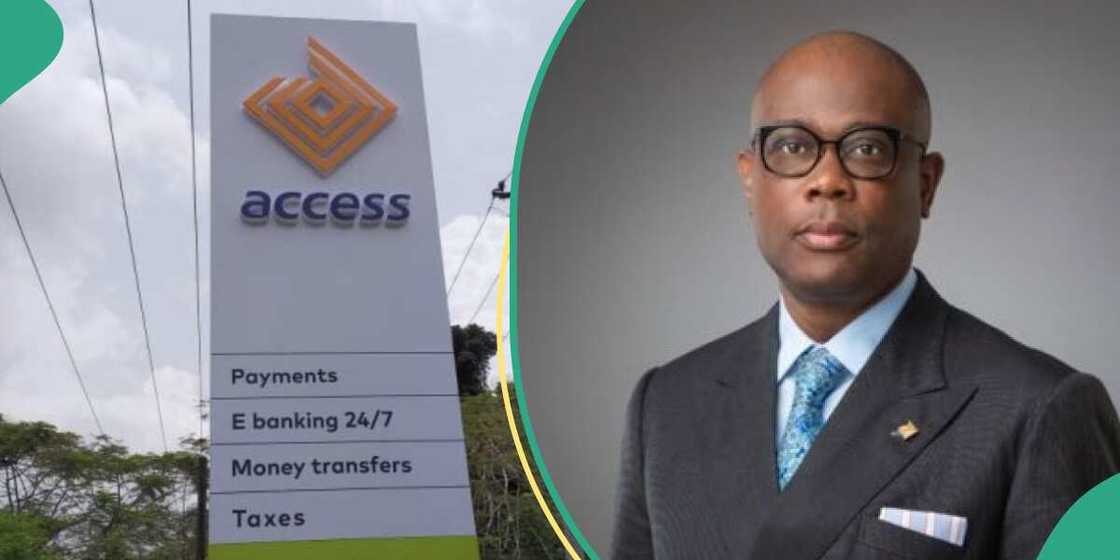

After Buying New Bank, Access Crosses N1trn in Market Value, Sends Message on CBN Loans

- Access Holdings Plc, the parent company of Acess Bank, has crossed the N1 trillion mark

- The bank achieved the milestone after its share price skyrocketed by 8.9%

- The development comes after the bank completed a deal to acquire a bank in Zambia

Pascal Oparada has over a decade of experience covering Tech, Energy, Stocks, Investments, and Economy.

Access Holdings Plc has surpassed the N1 trillion market capitalization threshold.

According to market analysis, the bank achieved the milestone at the end of trading on Tuesday, January 9, 2024, as its stocks rose by 8.39% to N29.70 from N27.40 per share.

Source: Facebook

Access Bank battles UBA as a trillion naira company

The new development raised the company's market valuation from N973.93 billion on Monday, January 8, 2024, to N1.05 trillion.

The development follows an announcement by a rival bank, the United Bank for Africa (UBA), that it had hit N1.02 trillion from N990.07 as of Friday, January 5, 2024.

Another bank, FBN Holdings, also hit the same milestone of N1 trillion after its share price spiked from N26 to N28.6.

Other banks with a trillionaire in market cap

First Bank initially crossed the N1 trillion threshold on December 6, 2023, for the first after it recorded N1.05 trillion in market cap from N960.19 billion.

The bank later exited the trillion naira company list the following day.

TheCable reports that Access Bank's performance means that all of Nigeria's tier-1 banks have crossed the N1 trillion mark.

Other banks include GTCo, with N1.42 trillion, and Zenith Bank, with N1.4 trillion.

Access Bank sends message to customers on CBN loans

The development comes as Access Bank, on Monday, January 8, 2024, asked its customers to repay any outstanding debts obtained under the Central Bank of Nigeria (CBN) loan scheme.

The directive is part of the bank's plans to ensure timely and responsible loan repayment, which aligns with the regulatory guidelines of the CBN.

In an email to customers, Access Bank asked them to fulfill their financial obligations with the bank.

Punch reports that the bank said all existing CBN intervention funds with approved interest rates remain the same and will be repaid with terms and conditions.

Access Bank buys another bank, Herbert Wigwe speaks on achievement read

Legit.ng reported that Access Bank Zambia Limited, a subsidiary of Nigeria's Access Corporation, has confirmed the successful acquisition of African Banking Corporation Zambia Limited, which operates under Atlas Mara Zambia.

In a statement released on the Nigerian Exchange, the bank said it has received all necessary regulatory approval to complete the acquisition.

The development means Atlas Mara is now a wholly owned subsidiary of Access Bank Zambia, Punch reports.

PAY ATTENTION: Unlock the best of Legit.ng on Pinterest! Subscribe now and get your daily inspiration!

Source: Legit.ng