CBN Suggests Solution as Customers of GTBank, Zenith Bank, Others Experience Network Issues

- Nigerian banks have been advised by the CBN to make significant investments in cybersecurity

- The CBN governor asserts that banks must stay ahead of criminals in order to prevent clients from losing their money

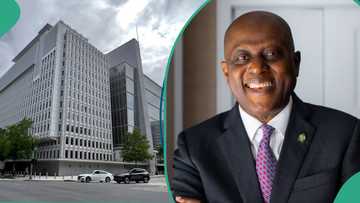

- Olayemi Cardoso, CBN governor, suggested that banks should establish a robust cybersecurity system to guarantee the safety of their customers' funds

Legit.ng journalist Zainab Iwayemi has over 3-year-experience covering the Economy, Technology, and Capital Market.

To protect depositors' money from hackers, the Central Bank of Nigeria (CBN) has urged banks in the country to invest heavily in cybersecurity.

Source: Getty Images

The governor of the CBN, Olayemi Cardoso, said this in a panel discussion at the Nigeria Economic Summit (NES) in Abuja on "Fiscal and Monetary Policy Reforms: Removing Barriers to Private Sector Investment."

He said this amid concerns following announcement of service disruptions and system updates by Nigeria banks.

Innovations taking place

There is a lot of innovation taking place in the banking industry, particularly in the field of electronic banking, according to Cardoso, who was represented by Adetona Adedeji, CBN's acting director of banking supervision.

According to him, banks must stay ahead of criminals to protect customers from losing their money, even as innovations enhance the user experience by making banking smoother.

“There has been a lot of innovation in the banking sector today, especially in e-channels,” Adedeji said.

“Therefore, we require a robust risk management system. We expect every bank to implement a very strong cybersecurity framework.

“We want customers to be protected from criminals. These are individuals we have been working hard to convince to deposit their money instead of keeping it under their pillows.

Read also

World Bank praises CBN governor Yemi Cardoso’s policies on naira, interest rate, gives reasons

“We don’t want a situation where, after successfully encouraging them to bank their funds under financial inclusion initiatives, hackers exploit vulnerabilities and steal their money.”

Cardoso advised banks to establish a robust cybersecurity system that safeguards clients' funds, allowing them to deposit their money, sleep soundly, and wake up to find it secure the next day.

Another Nigerian bank announces network issues

Legit.ng earlier reported that First Bank of Nigeria issued an official update concerning ongoing service disruptions on its mobile banking platform, FirstMobile.

In a statement shared with customers, the bank apologized for the inconvenience caused and reassured users that its technical team was actively working to resolve the issues.

The service disruption occurred when many Nigerians rely heavily on digital banking services for their day-to-day financial activities.

Proofreading by James, Ojo Adakole, journalist and copy editor at Legit.ng.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng