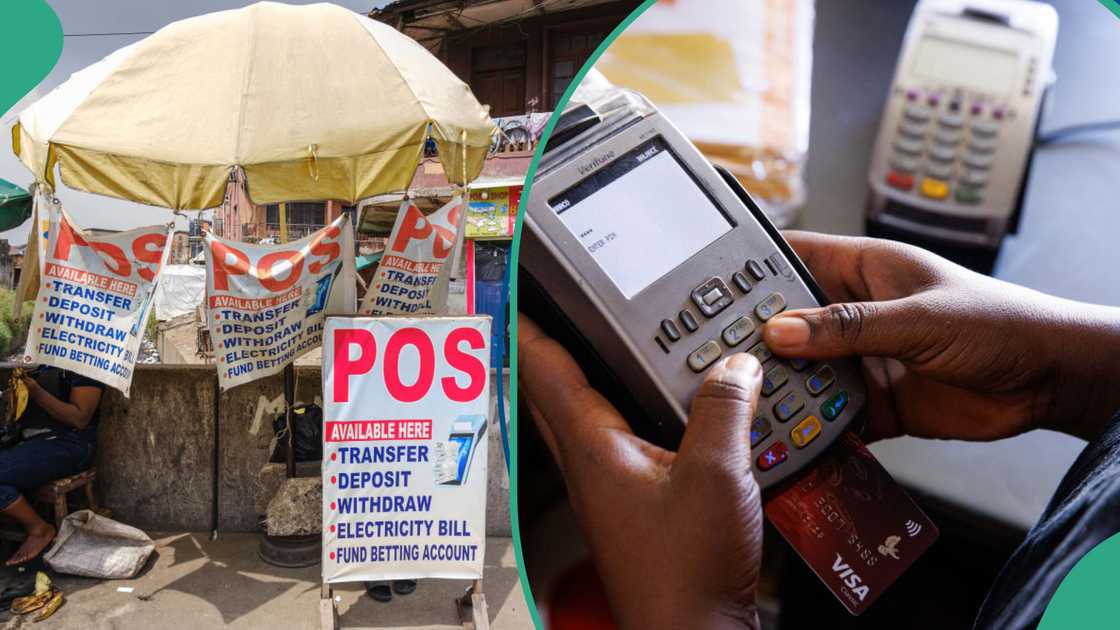

Nigerians, Business Owners React to CBN’s Limit on PoS Transactions

- The newly introduced cash transaction limit imposed on PoS operators has received thumbs down from Nigerians and business owners

- They disclosed that the new directive is out of tune with reality and would hamper the financial inclusion drive of the Nigerian government

- The apex bank introduced a daily cash-out transaction limit of N100,000 per customer for PoS operators as a new measure to boost cashless policy

CHECK OUT: Education is Your Right! Don’t Let Social Norms Hold You Back. Learn Online with LEGIT. Enroll Now!

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

The organised private sector has decried the decision of the Central Bank of Nigeria (CBN) to limit withdrawals from Point-of-Sale (PoS) agents, saying the CBN is out of touch with reality.

The apex bank introduced a daily cash-out transaction limit of N100,000 per customer for PoS operators as a new measure to boost the cashless policy in Nigeria.

Source: Getty Images

CBN limits PoS transactions

The order was contained in a December 17, 2024, circular to deposit money banks (DMBs), microfinance banks, mobile money operators, and Super Agents, mandating their immediate compliance.

The circular outlined crucial measures to ensure uniform operational standards, fight fraud, and boost electronic payment use in agency banking.

Per the directive, PoS operators must ensure that individual customer withdrawals do not surpass N100,000 daily.

CBN reveals the reason for the new transaction limits

Also, the operators are restricted to a combined cash-out limit of N1.2 million daily, while customers face a maximum cash withdrawal limit of N500,000 weekly.

CBN asked all agency banking transactions to be done exclusively via float accounts maintained by principal institutions.

It required agent banking services to be separated from other merchant activities, using approved agent code 6010 for transactions.

CBN directed all agent banking terminals to be connected to the Payment Terminal Service Aggregators and daily transaction reports, including withdrawal limits and float account balance, which must be electronically transmitted to the Nigerian Inter-Bank Settlement System (NIBBS) using a reporting template provided by the CBN.

Nigerians react

However, experts have said the new directive is expected to affect PoS operators and customers, especially in places with limited access to banking operations.

Punch reports that Dele Oye, the President of the Nigeria Association of Chamber of Commerce, Industry, Mines, and Agriculture, disclosed that the CBN was out of tune with reality.

According to Oye, CBN’s monetary policies are not grounded in the real world and are disconnected from the everyday struggles of businesses and Nigerians.

Also, Segun Kuti-George, the national vice president of the Nigerian Association of Small-Scale Industrialists, noted the policy's impact on Nigerians and businesses.

He said:

PoS operators begin new charges

Legit.ng earlier reported that PoS operators increased their charges on Monday, December 2, 2024, in compliance with the Electronic Money Transfer Levy (EMTL) mandated by the Nigerian government.

The EMTL mandates that mobile money operators such as Opay, Palmpay, and others charge N50 for every N10,000 and above in recipient accounts.

The Federal Inland Revenue Service (FIRS) ordered the levy on behalf of the Nigerian government.

Proofread by Kola Muhammed, journalist and copyeditor at Legit.ng

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng