FG to Borrow Fresh $2.2 Billion from External Creditors to Boost Economic Recovery

- The Nigerian government is planning to boost the country’s finances and economic reforms with an additional $2.2 billion in borrowings

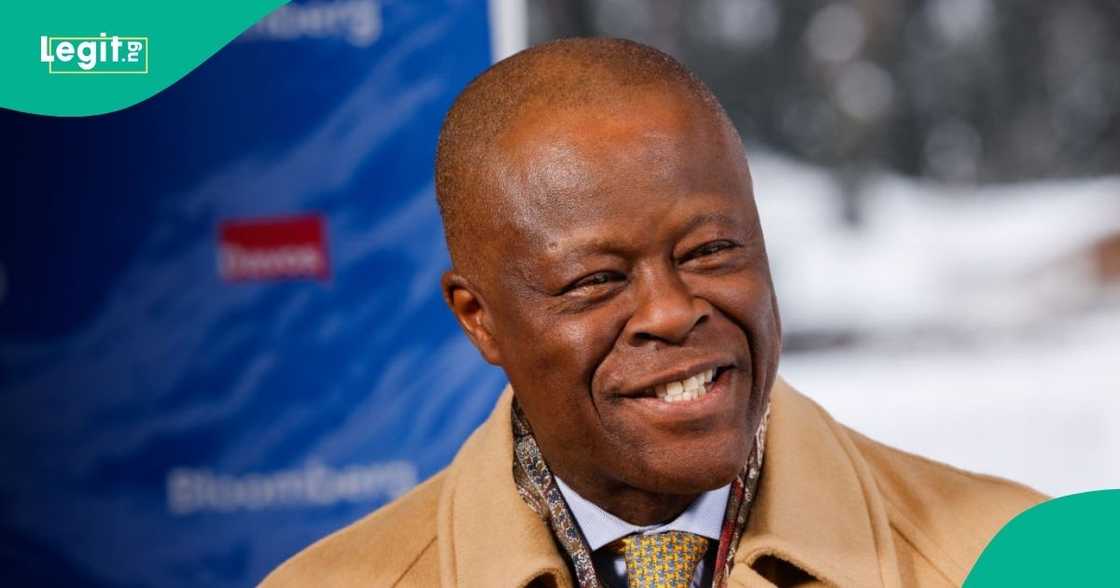

- The minister of Finance, Wale Edun, said the new loan will come from Eurobonds and Sukuk bonds

- Edun stated that the borrowing will happen within the 2024 fiscal year, with the final structure of the funding determined by market forces

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

The Nigerian government has approved a $2.2 billion external borrowing plan to boost the country’s finances and support economic reforms.

The Finance Minister, Wale Edun, disclosed this on Thursday, November 14, 2024, after the Federal Executive Council (FEC) meeting in Abuja.

Source: Getty Images

FG plans to complete ongoing projects with loans

The finance minister disclosed that the packages will come via a combination of Eurobonds and Sukuk bonds, with $1.7 billion expected from the Eurobond offer and $500 million from Sukuk.

Per the minister, the move aims to complete the Nigerian government’s borrowing scheme and will proceed immediately after the National Assembly approves it.

Leadership reports that the minister reiterated the importance of approval as a sign of growing confidence in Nigeria’s economy under the present government.

Nigeria’s external debt to balloon

He stressed the resilience of the Nigerian financial market, pointing out recent successes in domestic dollar bond issuances that attracted investors.

If approved, the new loan will skyrocket Nigeria’s external debt, which the Debt Management Office (DMO) said now stands at over $42 billion.

DMO data shows that the 36 states, including the FCT, owe about 11% of the loans, at $4.89 billion, and the central government’s debt is $38 billion

The country’s multilateral debt is $17.13 billion, while bilateral debt, including those from China EXIM Bank, Jika, KWF, IsDB, and AFD, is $5.49 billion.

FG repays Chinese, IMF, World Bank loans with $3.58bn

Legit.ng earlier reported that the Nigerian government spent $3.58 billion servicing foreign debt in the first three quarters of 2024, representing a 39.77% increase from the $2.56 paid during the same period in 2023.

Central Bank of Nigeria (CBN) data shows the amount spent on international payments within that period.

The rise in external debt service payments indicates the pressure on Nigeria’s financial balance amid economic challenges.

Proofread by Kola Muhammed, journalist and copyeditor at Legit.ng

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng