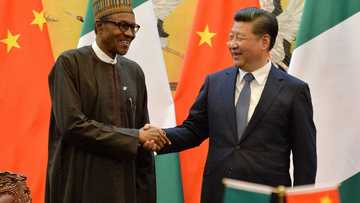

Chinese Banks Mull Nigeran Operations Amid Trade Increase Between the Two Countries

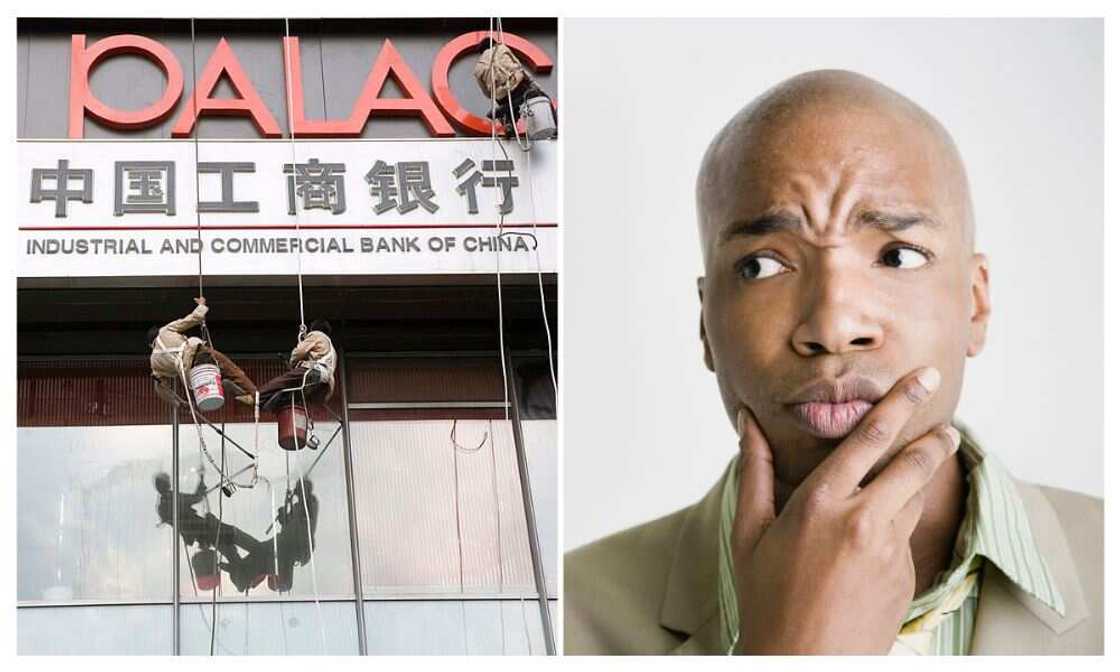

- Chinese banks are thinking of coming to Nigeria as trade volume between Nigeria and China has jumped over the years

- This year alone, trade between the two countries has jumped to N1.49 trillion from N579 billion in the second quarter of 2018

- The trade increase comes as the two nations signed a currency swap deal in 2018 to ensure hassle-free transactions

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

The Chinese Ambassador to Nigeria, Cui Jianchun, said some Chinese banks are mulling the option of establishing operations in Nigeria to take advantage of the growing transactions between the two countries.

The Ambassador said this during BusinessDay’s CEO Forum in Lagos and tagged Managing the Future: Unlocking the Power of the Platform Economy.

Source: Getty Images

Trade between Nigeria and China grows

Trade between Nigeria and China has doubled in the last four years and jumped 157 per cent to N1.49 trillion in the second quarter of this year from N578 billion in the second quarter of 2018.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

Nigeria’s imports from the Asian country stood at N1.4 trillion in the second of 2022 and exported goods worth N71.11 billion, data from the National Bureau of Statistics said.

According to the Chinese Ambassador, China supports getting more products from Nigeria to balance the trade between the two nations.

Currency swap deal signed to ease transactions

To ensure hassle-free transactions between Nigeria and China and to ease demand for the dollar in the economy, the Central Bank of Nigeria signed a currency swap pact with China in 2018.

The swap deal accelerated transactions between Nigeria and China and cut out value creation, extraction, and addition intermediaries without going via a reserve or third currency.

The swap pact is a $2.5 billion agreement signed with a three-year tenor between Nigeria and the People’s Bank of China. The deal ended in 2021 and has been renewed.

Two Nigerian states have highest debt exposure to China as total debt stock hits $100 billion

Legit.ng report that as of November last year, two Nigerian states have the highest debt exposure to China, and Nigeria's debt to the Asian country has hit about $3.4b billion.

According to data from Debt Management Office (DMO), the states of Kaduna and Cross River has the highest debt to China, given through China's Exim Bank.

The states are also exposed to lenders like Japan International Corporation (Jica) India and KFW Development Bank.

Source: Legit.ng