Nigeria Foreign Reserves Deplete Further Despite Oil Prices as CBN Withdraws Almost a Billion in 3 Months

- Nigeria's foreign reserves are depleting as the Central Bank of Nigeria withdraws funds to fulfil foreign currency market demands

- Nigeria's reserves have dropped by about a billion dollars in three months since the start of 2022, according to data

- The recent increase in oil prices was supposed to benefit Nigeria's foreign reserves, however, there was no impact

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

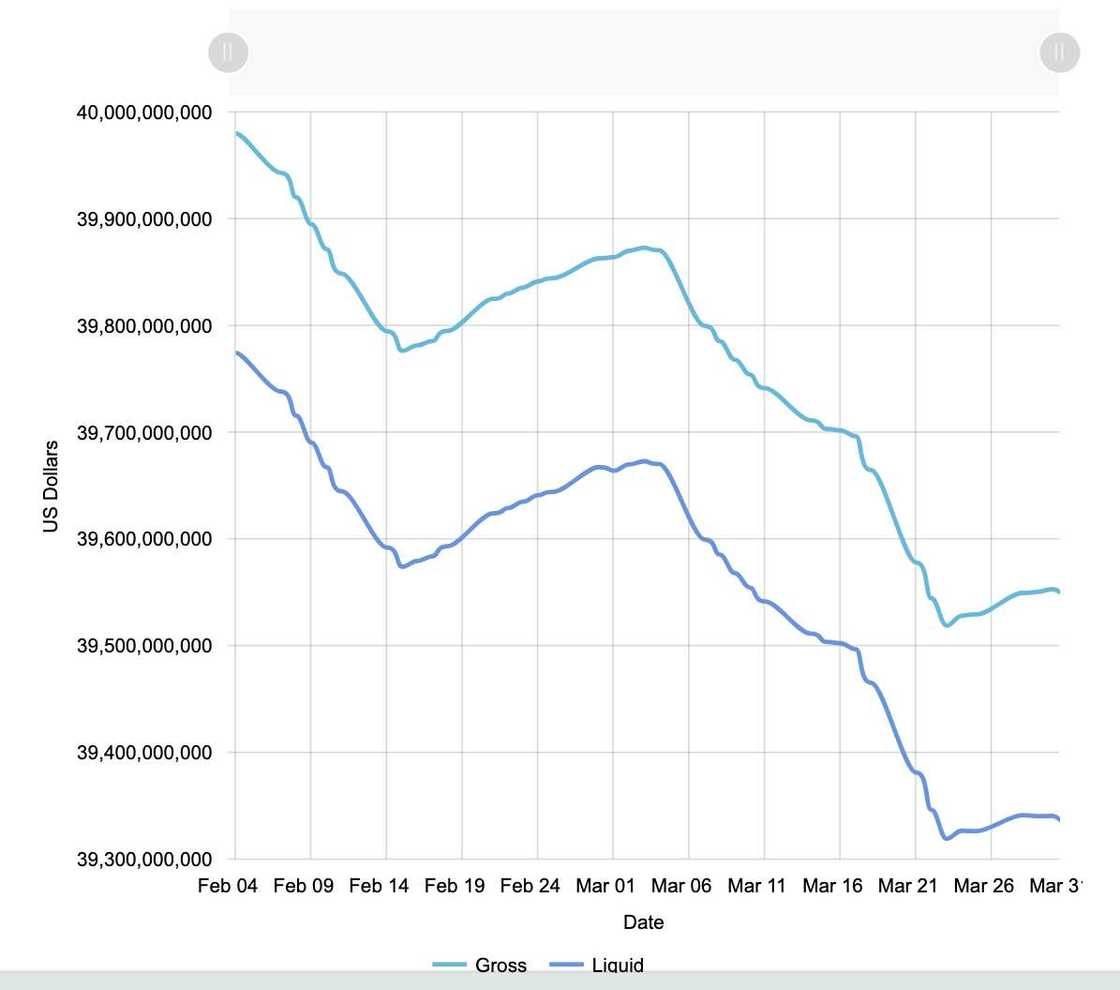

Nigeria’s external reserve dropped by $971.4 million in the first quarter of 2022 (Q1), the Central Bank of Nigeria (CBN) data on daily reserves’ movement has revealed.

According to the CBN data obtained on Monday, 4 April 2022, Nigeria's reserves dropped by $39.55billion billion as at March 31, 2022, compared to $40.52billion it commenced in 2022.

This happens despite a steady increase in global oil prices within the period rising to as high as $160 per barrel.

Source: Facebook

What this means is that Nigeria's three richest men's net worth is now 86 per cent of Nigeria reserves.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

As at Monday, 4 April, Bloomberg reports that Aliko Dangote is worth $20 billion.

Similarly, Forbes also announced Mike Adenuga's current networth stands at 7.4 billion while Abdulsamad Rabiu is worth $6.8 billion.

Breakdown

In January, the external reserve had dropped by $478.95milion to $40.04billion, while in February, it depreciated further by $121.45million to $39.98billion from $39.86billion.

However, in March 2022, the external reserve moved from $39.86billion to $39.55billion as at March 31, 2022, representing a decline of $317.8 million.

Analysis of the CBN’s data showed that the external reserve was at a threshold of $40billion in January and moved to $39billion in February 2022.

Quick summary of CBN's intervention in the forex market

One of the key mandates of CBN is its monetary policy toolkits which include currency intervention so as to ensure that the exchange rate of the naira relative to other currencies is stable.

The stronger the reserves it becomes easier for demands from importers and travellers to be met.

Ex-CBN Head criticises Emefiele's decision to ban BDC operators from selling forex

Meanwhile, Obadiah Mailafia, a former deputy governor of the Central Bank of Nigeria (CBN), has criticised the decision of the apex bank to stop providing foreign exchange to bureau de change operators.

Mailafia said the decision could weaken the value of the naira against the dollar and other foreign currencies, as there might be a scarcity of forex.

With his experience of the banking system in Nigeria, Mailafia said the banks might hoard forex for themselves and sell at a high cost to buyers whenever the lenders want.

Read also

"No more zero balance": CBN wants banks to upgrade ATMs for loans as UBA, 4 others fail to meet N65/N100 rule

Source: Legit.ng