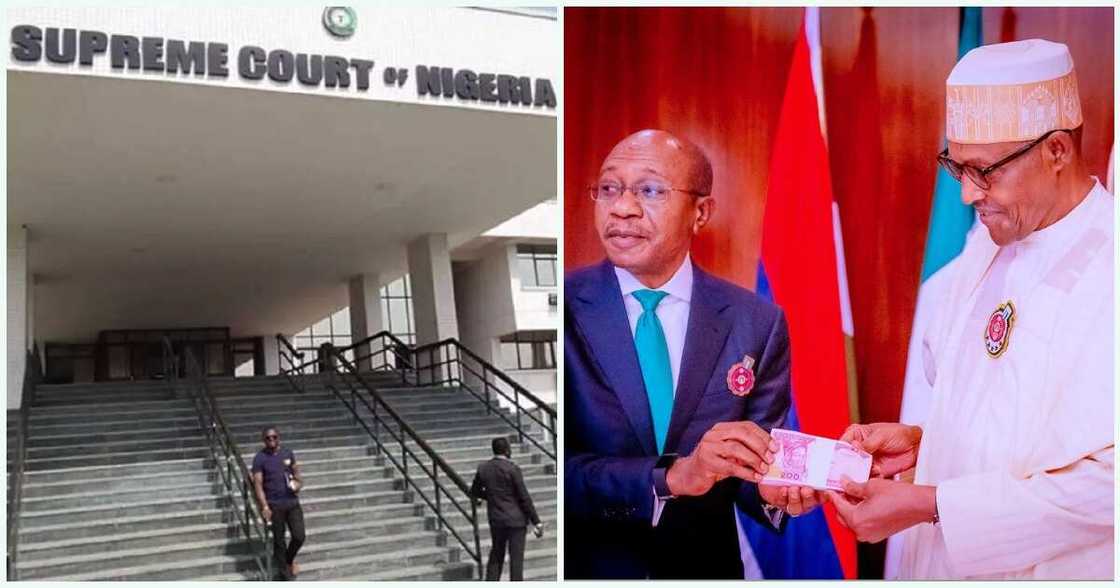

CBN to Reveal Next Move as Supreme Court Halts Ban on Use of Old Naira Notes After February 10

- The Central bank of Nigeria's moves to phase out the old 1000, 500, and 200 notes has got clog in its wheel

- The Supreme Court has temporarily halted the move by the Federal Government to ban the use of the old naira notes from February 10, 2023.

- A seven-member panel reached the decision after an ex-parte application brought by three northern states of Kaduna, Kogi, and Zamfara

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

The Central Bank of Nigeria will have to make a decision in the next few hours following a decision from the supreme court to halt the facing out of old N1000, N500, and N200 notes by February 10, 2023.

Justice John Okoro, who presided over the Supreme Court panel on Wednesday, 8 February 2023, restrained the Federal Government from suspending, deciding, or discontinuing the usage of old naira notes until it decides after an application from three northern governors.

Legit.ng had reported that the three northern states had specifically applied to the supreme court to allow the use of now older naira notes after CBN's deadline date.

Source: Facebook

Counsel to the three governors, led by A. I. Mustapha (SAN), urged the apex court to grant the application in the interest of justice and the well-being of Nigeria, ThisDay reports.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

He stated that the policy of the government had led to an “excruciating situation that is almost leading to anarchy in the land”.

While he referred to Central Bank of Nigeria’s (CBN) statistics which put the number of people who don’t have bank accounts at over 60 percent, Mustapha lamented that the few Nigerians with bank accounts can’t even access their monies from the bank as a result of the policy.

The senior lawyer further argued that unless the Supreme Court intervenes the situation will lead to anarchy because most banks are already closing operations.

Details of the supreme court judgment

Delivering a ruling in the motion, Justice Okoro, held that after careful consideration of the motion exparte this application is granted as prayed:

“An order of Interim Injunction restraining the Federal Government through the Central Bank of Nigeria (CBN) or the commercial banks from suspending or determining or ending on February 10, 2023, the time frame with which the now older version of the 200, 500 and 1,000 denomination of the naira may no longer be legal tender pending the hearing and determination of their motion on notice for interlocutory injunction”.

What next for CBN

The hearing of the supreme next suit is on Wednesday, February 15, 2023, which is five days after the CBN deadline.

It is now looking increasingly unlikely that the February 10 deadline for swapping of old to new naira notes will stand.

The Punch reports that Godwin Emefiele has consistently insisted that there will be no extension to the old naira notes as legal tender.

He did, however, request that any Nigerian who still needs to exchange old naira notes visit any of the CBN branches across the country.

Legit.ng several attempts to speak with CBN spokesman Osita Nwanisobi were not successful at the time of writing.

Nevertheless, it is expected that the CBN will be making an announcement in reaction to the supreme court judgment in the coming days or hours.

USSD code to block bank account when ATM card, or phone is stolen

Meanwhile, with the CBN forging ahead with its plan to ensure that Nigeria becomes a cashless society, it is important customers are security conscious.

Nigerians will have to open a bank account and also get an ATM card or use their phones for transactions.

Read also

Speakership: APC forum rejects Tajudeen’s nomination, makes case for Wase, northcentral zoning

As more Nigerians become banked, it is expected that electronic fraud will increase, Legit.ng has provided a list of USSD codes to quick block accounts.

Source: Legit.ng