Further hike in UK inflation hits rate cut chance

Source: AFP

CHECK OUT: Education is Your Right! Don’t Let Social Norms Hold You Back. Learn Online with LEGIT. Enroll Now!

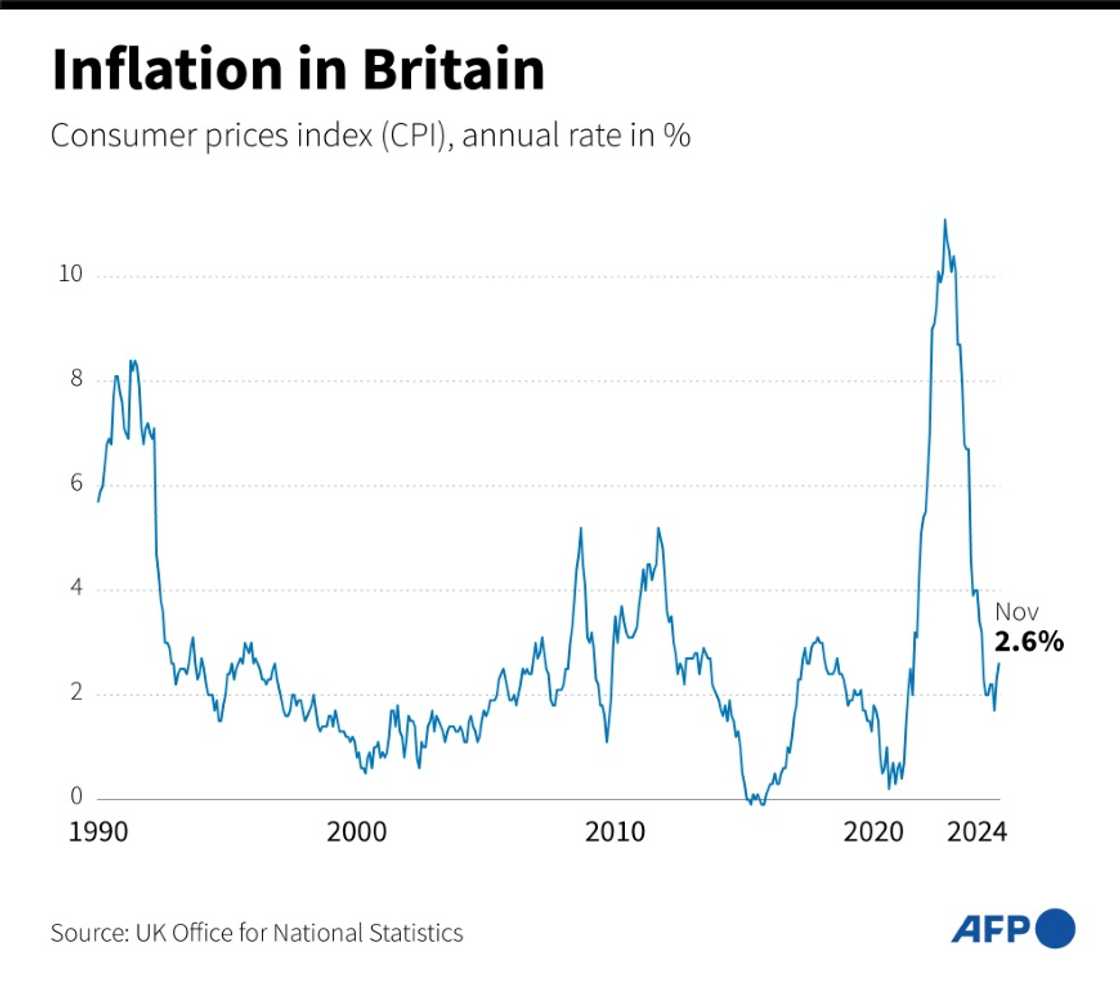

UK annual inflation climbed further above the Bank of England's target rate in November, official data showed Wednesday, firming expectations that it will avoid cutting interest rates this week.

The Consumer Prices Index reached 2.6 percent in the 12 months to November, up from 2.3 percent for October, the Office for National Statistics (ONS) said in a statement.

CPI had struck a three-year low of 1.7 percent in September before higher energy bills pushed it back above the BoE's inflation target of 2.0 percent.

November's additional rise is a further blow to the Labour government, which has found efforts to grow the economy come unstuck since winning power in July.

"I know families are still struggling with the cost of living and today's figures are a reminder that for too long the economy has not worked for working people," finance minister Rachel Reeves said in reaction to the inflation data.

On a monthly basis, CPI rose by 0.1 percent in November compared with a fall of 0.2 percent a year earlier, the ONS added.

The largest upward contribution to the monthly change came from transport, it said.

Core CPI -- excluding energy, food, alcohol and tobacco -- rose 3.5 percent in the 12 months to November, up from 3.3 percent in October.

Interest rates

"The further rebound in CPI inflation... could have been worse," noted Paul Dales, chief UK economist at Capital Economics research group.

"But coming on the back of the stronger-than-expected rebound in wage growth in yesterday's release, there is almost no chance of the Bank of England delivering an early Christmas present with another interest rate cut tomorrow."

That contrasts with the US Federal Reserve, which is widely forecast to trim borrowing costs Wednesday. That would follow a cut by the European Central Bank last week.

Source: AFP

The BoE is now seen holding its key interest rate at 4.75 percent on Thursday, having trimmed borrowing costs by 25 basis points in November.

That came after the BoE reduced it key rate in August for the first time since early 2020, from a 16-year high of 5.25 percent as UK inflation returned to normal levels.

UK inflation had soared to above 11 percent in October 2022, the highest level in more than four decades, as the Russia-Ukraine war cut energy and food supplies, sending prices soaring.

Companies faced supply constraints also as they struggled to return to the pre-Covid rhythm of working.

However as inflation began to come down, central banks started to cut interest rates, helping to ease a cost of living crisis.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: AFP