Indonesia palm oil firms eye new markets as US trade war casts shadow

Source: AFP

Don't miss out! Join Legit.ng's Sports News channel on WhatsApp now!

Indonesian palm oil companies are seeking new markets in Europe, Africa and the Middle East as they try to protect themselves from the impact of Donald Trump's trade war, a top industry executive told AFP.

Indonesia is the world's biggest producer of the edible oil -- used in making foods such as cakes, chocolate, and margarine as well as cosmetics, soap and shampoo -- and accounts for more than half the global supply.

But the 32 percent tariffs imposed on the country make it one of Asia's hardest hit by the US president's sweeping measures that have sent shockwaves around the world.

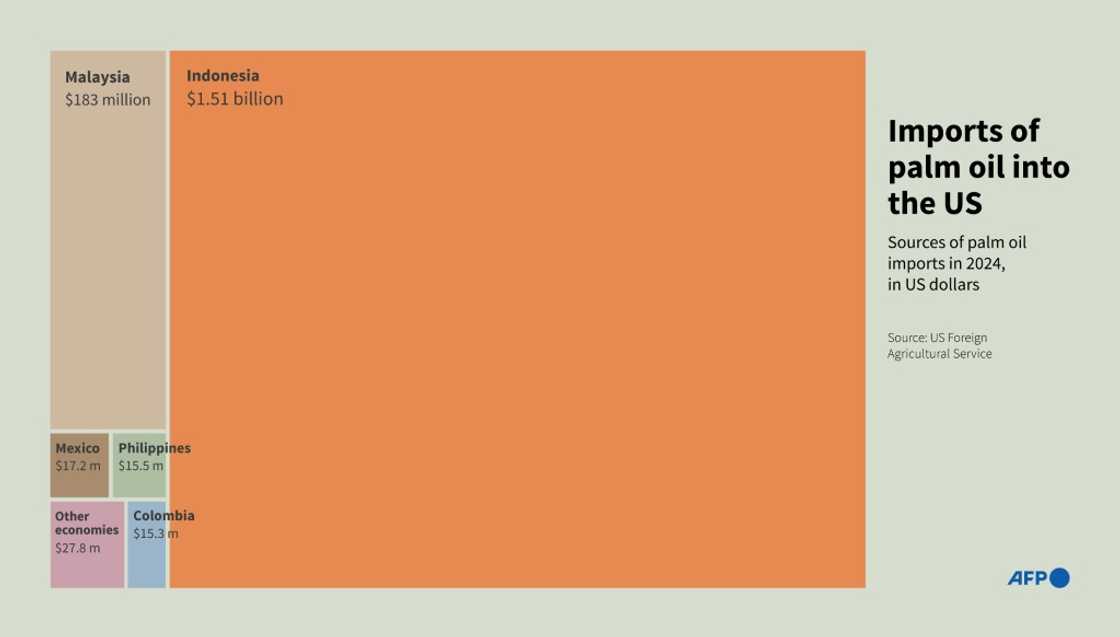

Palm oil is one of Indonesia's biggest exports to the United States, and while Trump has announced a 90-day pause on implementing the levies, producers say the uncertainty is forcing them to look elsewhere to earn their keep.

"It actually gives time for us to negotiate... so products can still enter there. I think this is very good," said Eddy Martono, chairman of the Indonesian Palm Oil Association (GAPKI) on Thursday.

However, he warned that market diversification "must still be done" to avoid the impact of the tariffs if they come into force later in the year, adding that firms would look to Africa -- specifically top importer Egypt -- the Middle East, Central Asia and Eastern Europe.

Source: AFP

"We should not just depend on traditional markets. We will continue to do it. We have to do that," he said.

Exports of palm oil products to the United States have steadily grown in recent years, with Indonesia shipping 2.5 million tons in 2023, compared with 1.5 million tons in 2020, according to GAPKI data.

Eddy called on Jakarta to keep its dominance in that market through talks, particularly as rival palm oil producer Malaysia was hit with lower tariffs.

"Indonesian palm oil market share in the United States is 89 percent, very high. This is what we must maintain," he said.

According to Indonesian government data, the United States was the fourth-largest importer of palm oil in 2023, behind China, India and Pakistan.

Smallholder pain

But Eddy remained confident the US would still need Indonesian palm oil if no deal was sealed when the 90 days are up.

"It is still a necessity for the food industry. I believe our exports to the US will slightly decline or at least stagnate," he said.

"Those who are harmed first are consumers in America because their main food industry products need palm oil."

Indonesian Finance Minister Sri Mulyani said at an economic meeting Tuesday that she would lower a crude palm oil export tax, alleviating some of the pain.

Source: AFP

While Eddy welcomed the move, saying it would make Indonesia's palm oil exports more competitive, for the country's 2.5 million palm oil smallholder farmers, the threatened tariffs were worrying.

Mansuetus Darto, the national council chairman of the Palm Oil Farmers Union (SPKS) said the measures would have had a far-reaching impact if a deal wasn't struck.

"The raw material of the palm oil will pile up and then farmers cannot harvest anymore because of overcapacity in existing plants," he said before the pause was announced.

President Prabowo Subianto opted for a path of negotiation with Washington instead of retaliation and will send a high-level delegation later this month.

While Trump took aim at Indonesia's billion-dollar trade surplus with the United States, Prabowo said his threatened levies may have done Indonesia a favour by "forcing" it to be more efficient.

Chief economic minister Airlangga Hartarto also said Jakarta would buy more products such as liquefied natural gas and liquefied petroleum gas to close the gap with the world's biggest economy.

That has given hope to the industry that a deal with Trump can be done, otherwise they will be forced to turn elsewhere.

"There is still time," said Mansuetus after the pause was announced.

"The government should prepare to negotiate as best as possible with the US government."

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: AFP