5 Reasons CBN’s Naira Redesign Policy Has Been Unsuccessful

- The NESG has pointed out some factors responsible for the poor success rate of the CBN's naira redesign policy

- The economic advocacy group faulted the CBN for introducing the initiative when Nigeria was dealing with many economic issues

- The report explored recommendations to help reverse the adverse socio-economic effect and help restore confidence in the apex bank

PAY ATTENTION: See you at Legit.ng Media Literacy Webinar! Register for free now!

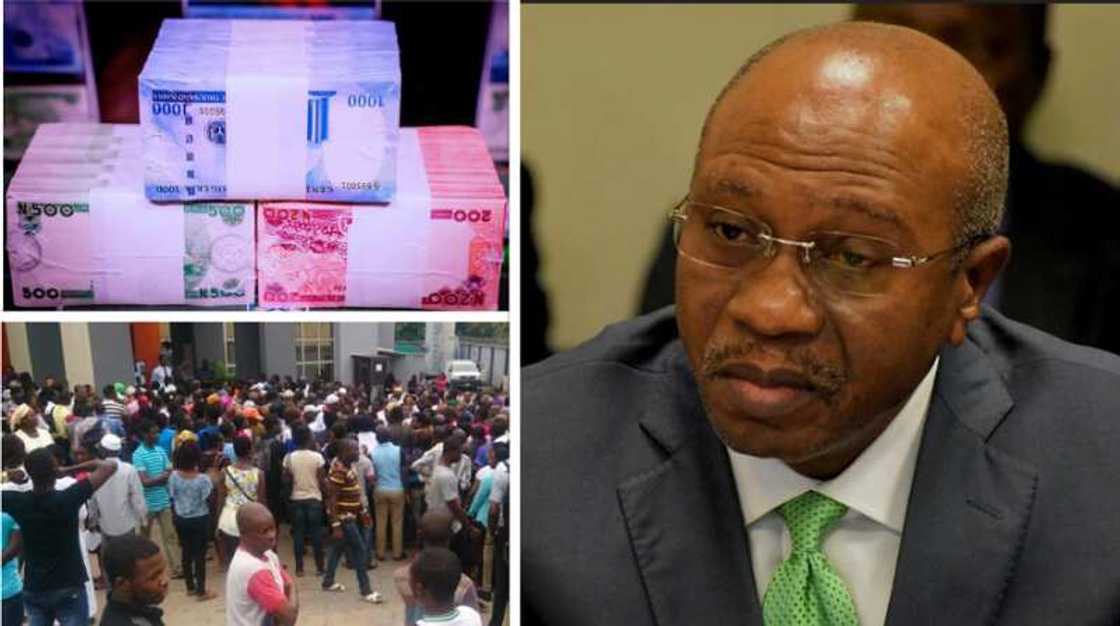

The Nigerian Economic Summit Group (NESG) has highlighted some reasons for the less-than-commendable success rate of the Naira redesign and swap policy recently initiated by the Central Bank of Nigeria.

The NESG noted this in its recent report titled, NAIRA REDESIGN POLICY: CAUGHT IN THE WEB, released in February 2023, where it analysed the Central Bank of Nigeria (CBN)'s intent for the policy, the issues that have emanated and the likely outcome of a prolonged cash crunch.

Source: UGC

The private policy advocacy group stated that the CBN's plan to redesign the country's currency which is authorised by Section 18(a) and (b) of the CBN Act of 2007, could not have come at a worse time when Nigeria was already dealing with biting fuel scarcity, inflation and other economic woes.

It, however, put forward the possible reasons the policy has been clouded in controversies and likely lack of success.

PAY ATTENTION: Subscribe to Digital Talk newsletter to receive must-know business stories and succeed BIG!

Improper timing

One of the significant reasons the naira redesign policy has not been successful is the relatively short timeframe for implementation.

It would be recalled that the CBN launched the new naira notes in November and set a deadline of January 31st for depositing old naira notes.

The period the CBN decided to implement the policy is known for high spending and increased use of cash. The end of December was the yuletide season, and the following month was the peak of the electioneering season.

Read also

Hundreds of Customers Troop to Banks as CBN Orders Recirculation of Old N200, N500, N1000 Notes

The demand for cash is more robust than usual during these periods. Restricting the cash in circulation only inflicted hardship on the people despite the policy's good intentions.

High level of informality

Nigeian has a substantially large informal sector said to be contributing about 65% to the country's Gross Domestic Product (GDP). As with countries with a large informal sector, money outside the banking system is generally much.

Until the share of the informal sector drastically declines, the currency outside banks will likely keep increasing.

Low rate of financial inclusion

Much of Nigeria's population is unbanked and financially excluded. As a result, it is most difficult for those in this category to gain access to the new banknotes when it is already hard enough for those with bank accounts to get them.

So, until many unbanked Nigerians are brought into the financial system, the CBN will continue to find it strenuous to control currency circulation outside the banking system.

Ineffective policy coordination

When the CBN announced the policy in October 2022, it became apparent that it lacked effective coordination with the Ministry of Finance, as the ministry claimed not to be aware of the policy.

Even some state governors at different times spoke against the timing and appropriateness of the policy, casting doubts in the minds of Nigerians about the workability of the policy and enforcement of the deadline.

The lack of coordination undermines investors' confidence and causes apprehension ahead of the country's general elections.

Lack of public sensitisation & stakeholders' engagement

Even though the constitutional right to implement the naira redesign policy lies with the CBN, the process was truncated by its failure to carry stakeholders along in the conception and implementation of the policy.

In addition, the CBN did not do sufficient publicity and sensitisation of the public, resulting in delays in adjusting to the policy, as seen in recent reports.

Read also

Naira scarcity has cost Nigerian economy N20 trillion as CBN mops uP 70% of cash from circulation

NESG's recommendation to help CBN's naira redesign policy

As laudable as the CBN's naira redesign policy may be, one can not help but admit that its myriad unintended challenges have caused hardship to many Nigerians, resulting in protests in and from different quarters.

As a result of this, the NESG has given some recommendations to help reverse the adverse socio-economic effect and help restore confidence in the financial system.

The NESG recommends that the CBN allows a gradual phaseout of the old notes. By so doing, the CBN should reconsider allowing the side-by-side usage of old and new notes until the old notes eventually all return to bank vaults.

Also, the CBN should expedite printing new notes and forge a more transparent distribution channel to efficiently deliver new notes to banks and other financial institutions.

The CBN should intensify public sensitisation by organising a campaign to educate the public on the need for the naira redesign policy and the reasons for cash scarcity. This would help calm Nigerians who are angry and dissatisfied with the policy and current naira scarcity.

Read also

Did Emefiele give money to Lagos LP guber candidate for election? Fresh details emerge as CBN reacts

Lastly, the CBN should help strengthen digital infrastructure to expand the capacity of the digital financial system to accommodate the mass migration to digital channels.

Nigerians frustrated as CBN's naira policy causes scarcity across Nigeria

CBN's move to recall old naira notes in exchange for the newly redesigned naira notes and enforcement of a cashless policy has brought extreme hardship on Nigerians due to the scarcity of the currency.

Every day, thousands of customers besiege various banks and ATM points to withdraw, only to be confronted with the fact that the naira has become scarce and the banks do not have enough to dispense to all customers.

The scarcity has caused a lot of frustration amongst Nigerians, resulting in protests and vandalisation of bank properties in cities like Ibadan, Abeokuta and Benin.

While the protests were ongoing, videos emerged of customers stripping inside banking halls demanding their money. Customers are fighting each other and also fighting bank staff. Many ATM points have been converted to temporary sleeping camps by some customers.

Unfortunately, bank app transactions in recent times have become more strenuous and unreliable, probably because of an increase in the volume of transactions since cash became scarce.

PoS operators who could have served as alternatives are also dealing with a cash shortage. Most do not even have the cash to give out, and the few who manage to get a hold of a little cash have turned 'overnight celebrities' and are charging as much as N1000 extra for a N5000 withdrawal.

Source: Legit.ng