CBEX Allegedly Collapses, Traps Trillions of Naira Days After Requesting Additional Deposits

- After days of trending on social media, CBEX, an investment platform, has allegedly crashed

- Trillions of naira belonging to investors in several countries have been trapped on the platform

- While some Nigerians are lamenting on social media, some are said to have hit the streets, looting the CBEX office

Legit.ng journalist Ruth Okwumbu-Imafidon has over a decade of experience in business reporting across digital and mainstream media.

The CBEX platform has reportedly collapsed, leaving investors with substantial amounts of Naira trapped.

This incident follows a recent request by the platform for additional deposits from its users, raising concerns about the platform's legitimacy and its operations within the country.

Legit.ng checks reveal that the platform has changed its domain name severally between January 2024 and February 1, 2025.

Source: UGC

It went from cbex.cx to cbex8.com in July 2024, then to cbex9.com in September 2024, cbex-dex.com on November 13, 2024, and cbex39.com in February 2025.

Read also

Can Nigerians still withdraw their money on CBEX? Expert shares key things you need to know

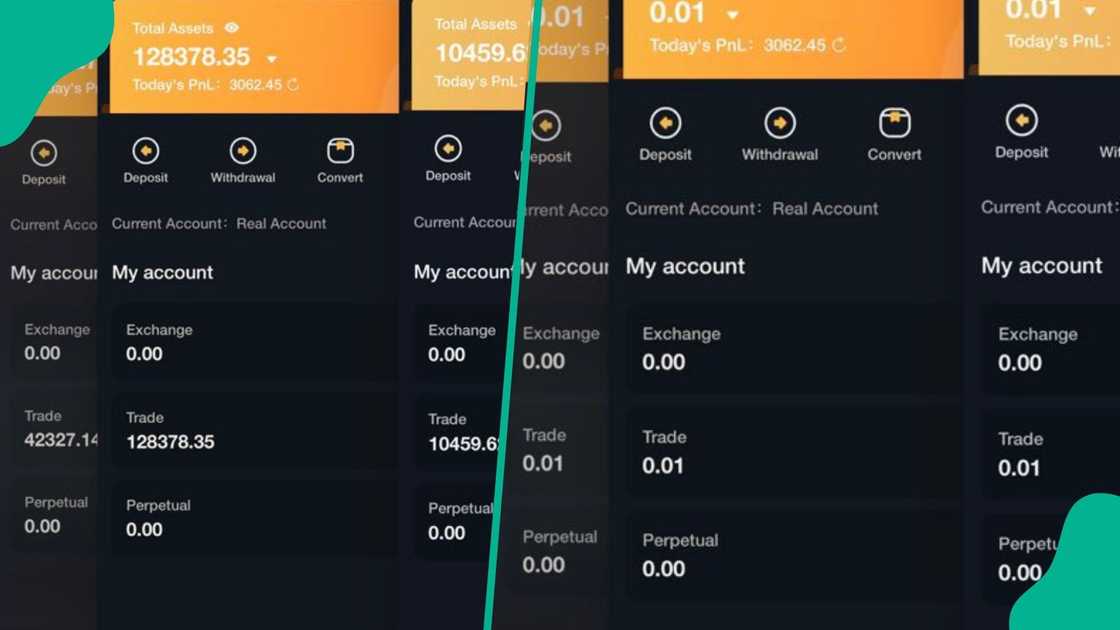

Several users on social media claim to have deposits running into hundreds of thousands of dollars, and this could imply that trillions of naira have been trapped with CBEX.

CBEX restricts withdrawal of funds

CBEX, an investment platform claiming to offer 100% returns within 30 days via online trading, restricted withdrawals on April 9, 2025.

The message notifying the customers stated that withdrawals would resume on April 15, 2025, after the security breach had been resolved.

A user noted in a video that several new users also signed up in the days after the restricted withdrawals, in the belief that it was only a temporary security glitch and would be resolved in a matter of days.

Several voices on X (formerly Twitter) warned new signups from proceeding, noting that restricted withdrawals are the first stage of an eventual crash. One user @Ndfrek posted on April 11, 2025;

Read also

Cbex crash: Man who lost N9m shares how eople he introduced to platform bought lands, trailer

“The first step a ponzi scheme takes before its inevitable crash is to restrict withdrawals. The second step is when they tell you to invest a little more before you can withdraw. The final step is when you try to check the website & you see "under maintenance. CBEX is on Step 1”

CBEX demands more deposits

Like a self-fulfilling prophecy, the second phase soon unfolded. CBEX sent a message to its users saying;

“All accounts need to undergo the following verification steps to ensure their authenticity. 1. For accounts with funds below $1,000 before any losses, a deposit of $100 is required. 2. For accounts with funds exceeding $1,000, a deposit of $200 is required. Additionally, please keep your deposit receipts to ensure you can prove the authenticity of the account during future withdrawal reviews.”

Users were still reacting to this message when it was confirmed that by 6 pm, the same Monday evening, CBEX had locked all its telegram groups.

Numerous users took to social media to report that their account balances had been reduced to zero, suggesting that their funds had been moved.

Interestingly, the website is still up, but users say they are unable to contact support to inquire about their missing funds.

Nigerians speak on CBEX crash

An X user, Olufemi Ayodele @phemidawiz posted;

“My barber spent some time preaching CBEX to me. I kept telling him to do proper background check but e no gree. This Ponzi people just enjoy the gullibility of Nigerians. Once they cook a some scam app like this, first target is Nigeria. Na we wise pass yet na we mumu pass!”

A Nigerian in the UK, Mr. Samuel Ngozi, told Legit.ng that his friend had pressured him for months to sign up, but it felt too good to be true. He said;

“The fraudulent scams are becoming too much, and its almost like Nigeria is almost their target. A friend had been on my neck to sign up but I looked at it and concluded that it was one of those hybrid Ponzis. They have suspended withdrawals, and we know what usually follows after that”

Read also

Hong Kong govt's warnings on CBEX Nigerians should not have ignored as investment app freezes funds

He expressed hope that the new ISA 2025 would empower the SEC to crack down on such Ponzi schemes and clamp them down fully, for the sake of Nigerians.

Source: Twitter

Recall that the Securities and Exchange Commission had warned Nigerians against Ponzi schemes and released a list of 58 Ponzi schemes operating in Nigeria.

SEC to prosecute Ponzi Scheme operators under ISA 2025

The Securities and Exchange Commission (SEC) recently announced its readiness to go all out against Ponzi scheme operators.

The SEC DG noted that the newly signed ISA (2025) has given the commission legal authority to prosecute illegal scheme operators.

The Act also recommends stiff penalties, including a 10-year jail term for offenders, replacing the former Act that had no penalties attached.

SEC bans unregistered online trading/investment platforms

In related news, the federal government has taken a decisive step to strengthen market oversight with the newly signed ISA 2025.

Legit.ng reported that one of the provisions outlaws online foreign exchange (forex) trading platforms and other online exchanges that are not registered or regulated by the SEC.

This is a move aimed at protecting Nigerian investors in the online space and curbing market abuses, as digital trading and crypto finance continue to grow in Nigeria.

This article has been updated by head of business desk, Victor Enengedi, with additional information.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Proofreading by James Ojo, copy editor at Legit.ng.

Source: Legit.ng

Ruth Okwumbu (Business Editor) Ruth Okwumbu-Imafidon is a business journalist with over a decade's experience. She holds both a Masters' and B.Sc. degrees Mass Communication from the University of Nigeria, Nsukka, and Delta State University. Before joining Legit.ng, she has worked in reputable media including Nairametrics. She can be reached via ruth.okwumbu@corps.legit.ng

James Ojo (Copyeditor) James Ojo is a copy editor at Legit.ng. He is an award-winning journalist with a speciality in investigative journalism. He is a fellow of Nigeria Health Watch Prevent Epidemics Journalism Fellowship (2023), WSCIJ Collaborative Media Project (2022), ICIR Health Reporting (2022), YouthHubAfrica’s Basic Education Media Fellowship (2022), Countering the Fake News Epidemic (MacArthur Foundation) 2021, and Tiger Eye Foundation Fellowship. Email: james.ojo@corp.legit.ng