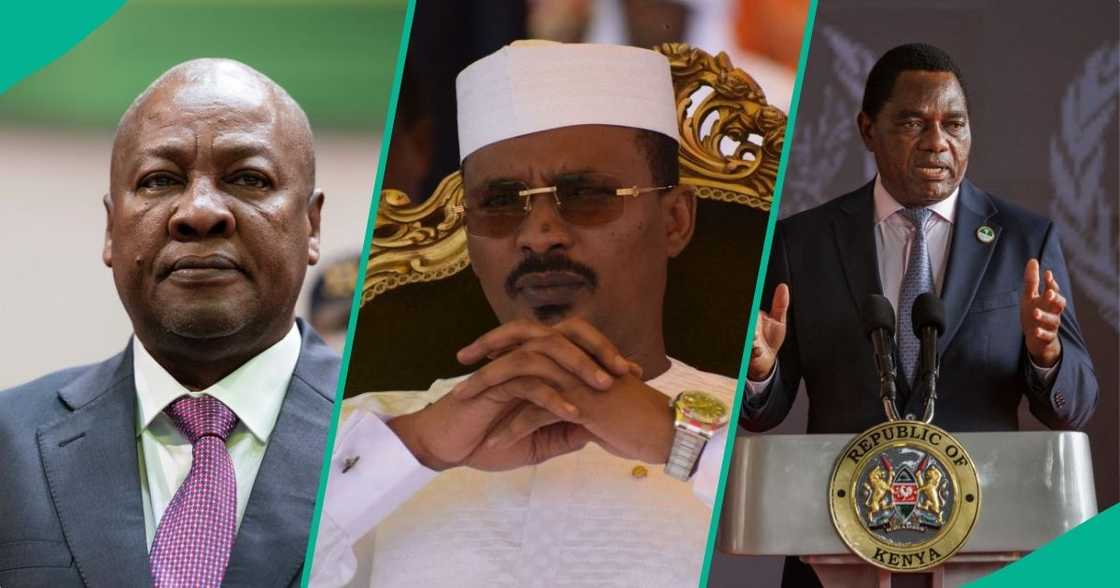

Full List of 4 African Countries on The Brink of Debt Default to IMF, World Bank, Others

- About four African countries are on the verge of falling to severe debt defaults with international creditors

- Countries such as Ghana, Ethiopia, Chad and Zambia are aggressively pushing for debt restructuring with creditors

- Reports say some of the countries have already defaulted on their debts, which may lead to sanctions by international creditors

Don't miss out! Join Legit.ng's Sports News channel on WhatsApp now!

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

About four African countries are at risk of debt defaults as mounting debt burdens, increased interest rates, and dwindling revenue threaten national budgets.

These countries struggle to meet their debt obligations, leading to concerns about potential defaults and economic instability.

Source: Getty Images

The push for debt relief

A lobby group, the African Forum and Network on Debt and Development (AFRODAD), which advocates for debt relief and addresses loan-related issues in Africa, released the affected countries to include Zambia, Ghana, Ethiopia, and Chad.

Jason Braganza, AFRODAD’s executive director, called for an overhaul of the global financial system to allow a UN-led mechanism to assist distressed countries.

Braganza stressed the urgency of reforming the global debt systems, particularly for African countries facing debt distress.

Top African countries in debt distress

Zambia

Zambia is the first African country to default on its loans during the COVID-19 pandemic after failing to meet a $42.5 million Eurobond payment five years ago.

Despite talks with lenders, the country has struggled with restructuring under the G20 Common Framework due to delays caused by misunderstandings between Western bondholders and China, its largest creditors.

Ghana

According to reports, in December 2022, Ghana announced it would default on most of its external loans of about $28.4 billion.

The move was part of an effort to push for debt restructuring amid a severe economic crisis caused by high inflation and a depreciating currency.

Ghana has since engaged in an IMF-backed debt restructuring plan.

Ethiopia

The East African country asked for debt relief under the G20 Common Framework in 2021, but the progress has been slow due to its civil war.

In 2023, Ethiopia reportedly became Africa’s third country to default on its international debt obligations in three years, after failing to pay a $33 debt service on its only international government bond.

Chad

Chad emerged as the first African country to reach a debt restructuring plan under the Common Framework in November 2022.

In 2022, Chad reached an agreement in principle via the G20 Common Framework to restructure about $3 billion in debt, aiming to maintain a moderate debt risk distress.

The rising debt crisis in Africa

African countries, including Nigeria, employ several strategies to manage their rising debt burdens.

However, challenges remain as debt service costs continue to increase.

Business Insider reports that as of 2024, African countries were expected to spend about $74 billion on debt servicing, with a significant amount owed to private creditors.

The African Development Bank (AfDB) has sounded the alarm that from 2025 to 2033, Africa will need about $10 billion for debt servicing.

The increasing debt limits investment in key sectors such as healthcare, and education, and constrains economic growth, experts say.

Source: Getty Images

They warn that unsustainable debt levels, caused by global economic challenges and currency devaluation, could cause nations in Africa to fall into financial distress.

Nigeria’s debt to the World Bank to rise to $9.2bn under Tinubu

Legit.ng earlier reported that the Nigerian government is about to secure six new loans of about $2.23 billion from the World Bank in 2025 as the bank continues to support the country’s economic reforms.

According to data from the World Bank, the new borrowings will bring Nigeria’s total debt to the World Bank to $9.25 billion in three years, showing a continued dependence on external funding to support critical sectors of the economy.

A breakdown of Nigeria’s loan approvals from the global financial institution since 2023 under President Bola Tinubu shows a rising increase in funding commitments.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng