3 Nigerian Banks Report 26,877 Fraud Cases in Six Months

- Nigerian banks have recorded the number of fraud cases in their companies the first half of this year

- The reports which were gleaned from their financial records for 2022 show that they had a total of 26,877 fraud cases

- Access Bank, Guaranty Trust Holding Company and Fidelity Bank reported the highest number of fraud cases

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

According to financial reports, Access Bank, GTB and Fidelity Bank registered about 26,877 fraud cases in the first half of 2022.

The report shows a 56.45 per cent decline from 61,715 fraud cases recorded by the banks between June and December last year.

Source: Getty Images

Access, GT, Fidelity banks top list

The Punch report said that Guaranty Trust Holding Company and its subsidiary firms reported 15,004 fraud cases in the period under review.

Read also

Dangote set to borrow N112 billion from Nigerians to complete refinery project, full repayment date in 10yrs

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

GTB reported that N155 billion and $50,700 were affected in those cases, with N158.73 million recorded as an exact and expected loss.

Also, Access Bank reported N1.2 billion in fraud cases for the period. It recorded 10,76 fraud attempts in the first half of this year.

The bank said about 7,104 attempts succeeded while 3,602 were rebuffed. About N12,55 billion was affected in the attempts.

It also stated that 7,928 electronic and USSD fraud cases were recorded in the first half of the year, with 849 attempts successful.

Fraudulent transfers, withdrawals and reactivation of accounts were the most affected, with N9.48 billion successful attempts worth N9.48 billion made and actual loss to the tune of N1.08 billion made.

NIBSS gives reasons for increase fraud

Read also

From Obasanjo to Buhari: How Nigeria's debt ballooned 800% to N42.82 trillion in two decades

Other successful and unsuccessful attempts came under cash theft, suppression, pilferage and dry posting.

Fidelity Bank had about 1,167 issues in the same period. About N471.01 million and $8,367, the actual loss amounted to N4.80 million and $2,400.

Nigeria Interbank Settlement System (NIBSS) said Nigeria has one of the most improved electronic abilities in the world and that transaction speed including available channels have created a means for scammers.

Zenith Bank customer narrates ordeal after losing N6 million in 15 minutes; bank reverses money after bashing

Legit.ng reported that a Twitter user with the Twitter handle @Fashionjuel1 has narrated how her entire life savings was wiped off in 15 minutes from her Zenith Bank account.

The lady, who described herself as a healthcare enthusiast, said that on Friday, October 21, 2022, she had woken up at about 1 am join a church programme when she discovered that all her life savings and everything she had worked for all her life savings totalling N6 million disappeared without a trace in 15 minutes.

Read also

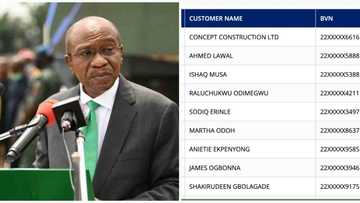

Banks publish more names of Nigerians committing forex malpractices as black market rate hit N760

According to her, it was to the porosity and negligence of the bank.

Source: Legit.ng