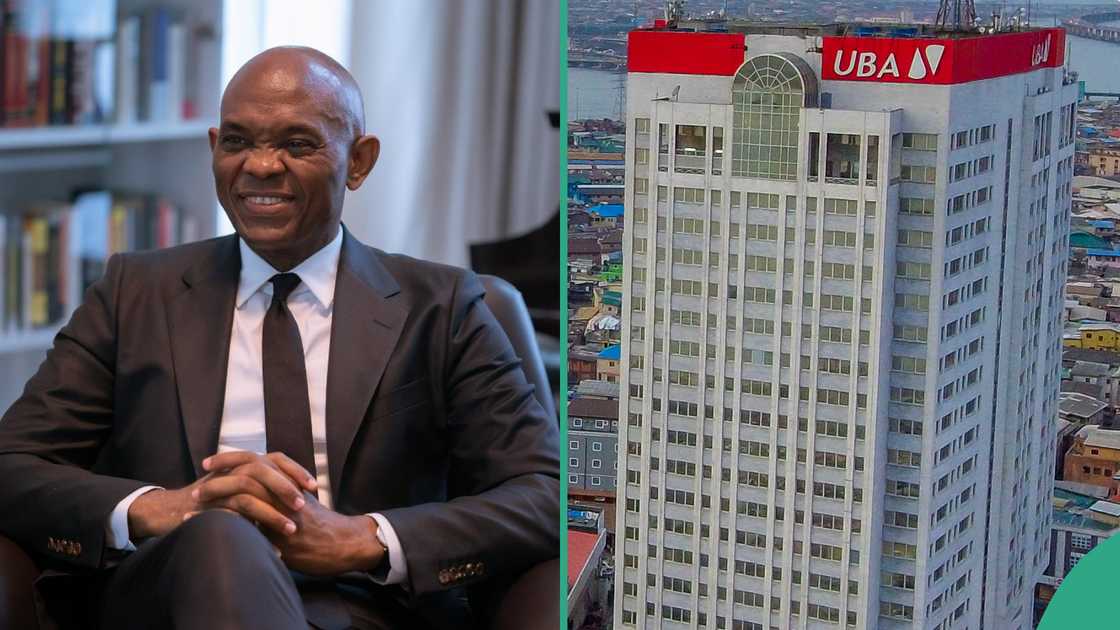

UBA Announces Plan for More Expansion After Opening Saudi, France, Other Branch

- UBA Plc has declared that it will invest in more digital technologies and business expansions using the net proceeds of its continuing rights sale

- In light of its expansion drive, it stated that current owners can buy 6.84 billion ordinary shares of 50 kobo each from UBA For N35 per share

- According to UBA Plc Group Chairman Tony Elumelu, this aims to further establish the bank as a dominant force in the pan-African banking industry

Legit.ng journalist Zainab Iwayemi has 5-year-experience covering the Economy, Technology, and Capital Market.

To build on its seven and a half decades of outstanding success, United Bank for Africa (UBA) Plc has announced that it will use the net proceeds of its ongoing N239.4 billion rights offer to invest in more digital technologies and business expansions.

Source: UGC

Existing shareholders can purchase 6.84 billion ordinary shares of 50 kobo each from UBA for N35 a share, The Punch reported.

For every five ordinary shares owned as of November 5, 2024, one new ordinary share worth 50 kobo each is used to pre-allot the rights issue. The deadline for closing the rights issue is December 24, 2024.

According to Tony Elumelu, Group Chairman of United Bank for Africa (UBA) Plc, the main goal of the ongoing rights offer is to solidify the bank's standing as a leader in the pan-African banking sector and a very lucrative organization for all parties involved.

He said the group made the decision on the rights issue to guarantee that shareholders will continue to reap the benefits of a more robust, inventive, and resilient pan-African banking organization.

Elumelu claimed that the rights offering would boost the bank's global operations while allowing it to promote corporate growth and organic expansion both inside and outside of Nigeria. A deal for UBA to start full banking operations in France was recently signed.

He asserts that the bank will expand its global reach and strengthen its global operations by investing more in these international markets, given its position in major global financial centres such as the United States of America (USA), France, the United Kingdom (UK), and the United Arab Emirates (UAE).

UBA's recent strides

While African subsidiaries account for over half of the group's overall performance, the bank will also make further investments in its current African operations while looking for new prospects. Beyond Nigeria, UBA currently operates in 19 African nations.

In addition to broadening its geographic reach, Elumelu noted that UBA is also playing a crucial and strategic role in the economic transformation of Africa as a continent. He mentioned that the bank's expansion goal is motivated by its concept of developing African enterprises.

Elumelu added that although the rights offering will allow the bank to fulfil the Central Bank of Nigeria's (CBN) new capital requirements, the net proceeds would improve the bank's ability to lend to small and medium-sized businesses (SMEs).

He explained that the bank would invest much more in technology to strengthen its standing as a leading provider of financial services and provide a more comprehensive client experience.

UBA sends message to customers

Legit.ng reported that for its numerous clients, United Bank for Africa (UBA) has issued a noteworthy update on dormant and inactive accounts.

In a statement sent out on Wednesday, UBA notified clients that savings accounts that had not been used for a specified period of time would now be considered dormant or inactive.

Remember how the governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has voiced concern about the vulnerability of dormant bank accounts to fraud?

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng