Expert Predicts New Exchange Rates as Naira Crashes in Black Market, Rises 5.38% in Official Window

- The Nigerian currency, the naira, gained about N89 against the US dollar in the official market on Monday, October 14, 2024

- The naira appreciated to N1,551.92 per dollar as against the N1,641 it traded on Friday, October 11, 2024, representing a 5.38% gain

- However, the naira collapsed in the parallel market to an all-time low of N1,700 per dollar

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

The Nigerian currency, the naira, appreciated 5.38% in the official Nigerian Autonomous Foreign Exchange Market (NAFEM) on Monday, October 14, 2024.

The local currency traded at N1,552.92 per dollar, up from N1,641 per dollar on Friday, October 11, 2024, an N89 gain in the official market.

Source: Getty Images

Naira suffers massive crash in the black market

Data from the FMDQ Exchange shows that currency dealers in the official market quoted the US dollar at a high of N1,682 per dollar and a low of N1,540.

Read also

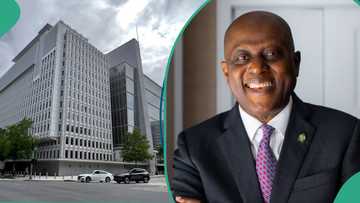

World Bank praises CBN governor Yemi Cardoso’s policies on naira, interest rate, gives reasons

Meanwhile, the foreign exchange turnover witnessed an improvement in the official window, hitting $343.71 million on Monday, October 14, 2024.

However, on Monday, 14, 2024, the Nigerian currency suffered a massive loss in the parallel segment of the foreign exchange market, setting a new record at N1,700 per dollar.

The amount is the lowest the naira has traded in the official market.

Experts predict more crash

Analysts predict a further dollar crash before Christmas due to increased demand from importers and other users.

Janet Ogochukwu, a senior banker and economist, said the local currency's fall in the parallel market was due to rising demand from those travelling for medicals and importers who wanted to avoid the hurdles in the official market.

“We are witnessing a gradual crash in the official window, which might affect the official market.

Unless the regulators intervene, the naira will hit N2000 in the parallel marker and N1,700 in the official window on or before December this year. This is because hardly any FX earnings support the naira at both ends.”

She disclosed that the rise in FX reserves is not just due to any earnings from external sources but also remittances and the Nigerian government's recently concluded domestic dollar bond.

“The issue is not that there is no inflow; the inflows are from intangible assets such as bonds and diaspora remittances. Nigeria is not exporting enough products to earn from tangible assets,” she said.

The naira to dollar exchange rate records slight depreciation

Legit.ng earlier reported that the value of the Nigerian currency depreciated against the US dollar in the official foreign exchange market.

New data showed that the naira closed against the dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEX) at N1,641.27/$1 on Friday, October 11, 2024.

The latest exchange rate is N18.70, or 1.15 % depreciation, compared with Thursday, October 9's closing rate of N1,622.57/$1.

Proofreading by James, Ojo Adakole, journalist and copy editor at Legit.ng

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng