Auto Shanghai showcases new EV era despite tariff speedbumps

Source: AFP

Don't miss out! Join Legit.ng's Sports News channel on WhatsApp now!

The world's largest auto industry expo opens its doors Wednesday in Shanghai, showcasing the new electric world order even as mounting trade barriers risk dampening China's global ambitions.

With nearly 1,000 exhibitors present, foreign carmakers are raring to show they can keep pace with the ultra-competitive Chinese firms that dominate the sector's electric frontier.

Beijing's historic backing of EV and hybrid development has seen the domestic market flourish, with analysts considering it younger-leaning and more open to novelty.

It is the world's biggest, still growing while other major markets see declines.

"Domestic growth in China is being driven by rapid adoption of electric vehicles, increasingly with intelligent-vehicle features such as autonomous-driving systems," a report released on the eve of the show by consultancy AlixPartners said.

Auto Shanghai, which runs until May 2, will see a flurry of launches for electric, high-tech new models -- luxury SUVs, saloons and multi-purpose vehicles.

On Tuesday night Volkswagen, the largest foreign group operating in the country, unveiled a series of new vehicles and a driver assistance system built "in China for China" -- its play to reverse its sliding fortunes there.

"Our biggest push in EV history begins here," the group's China head Ralf Brandstatter said at a news conference.

Cut-throat competition

Source: AFP

Foreign brands are up against cut-throat competition from dozens of local rivals.

Exhibitors at the show range from state-owned behemoths, start-ups such as Nio and Xpeng, tech giants with skin in the game such as Huawei, and consumer electronics-turned-car company Xiaomi.

The domestic contest has undoubtedly pushed Chinese companies to develop faster and fostered innovation.

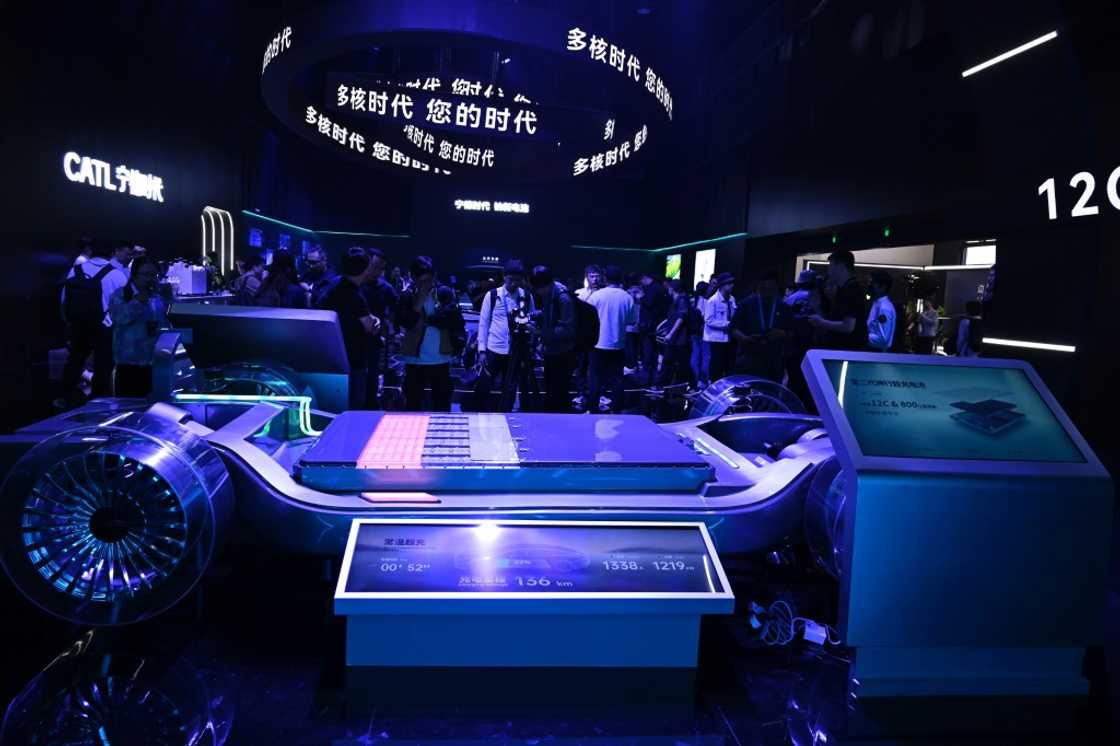

On Monday, battery giant CATL announced it had developed a quicker charging model than rival BYD -- one that can regain a 520-kilometre (320-mile) range in just five minutes of charging time.

However, the effect of the crowded market on individual companies can be harsh -- some start-ups have already gone bust, while brands including SAIC Motor, BYD and Geely are engaged in a brutal price war.

Many Chinese automakers have looked to grow their overseas sales in markets such as Europe, Latin America and Southeast Asia to safeguard their future.

Last year, China exported 6.4 million passenger vehicles, more than 50 percent above second-ranked Japan, according to AlixPartners.

There are still potential roadblocks though.

Nio on Tuesday said it had underestimated the difficulties of expanding into Europe, blaming logistical hurdles and noting tariffs would have an impact on price competitiveness.

Tricky tariff terrain

Tariffs will also be on the minds of foreign companies who make cars in China themselves, such as the United States' General Motors and Ford.

Beijing and Washington are at an impasse after President Donald Trump's tariff policy triggered a tit-for-tat escalation between the two superpowers, ending in staggeringly high reciprocal levies.

Since last year, Chinese carmakers have also faced extra duties from the European Union, which says state support has unfairly undercut its own automakers.

However, exports to Russia and the Middle East have helped cushion these and other tariff impacts, AlixPartners said Tuesday.

And although the levies will increase the cost of China's vehicle component exports by about 24 percent, "this represents only about 3.8 percent of China's total auto industry production value", it noted.

Other speedbumps are internal.

China's post-pandemic recovery has wobbled, with low domestic consumption a persistent issue, while concerns have been raised about overcapacity.

However, "anyone who says that China is becoming less important and weaker should look at Shanghai", warned German automotive expert Ferdinand Dudenhoeffer in a note on Tuesday.

"The opposite is true. If our car industry wants to recapture the successes of the past, it must become more Chinese."

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: AFP