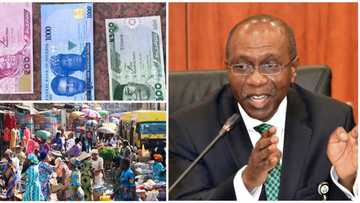

Naira Redesign: CBN Records Major Breakthrough As Nigerians Return Billions to Commercial Banks

- The Central Bank has made significant progress in redesigning the new naira notes.

- The policy was designed to combat increasing inflation, which was mostly driven by the amount of cash with Nigerians

- According to new data, one month after the CBN announced the redesign of the Naira notes, Nigerians returned over 140 billion nairas to commercial banks

Legit.ng is celebrating business personalities of 2022. See top entrepreneurs of Fintech, Startup, Transportation, Banking and other sectors!

The Central Bank of Nigeria has recorded massive success in its effort to take back the excess cash in the economy.

The apex bank in its latest monetary data released on Monday, 9 January 2023 revealed that Currency in Circulation(CIC) has reduced to N3.16 trillion in the month of November 2022 compared to N3.3 trillion reported in October 2022.

The November CIC figure is the lowest it has been since november 2021.

Source: Facebook

Currency in circulation is the amount physically used to conduct transactions between consumers and businesses, rather than stored in a bank, financial institution, or central bank.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

Based on CBN data, it means that in one month Nigerians returned over N140 billion to the banking sector.

CBN redesign policy

While announcing the plan to redesign naira in October 2022, the CBN Governor, Godwin Emefiele in a statement said:

“There is significant hoarding of banknotes by members of the public, with statistics showing that over 85 percent of the currency in circulation are outside the vaults of commercial banks.

“To be more specific, as at the end of September 2022, available data at the CBN indicate that N2.73 Trillion out of the N3.23 trillion currency in circulation, was outside the vaults of Commercial Banks across the country; and supposedly held by the public."

Read also

Again, CBN defends decision to redesign naira notes as traders continue to reject it few days to deadline

Emefiele further expressed concerns noting that the huge pile of cash in the hands of Nigeria is playing a role in the rising inflation.

More positive results from the Naira redesign

According to another money and credit data set currency outside banks captures the total financial assets by individuals dropped in the month of November.

According to CBN statistics, as at November 2022, their Currency outside the bank stood at N2.65 trillion.

This is a 6.69 percent or N200 billion drop when compared to N2.84 trillion currency outside the banking sector as at October 2022.

Full list of banks' USSD codes for e-payments

Meanwhile in another report, Legit.ng has provided a list of all banks' USSD codes for quick payment.

USSD transactions are one major structure for the CBN in its drive to ensure a cashless society since it doesn't need the internet.

The report also provided a breakdown of steps any Nigerian can start using the various service it provided.

Source: Legit.ng