Nigerian Banks With Best Profits in 2023, UBA, Access Bank, Zenith, Others Show Off Huge Balance Sheets

- Commercial banks in Nigeria have declared their earnings for the first half of 2023

- The banks, in the various financial statements, displayed huge earnings for half-year 2023

- UBA, Zenith Bank, Access, and Wema Bank, among others, are top earners for the first six months of 2023

Nigerian banks are showing off huge balance sheets primarily accrued in the first half 2023.

The development is due to the stellar performance of bank stocks in the Nigerian Exchange, which lifted companies' performances this year.

Source: UGC

UBA: N853.2 billion

According to a financial statement released by United Bank for Africa (UBA), it earned about N853.2 billion, an increase from N660.2 billion recorded the year before.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

The Guardian reports that the bank said the result is for the year ending December 31, 2022.

The bank's total assets rose by 27.2% to cross the N10 trillion mark, closing at N10.9 trillion in December 2022, from N8.5 trillion in 2021.

FCMB Group Plc reports 148% profit growth

The FCMB Group recorded positive performance across key indicators with a 148% growth in profit before tax of N38.2 billion from January to June of 2023, compared to N15.4 billion in the same period of 2022.

The Group's statement highlights its diversified unaudited six-month results released on the Nigerian Exchange Limited, showing that different divisions achieved strong earnings growth.

Its Group earning accounted for 185.5%, Consumer Finance 10.3%, Investment Management 53.3%, and Investment Banking 54.3%.

Additionally, the Group's gross revenue rose by 88.7% to N238.2 billion for June 2023 as against N126.2 billion for the same period in 2022.

Access Holdings Declares N88.74bn Net Profit

Access Holdings declared a profit after tax of N88.739 billion in its half-year results ended June 30, 2022.

Read also

Tony Elumelu's Transcorp profit hits N82.1 billion in first half of 2023, despite Otedola's exit

The company's Board of Directors proposed an interim dividend of N7.109 billion, representing 20 kobo per share for its shareholders.

In its half-year financials to the Nigerian Exchange Limited, the banking group made substantial improvements across key performance indicators.

The bank's profit after tax increased by 2.21% from N86.819 billion in the first half of 2021 to N88.739 billion, while earnings per share amounted to N2.52 from N2.47 in 2021.

Access Bank's gross earnings rose by 31.42% to N591.803 billion against N45.302 billion, while interest income increased by 16.46 percent to N342.304 billion from N319.685 billion recorded in the half year of 2021.

Zenith Bank's quarterly profit hits N66 billion

According to reports, Nigeria's second-largest bank, Zenith Bank, grew its earnings for the first three months of 2023 by N66 billion.

Zenith Bank extended its net income on fees and commission marginally by 2 percent to N34.1 billion after costs on electronic products plummeted by 18.2%.

Read also

Ecobank grows profit by 18% to $308 million in 6 months, CEO explains financial performance

Wema Bank's profit rises by 97 percent to N10.48bn

Despite its lack of national spread, Wema Bank recorded a post-tax profit increase of 97% in the first half of 2023.

The result shows its profit rose to N10.48 billion from N5.30 billion in the first half of 2022.

Wema Bank disclosed this in its unaudited financials for June 2023, filed with the Nigerian Exchange Limited.

The bank's performance improved with gross earnings of N89.09 billion year-on-year, representing a 49% increase for the half year of 2023, compared to N59.59 billion recorded in the same period in 2022.

Punch reports that Wema Bank's interest income spiked by 53% to N76.11 billion from the N49.75 billion record in 2022.

Non-interest income increased by 32% to N12.98 billion against the 9.85 billion recorded in 2022.

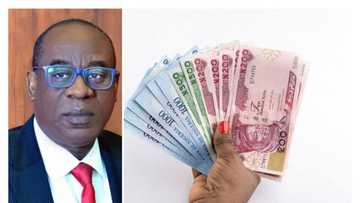

The Managing Director/Chief Executive Officer of the bank, Moruf Oseni, said the bank's half-year result in 2023 saw considerable upsides, with profit before and after tax thriving by 75% on the execution of its corporate strategy.

Speaking on the result, the Managing Director/Chief Executive Officer of the bank, Moruf Oseni, said, "Our H1 2023 results saw significant upsides with profit before and after tax growing strongly by about 97 percent. The management team at Wema Bank is focused on driving the execution of our current corporate strategy."

"Drivers N150k, cleaners, N80k": GTBank, Zenith, Stanbic, UBA other Nigerian banks announce salary increase

Legit.ng reported that to reduce the biting effect of inflation caused primarily by the removal of subsidies from petrol, Nigerian banks have adjusted their employees' salaries and wages, thus prioritising the welfare of their workforce. Recently,

Wema Bank raised the salaries of its employees to alleviate the brutal effect of fuel subsidy removal, citing economic realities as the reason.

The bank said its vision extends beyond its bottom line, and the salary adjustment is expected to have a positive ripple effect in the industry, a statement by the bank's divisional head, people, brand, and culture said.

Source: Legit.ng