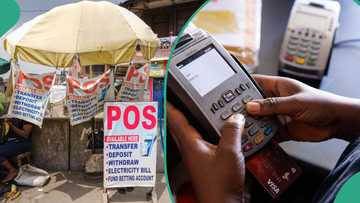

Fraudsters Steal N42.6bn from Nigerian Banks as Financial Institutions Explain Service Disruption

- The Association of Mobile Money and Bank Agents in Nigeria said fraudsters stole N42.6 billion from Nigerian banks in Q2 2024

- The losses were traced to agent locations in Benin City, Edo State, utilising stolen phones, cards, bogus warnings, and ransom money, according to the AMMBAN

- The AMMBAN disclosed that the losses were connected to the locations of agents who used ransom money outs, bogus alerts, stolen phones, and cards

Don't miss out! Join Legit.ng's Sports News channel on WhatsApp now!

Legit.ng journalist Zainab Iwayemi has over 3-year-experience covering the Economy, Technology, and Capital Market.

In the second quarter (Q2) of 2024, Nigerian banks lost N42.6 billion to fraudsters, the Association of Mobile Money and Bank Agents in Nigeria (AMMBAN) has said.

Source: Getty Images

AMMBAN national president Fasasi Sarafadeen Atanda, citing the Financial Institutions Training Centre (FITC), revealed that the losses were linked to agent locations using stolen cards, phones, phony alerts, and ransom cash out.

He stated that the 2024 AMMBAN survey found that more than 300 local government areas in Nigeria lack bank branches, ThisDay reported.

In order to turn the tide, AMMBAN has implemented an automated verifiable identity card for agents and established a Joint Task Force (JTF) in collaboration with the Office of the Inspector General of Police (IGP), Department of State Services (DSS), Nigeria Security and Civil Defence Corps (NSCDC), and other security agencies.

He said,

“Data on Access to Financial Inclusion. As at the last EFInA report in 2023, financial inclusion was at 64 per cent but on the ground, over 300 local government areas in Nigeria are without bank branches (AMMBAN Survey, 2024). Why access to commercial banks are of concern? CBN recent regulation on mandatory BVN and/or NIN for owning an account or a wallet requires the presence of bank branches, because they are majorly the structures enabled for BVN enrollment/modification.”

He reported that AMMBAN has implemented a one-stop shop for financial services, providing savings, credit, insurance, NIN, BVN, account opening, card issuing, Sim registration, and other services throughout the excluded local government regions.

Read also

FG launches N20bn loan scheme for Nigerians to acquire Innoson, other locally-assembled vehicles

According to him, Nigerian banks lost N42.6 billion to fraud in Q2 2024 (FITC), and the majority of the losses were linked to agent locations using ransom payouts, phoney alerts, stolen cards or phones, and other means.

Along with the office of the Inspector General of Police (IGP), DSS, NSCDC, and other security agencies, AMMBAN established a Joint Task Force (JTF) and provided agents with an automated verified identity card.

In the public interest, JTF has been supplying security agencies with intelligence on enforcement sanity and regulatory requirements at agent locations.

Meanwhile, Nigerian banks have begun to churn out messages to their customers explaining the reason for delayed funds transfers across its digital platforms, including USSD.

Customers from different banks earlier lamented not being able to make transaction of the traditional bank app.

Efe johnson said,

"I am glad the issue have resolved the issue now because there is nothing as frustrating as been stuck when you want to make a transaction."

Read also

Accounts exempted from FG’s electronic money transfer levy as PoS operators begin new charges

Zenith Bank alerts customers on service disruption

Legit.ng reported that Zenith Bank has revealed that service disruption across its digital platform on Tuesday, October 1, 2024, was due to routine IT maintenance.

The maintenance, which occurred between the hours of 12:01 am to 02:30 pm, affected customers' fund transfers and mobile banking.

Other banks have also followed suit, sending messages to customers on the reason for service disruption in recent times.

Proofread by Kola Muhammed, journalist and copyeditor at Legit.ng

Source: Legit.ng