5 Implications of Prolonged Naira Scarcity on Nigeria's Economy

- The NESG has pointed out some of the implications of a continued naira scarcity on the economy of Nigeria

- The economic advocacy group said that the policy has resulted in issues that are taking a toll on Nigeria's economy

- The report explored recommendations to help reverse the adverse socio-economic effect and help restore confidence in the apex bank

PAY ATTENTION: See you at Legit.ng Media Literacy Webinar! Register for free now!

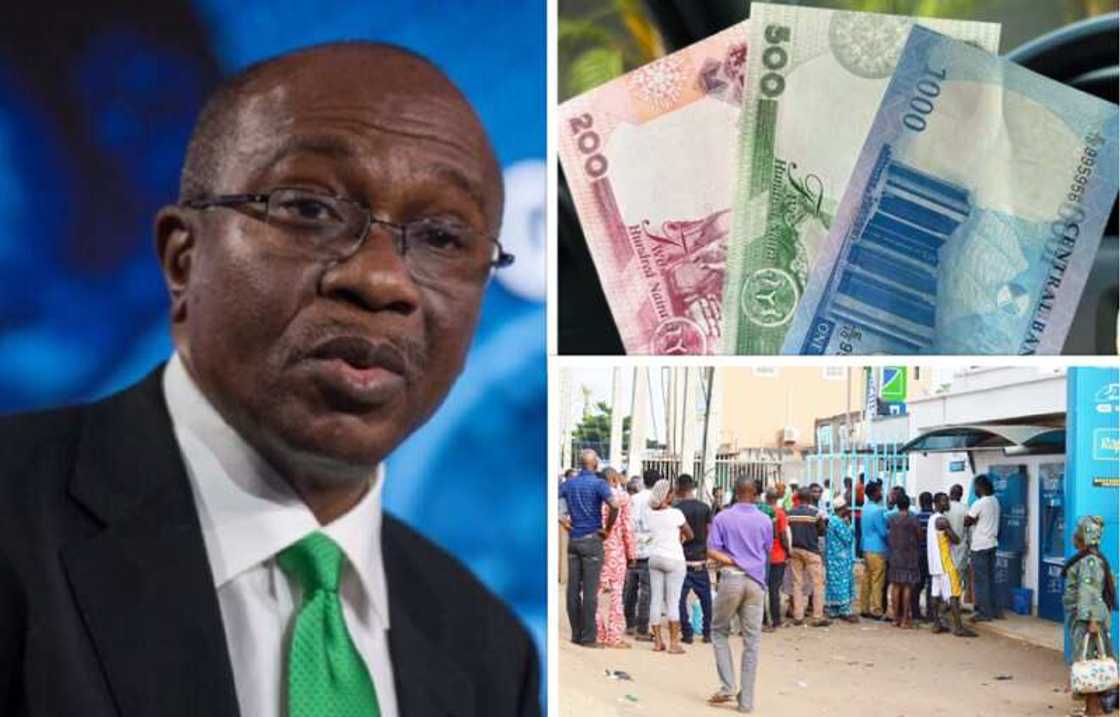

The Nigerian Economic Summit Group (NESG) has highlighted some of the implications of a prolonged naira scarcity on Nigeria's economy. This follows the Naira redesign and swap policy which was introduced by the Central Bank of Nigeria in November 2022.

The NESG noted this in its recent report titled, NAIRA REDESIGN POLICY: CAUGHT IN THE WEB, released in February 2023, where it analysed the CBN's intent for the policy, the issues that have emanated and the likely outcome of a prolonged cash crunch.

Source: UGC

The private policy advocacy group stated that the CBN's plan to redesign the country's currency which is authorised by Section 18(a) and (b) of the CBN Act of 2007, has caused an artificial cash crunch, increased pressure on the banking system and heightened social tensions, all of these which is taking a toll on Nigeria's economy.

