How New CBN ATM Charges Will Affect You And Numbers to Report Banks Violating The Rule

- The Central Bank of Nigeria (CBN) recently introduced a new ATM charge of N100 per transaction, among others

- CBN said the transaction fee will begin on March 1, 2025, and mandated banks to ensure enough cash on their ATMs

- Meanwhile, CBN has released Frequently Asked Questions (FAQs) on how the new charges will affect bank customers

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

The Central Bank of Nigeria (CBN) has updated ATM transaction charges to address increasing operational costs and boost ATM efficiency services in the industry.

The apex said the adjustment would encourage the deployment of more ATMs while ensuring fair and transparent customer charges.

Source: Getty Images

When will new ATM transaction fees take effect?

According to the CBN, the revised charges will become effective from March 1, 2025, and require all banks and financial institutions to comply with the circular.

Charges from my bank’s ATM

Withdrawals from a user’s ATM known as on-us transactions, remain free. The location of the ATM does not affect customers using the same bank that deployed an off-site ATM.

The new charges include: On-Us Transactions (Withdrawals at your bank’s ATM): No charge.

CBN said withdrawals at another bank’s ATM will attract N100 per N20,000 withdrawal.

Also, off-site ATMs will attract N100 per N20,000 withdrawal, plus a surcharge of up to N500. The surcharge will be displayed on a customer’s ATM screen before approval.

According to the apex bank, international withdrawals will attract fees based on cost recovery, meaning the fee applied by the international acquirer will be passed to the customer.

Difference between on-site and off-site ATMs

The financial sector regulator describes on-site ATMs as those located within or directly affiliated with a bank branch. Meaning the ATMs are on the bank premises.

While off-site ATMs are outside a bank’s premises, such as shopping malls, fuel stations, or other public areas.

N20,000 withdrawals

The bank said the N100 fee will still apply if you withdraw less than N20,000 from another bank

The reason for applying the fee for every N20,000 withdrawal is to prevent customers from being compelled to break their withdrawals to less than N20,000 per withdrawal, CBN said.

In other words, ATM transactions will incur a base fee of N100 per transaction. It is also important to note that a tiered fee structure will apply for transactions exceeding N20,000, with an additional N100 charged for each subsequent withdrawal of N20,000 or a portion thereof.

The CBN circular stated that the three free monthly withdrawals allowed for those withdrawing from another bank’s ATM will no longer apply under the new review.

How to know surcharge for off-site ATM withdrawal

The surcharge of up to N500 per N20,000 will be displayed at the point of withdrawal, allowing users to make an informed decision before proceeding with the transaction.

CBN disclosed that from the effective date, depositors who withdraw regularly from other banks’ ATMs will pay for each withdrawal.

Additionally, they may be surcharged if they withdraw from off-site ATMs.

It also said no bank is allowed to charge more than the stated amount or the capped surcharge, stating that though the surcharge for every transaction is fixed, there is flexibility for a bank to charge a lower amount, depending on its cost structure and business development drive.

How to avoid the new ATM charges

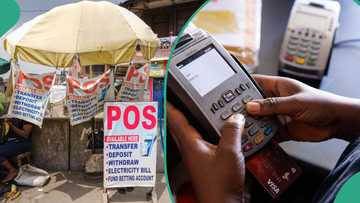

To avoid the new charges, CBN asked customers to use their banks’ ATMs or explore PoS services for payments to avoid the new charges.

The new charge allows withdrawals outside Nigeria to be charged according to the amount imposed by the international ATM acquirer.

It said the fees are based on banks allowing customers to withdraw up to N20,000 per transaction.

It means banks are now mandated to increase the ATM withdrawal threshold to N20,000 per transaction.

CBN disclosed that banks restricting customers with sufficient amounts in their accounts from withdrawing N20,000 per transaction would be sanctioned.

Currently, most banks allow customers to withdraw N5,000 per transaction for off-site ATMs and N10,000 for on-site.

CBN instructs banks on ATM withdrawal limit

Legit.ng earlier reported that the Central Bank of Nigeria (CBN) said it would penalise banks that prevent customers with sufficient funds from withdrawing up to N20,000 per transaction.

The apex bank disclosed this in a ‘FAQ document explainer released on Thursday in reaction to its recent review of automated teller machine (ATM) withdrawal fees.

The CBN stressed that ATM charges for withdrawals made from other banks’ ATMs, both on-site and off-site, are based on the expectation that customers can withdraw up to N20,000 per transaction.

Proofread by Kola Muhammed, journalist and copyeditor at Legit.ng

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng