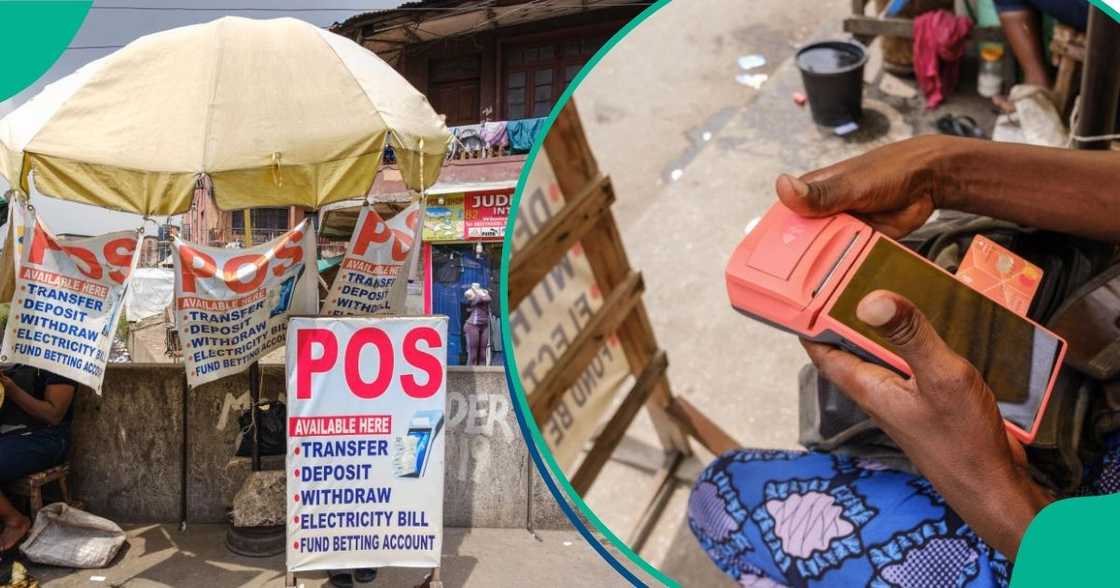

CBN Explains Reason For New Withdrawal Limits on PoS, ATM Terminals

- The Central Bank of Nigeria (CBN) has explained why it restricted transactions on PoS terminals

- The bank stated that the move was to boost Nigeria’s drive for cashless policy and enhance operational procedures

- CBN earlier restricted withdrawals from PoS at N100,000 for individuals and N1.2 million for operators

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

The Central Bank of Nigeria (CBN) has explained that introducing the N100,000 daily withdrawal limit on Point-of-Sale (PoS) terminals is part of its efforts to promote the cashless policy.

The bank added that the move will address operational challenges, reduce fraud, and establish uniform standards in Nigeria.

Source: Getty Images

CBN imposes new cash withdrawal limit

Legit.ng earlier reported that the CBN introduced the measure in a circular, limiting PoS operators to N100,000 for individuals and N1.2 million for operators.

The CBN circular listed several key measures agents must follow, including providing agent banking terminals with a daily maximum cash transaction limit of N100,000 per customer.

It also pegged a daily cash-out for each agent at N1.2 million.

CBN differentiates agent banking from merchants

It stated that agency banking differs from merchant activities and that agents apply approved Agent Code 6010 for agent banking.

The apex bank also warned that violations of these directives will “attract appropriate penalties, including monetary and/or administrative sanctions.”

PoS operators begin new charges

Legit.ng earlier reported that PoS operators have hiked their charges in line with the new Electronic Money Transfer Levy (EMTL) of N50 on every N10,000 received by Opay, Palmpay, and other fintech platform users.

The Federal Inland Revenue Service (FIR) ordered the implementation of the EMTL on behalf of the Nigerian government.

The policy was scheduled to begin on September 9, 2024, but it was delayed following Nigerians' outrage. Several fintech platforms, such as Opay, Palpay, Moniepoint, and others, sent messages to their customers on Sunday, December 1, 2024, notifying them of the impending debit of N50 on the recipient's accounts.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng