the financial institution.

Wigwe is one of Nigeria's highest-paid CEO and received huge compensation for his excellent work after an impressive year.

Source: Legit.ng