After Setting Limits for Zenith, Access, Others, CBN Moves to Restructure BDCs

- The governor of the Central Bank of Nigeria has disclosed plans to modify BDC operations in the country

- It said the action would help to improve their management and oversight and increase efficiency

- He also said it is creating a legal framework that will encourage people holding dollars to deposit in the bank

PAY ATTENTION: The 2024 Business Leaders Awards Present Entrepreneurs that Change Nigeria for the Better. Check out their Stories!

Legit.ng journalist Zainab Iwayemi has over three years of experience covering the Economy, Technology, and Capital Market.

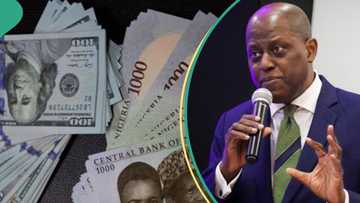

Olayemi Cardoso, the governor of the Central Bank of Nigeria (CBN), has said the apex bank is formulating plans to restructure the Bureau de Change (BDC) division to increase efficiency.

Source: Getty Images

During an interview with Arise TV, he said the goal is to reduce their workforce to improve management and oversight.

He also discussed several of the bank's policy measures and the state of the economy overall.

Getting rid of all the obstacles

In the short term, he added, the bank has worked hard and seen achievements in bettering market structures and eliminating all the obstacles preventing foreign exchange from entering the nation.

Cardoso said:

“We have addressed the challenges to remittance flows, reduced the ability of banks to hold on to positions, and more importantly, we now have the export proceeds from the national energy sector flowing back through the central bank. We have also initiated several short-term measures to make naira assets attractive to foreign investors.”

"Our policy focuses on achieving rate stability and maintaining market flexibility and liquidity. The move to unify the naira exchange rate and lift currency trading restrictions in June 2023 aims to establish market-driven rates through price discovery."

According to him, the plan aims to make the foreign exchange market more transparent and efficient to increase investor confidence and lower market volatility.

Read also

FG gives condition for Air Peace, others to slash ticket costs as Dangote Refinery products hit market

More policies from CBN

ThisDay reported that the governor of the CBN stated that the bank was looking into ways to encourage people who have foreign currency (FCY) outside of the banking system to deposit it. He said this would need the creation of a legal framework.

He also mentioned that talks are in progress to centralise all correspondent banking operations presently controlled by two big banks in the related banking sector by establishing a single FCY gateway bank.

He also said the central bank was strengthening surveillance and technological capabilities to monitor cryptocurrency transactions effectively.

Additionally, he stated that the central bank was bolstering its technological and monitoring capacities to monitor cryptocurrency transactions efficiently.

BDC operators open up on alleged shutdown

Legit.ng had reported that the Association of Bureau de Change Operators of Nigeria (ABCON) has spoken on Abuja Bureau de Change operators' alleged shutdown of forex operations.

Legit.ng earlier reported that BDC operators in Abuja announced the closure of their business premises indefinitely on Thursday, February 1, 2024.

In a statement, Dr Aminu Gwadabe, ABCON President, said the information on the shutdown of forex operations by Abuja BDCs was incorrect and never emanated from the national body or zonal offices of ABCON.

PAY ATTENTION: Donate to Legit Charity on Patreon. Your support matters!

Source: Legit.ng