UAE oil giant ADNOC swoops on German chemicals firm Covestro

Source: AFP

German chemicals group Covestro said Tuesday it had accepted a takeover bid from UAE state energy company ADNOC, as one of the key sectors in Europe's largest economy is gripped by crisis.

Elevated energy costs in the wake of Russia's 2022 invasion of Ukraine have weighed heavily on chemicals producers, which account for around five percent of Germany's GDP.

The deal valued Covestro, a maker of plastics, at some 12 billion euros ($13.3 billion), the German group said in a statement.

Under the terms of the agreement, valid until the end of 2028, the Abu Dhabi National Oil Company (ADNOC) will make an offer for all remaining Covestro stock at a price of 62 euros per share.

The state energy company of the United Arab Emirates will also inject around 1.2 billion euros into the chemicals firm through the issuance of new shares, once the deal is completed.

With ADNOC onboard, Covestro would have "an even stronger foundation for sustainable growth", the German group's CEO Markus Steilemann said in a statement.

ADNOC was a "financially strong and long-term oriented partner", Steilemann said.

The takeover offer was subject to a minimum acceptance threshold of "50 percent plus one share", as well as regulatory controls, Covestro said.

Chemicals crisis

ADNOC's bid for Covestro comes while the challenges facing the Germany's energy-intensive chemicals industry show no signs of abating.

The sector was "struggling in a difficult environment", the German chemical industry association VCI said in a report last month.

Weak demand and high energy costs in the wake of the Russian invasion of Ukraine were weighing on producers and leading them to cut back on production in Germany.

BASF, the world's largest chemicals group, said last month would cut costs and refocus on its "core businesses", while some of its German plants lacked competitiveness.

For its part, Covestro said it was "making significant progress in its strategic transformation".

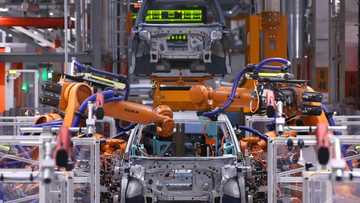

The group, which makes chemicals used in everything from building insulation to electric vehicles, unveiled savings plan in June amid ongoing takeover talks with ADNOC.

Leverkusen-based Covestro, which was spun off from chemicals giant Bayer in 2015, said it would cut material and personal costs in the hopes of saving some 400 million euros annually.

With ADNOC's support, Covestro could grow in "highly attractive sectors and can make an even greater contribution to the green transformation", Steilemann said.

Covestro's board said it would recommend shareholders accept ADNOC's offer under the terms of the agreement.

Diversification move

The deal was a coup for ADNOC as it seeks to expand its operations beyond oil, and if completed, would mark the first takeover of a company in Germany's blue-chip DAX index by a Gulf state-owned firm.

Covestro was a "natural fit" for ADNOC's growth strategy, the energy giant's CEO Sultan Al Jaber said in a statement.

Al Jaber, who served as president of last year's COP28 climate talks in Dubai, said the acquisition represented a step towards "diversifying ADNOC's portfolio".

The deal aligned with ADNOC's "future-proofing strategy and our vision to become a top five global chemicals company", he said.

Under the terms of the deal, Covestro said ADNOC had committed to maintain the group's "corporate governance and organisational business structure".

ADNOC would also respect existing agreements with workers' unions, while "there are no plans to sell, close or significantly reduce Covestro's business activities".

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: AFP