It, however, stated the consequential impacts of the prolonged cash crunch on the economy of Nigeria.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

Macroeconomic Instability

The scarcity of cash will likely cause a slowdown in economic growth as a result of many productive activities being interrupted by inaccessibility to cash. The uncertainty caused by the policy and the resultant economic effects would produce unpalatable socio-economic outcomes

A reduced productivity will result in a declining Gross Domestic Product (GDP) with adverse effect on the economic including increasing poverty indices and fewer job opportunities.

Fewer employment opportunities will decrease consumer spending which may lead to decrease government revenue from non-oil sources.

Fewer employment opportunities will also lead to low purchasing power which in turn would hamper demand for goods and services. Overall, this would lead to a decline in the standard of living Spurring civil disobedience, social unrest and security threats like we have seen in Ogun, Oyo and Edo States in recent weeks.

Restrain local trade and regional trade

Another major impact of cash scarcity will be most obvious in the trade sector. Business transactions has since become stiffened as a result of the scarcity resulting in a slowdown in local trade. Shortage of cash will also disrupt Nigeria's trade with countries in the West African region.

Constrain the informal sector

The informal sector which is primarily run on cash contributes about 65% of Nigeria's Gross Domestic Product (GDP). The informal sector also employs over 80% of the labour force, so one can easily imagine what a drought in cash can cause.

A prolonged cash crunch could translate to job losses in the informal sector with declining activity which will therefore lead to a potential slowdown of the overall economy.

Distrust in the financial system

While the cash crunch persists with many challenges of accessible the few available cash, many bank customers begin to lose confidence in the banking system. In the long run, those who eventually find cash will resort to stacking up rather than returning them into the financial system, a gesture which defeats the agenda of the CBN naira redesign policy.

Erosion of investment confidence

Sometimes government policies tend not to go down well with the people and result in unintended consequences. The naira redesign is one of such policy and it compounds the level of uncertainty in the economy resulting in investors' fear in committing their funds to the economy.

NESG's recommendation to help CBN's naira redesign policy

As laudable as the CBN's naira redesign policy may be, one can not help but admit that its myriad unintended challenges have caused hardship to many Nigerians, resulting in protests in and from different quarters.

As a result of this, the NESG has given some recommendations to help reverse the adverse socio-economic effect and help restore confidence in the financial system.

The NESG recommends that the CBN allows a gradual phaseout of the old notes. By so doing, the CBN should reconsider allowing the side-by-side usage of old and new notes until the old notes eventually all return to bank vaults.

Also, the CBN should expedite printing new notes and forge a more transparent distribution channel to efficiently deliver new notes to banks and other financial institutions.

The CBN should intensify public sensitisation by organising a campaign to educate the public on the need for the naira redesign policy and the reasons for cash scarcity. This would help calm Nigerians who are angry and dissatisfied with the policy and current naira scarcity.

Lastly, the CBN should help strengthen digital infrastructure to expand the capacity of the digital financial system to accommodate the mass migration to digital channels.

Nigerians frustrated as CBN's naira policy causes scarcity across Nigeria

CBN's move to recall old naira notes in exchange for the newly redesigned naira notes and enforcement of a cashless policy has brought extreme hardship on Nigerians due to the scarcity of the currency.

Every day, thousands of customers besiege various banks and ATM points to withdraw, only to be confronted with the fact that the naira has become scarce and the banks do not have enough to dispense to all customers.

The scarcity has caused a lot of frustration amongst Nigerians, resulting in protests and vandalisation of bank properties in cities like Ibadan, Abeokuta and Benin.

While the protests were ongoing, videos emerged of customers stripping inside banking halls demanding their money. Customers are fighting each other and also fighting bank staff. Many ATM points have been converted to temporary sleeping camps by some customers.

Unfortunately, bank app transactions in recent times have become more strenuous and unreliable, probably because of an increase in the volume of transactions since cash became scarce.

PoS operators who could have served as alternatives are also dealing with a cash shortage. Most do not even have the cash to give out, and the few who manage to get a hold of a little cash have turned 'overnight celebrities' and are charging as much as N1000 extra for a N5000 withdrawal.

Source: Legit.ng