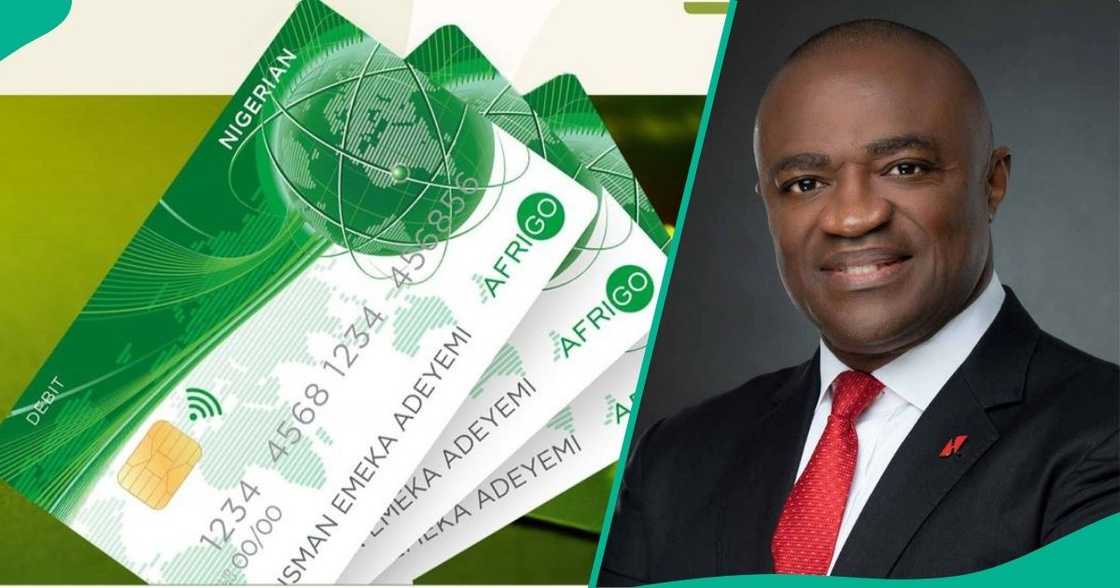

UBA Releases CBN’s National Domestic Card For Easy Payments, Explains Features

- The United Bank for Africa (UBA) has unveiled the AfriGo Card, a national domestic payment solution to boost accessibility in Nigeria

- The Central Bank of Nigeria (CBN) and the Inter-Bank Settlement System (NIBBS) launched the card to enhance payments

- It supports low-income earners and boasts impressive features such as chi-and-PIN security, ATM, and PoS payment solutions

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

The United Bank for Africa (UBA) has introduced the AfriGo Card, a groundbreaking domestic payment solution meant to boost accessibility, security, and efficiency in Nigeria’s financial system.

AfriGo was developed in partnership with the Central Bank of Nigeria and the Nigeria Inter-Bank Settlement System (NIBBS).

Source: Facebook

UBA reveals the card’s features

The card provides a reliable alternative to international payment schemes, facilitating seamless naira-denominated transactions.

AfriGo Card focuses on security, affordability, and accessibility and aligns with CBN’s financial inclusion drive and digital payment growth efforts.

According to reports, AfriGo boasts great features, including chip-and-PIN security, seamless ATM payments and PoS terminals, 24-hour access to funds, and rewarding benefits for holders.

The AfriGo Card was designed to cater to diverse demographics, supporting low-income earners, artisans, students, and market traders by offering flexible affordable and efficient finance management.

UBA promises seamless transactions with AfriGo Card

UBA’s statement signed by its Group Head of Retail and Digital Banking, Shamsideen Fashola, revealed the AfriGo Card’s versatility and other features, saying that with the card’s launch, the bank continues to show its leadership to foster financial innovation, inclusion, and accessibility for Nigerians.

“With Afrigo, we are offering a card that speaks directly to the needs of Nigerians from market women and students to small business owners and low-income earners,” Fashola said.

Per the statement, customers could get the AfriGo debit card at N1,000 including N75 VAT at any of the bank’s branches.

Read also

Nigerian billionaire set to announce 2025 cohort for entrepreneurship programme, $5,000 grant

Source: Getty Images

UBA joins Access Bank and others to launch AfriGo

UBA joins other banks and fintech platforms in launching the AfriGo Card.

In April 2023, Access Bank became the first financial institution to launch AfriGo, partnering with AfriGOPay, a financial services company aligned with the Nigeria Inter-Bank Settlement System (NIBBS) to launch Nigeria's first National Domestic Card, created to meet the payment needs of Nigerians.

The project initiated by the CBN and the NIBBS provides creative solutions to users of financial institutions in Nigeria, Africa and globally.

Access Bank's Deputy Managing Director of Retail Banking, Victor Etuokwu said the bank is the first financial institution in Nigeria to issue the first live card of the National Domestic Card in partnership with AfriGo.

The development is touted as a significant milestone for Nigeria's national payment infrastructure, where cash demand is at its peak.

CBN, NIMC to issue new National Domestic Card

Legit.ng earlier reported that the National Identity Management Commission (NIMC) has said Nigerians with the National Identification Number (NIN) will soon request a National ID card with payment features for financial and social services.

The card will be launched in partnership with the NIMC and the Central Bank of Nigeria (CBN) and powered by the Nigeria Inter-bank Settlement System (NIBBS) and AfriGo.

A statement by NIMC’s Head of Corporate Communications, Kayode Adegoke, said the National ID card, which is embedded with verifiable national identity features, is backed by NIMC Act No 23 of 2007, mandating it to enrol and issue a general multipurpose card to Nigerians and legal residents.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng