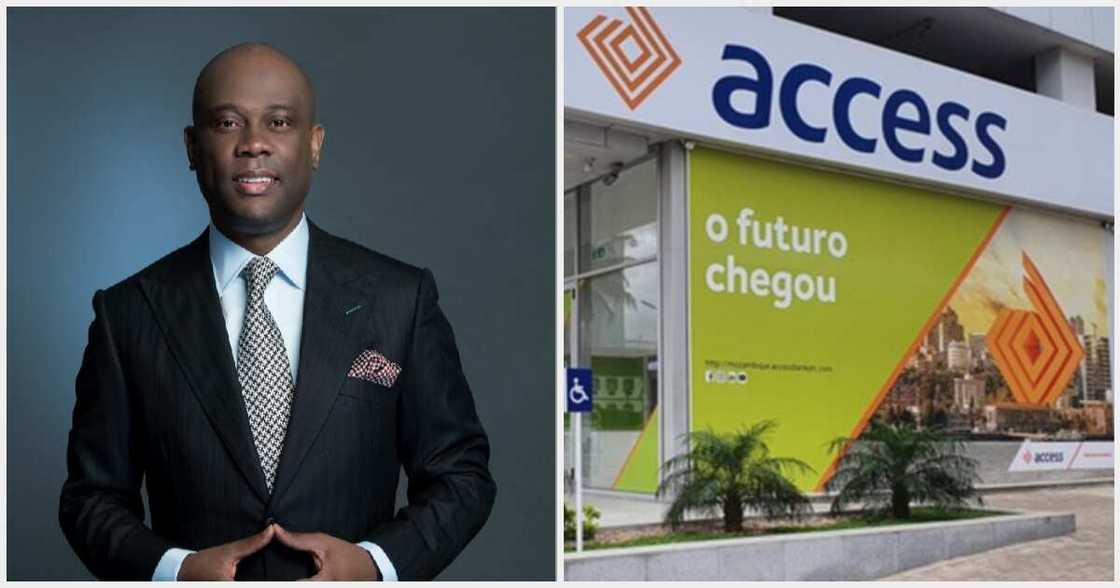

Access Bank Secures Govt Approval to Buy Another Bank in Angola After Setting New Banking Record in 2022

- Access Bank has obtained approval from the Central Bank of Angola to acquire a majority equity stake in Finibanco Angola S.A

- The Central Bank of Nigeria has approved the deal, and the bank now awaits Angolan authority to complete the regulatory requirements

- Finibanco Angola is a commercial bank that offers various financial services to individuals, companies, and institutions

Access Bank, a subsidiary of Access Holdings Plc, has obtained approval from the Central Bank of Angola, Banco Nacional de Angola, to acquire a majority equity stake in Finibanco Angola S.A.

The approval was revealed in a corporate notice filed by Access Bank on the Nigerian Exchange Limited on Wednesday, May 3, 2023.

The development marks another significant achievement for one of Nigeria's largest lenders, which earlier became the first financial institution in Nigeria to report over N1 trillion in gross earnings for a financial year.

Read also

CBN places 7,552 BVNs on its watchlist, to close million of accounts in Access, other banks

Source: Facebook

Access Bank's deal with Finibanco

Access Holdings announced the plan to take control of one of Angola's commercial banks on October 4, 2022, and the Central Bank of Nigeria approved it.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

The only requirement left for Access Bank to complete the deal is to obtain approval from the Angolan Competition Authority, satisfying the regulatory requirements.

Access Bank has also signed agreements with minority shareholders of Finibanco Angola S.A., who have expressed interest in selling their shares concurrently.

It will mean that Access Bank's total shareholding in Finibanco Angola S.A. will be over 80% when the process is completed.

Access Bank reacts

Access Holdings' Group Chief Executive Officer, Herbert Wigwe, expressed his pleasure at the development, stating that it positions the bank to provide high-value financial services to high-growth businesses and the rising consumer sector in Angola.

His words:

“We are excited to announce that we are now in a strong position to join a group of elite banks that offer top-tier financial services to fast-growing businesses and the burgeoning consumer market in Angola.

"Our bank has a wealth of valuable expertise that will serve as a positive catalyst for fostering greater innovation and promoting the expansion of the financial sector in Angola.

"This will complement our strategic growth goals in the wider SADC region."

What to know about Finibanco

Finibanco Angola is a commercial bank in Angola, a country in Southern Africa.

Established in 2004, it is part of the Finibanco Group based in Portugal.

Finibanco Angola offers financial services to individuals, companies, and institutions with over 20 branches and approximately $300 million in total assets and is profitable and well-capitalised.

Access Bank CEO Wigwe buys over N11.3bn new shares

Read also

“Don’t deal with them”: SEC names Prime Invest, 5 other blacklisted online trading platforms, warns Nigerians

Meanwhile, in another report, Access Holdings' CEO Herbert Wigwe has cemented his place as one of the bank's most significant shareholders

The bank revealed that he paid over N11 billion to buy more shares in the financial institution.

Wigwe is one of Nigeria's highest-paid CEO and received huge compensation for his excellent work after an impressive year.

Source: Legit.ng