US Fed likely to remain on pause and pare back rate cut expectations

Source: AFP

The US Federal Reserve is likely to keep interest rates unchanged this week, but could pare back the number of cuts it has penciled in for this year, as policymakers digest a mixed bag of economic data.

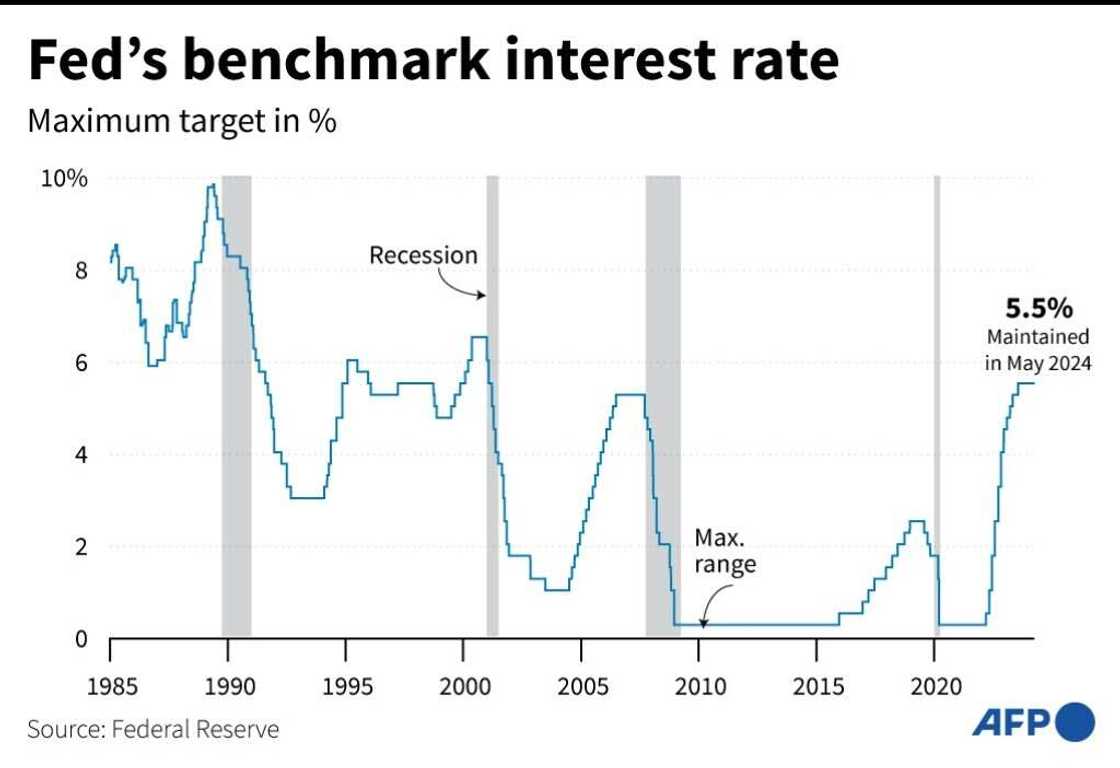

Stalled progress against inflation and a robust labor market have pushed many analysts to predict that the rate-setting Federal Open Market Committee (FOMC) will not cut interest rates from their current 23-year high before September at the earliest.

A September start to cuts would likely increase the gap between the Fed and the European Central Bank (ECB), which began easing monetary policy rates last week.

"Data released since the last meeting indicate that the threat of price re-acceleration due to strong economic activity has diminished somewhat," Wells Fargo economists wrote in a recent note to clients.

"However, we share the universal expectation that the FOMC will keep its target range for the federal funds rate unchanged at 5.25%-5.50% at the conclusion of its policy meeting on June 12," they said.

From three to two?

Source: AFP

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

After two days of debate, the Fed will publish its interest rate decision on Wednesday afternoon and will also update its economic forecasts from March.

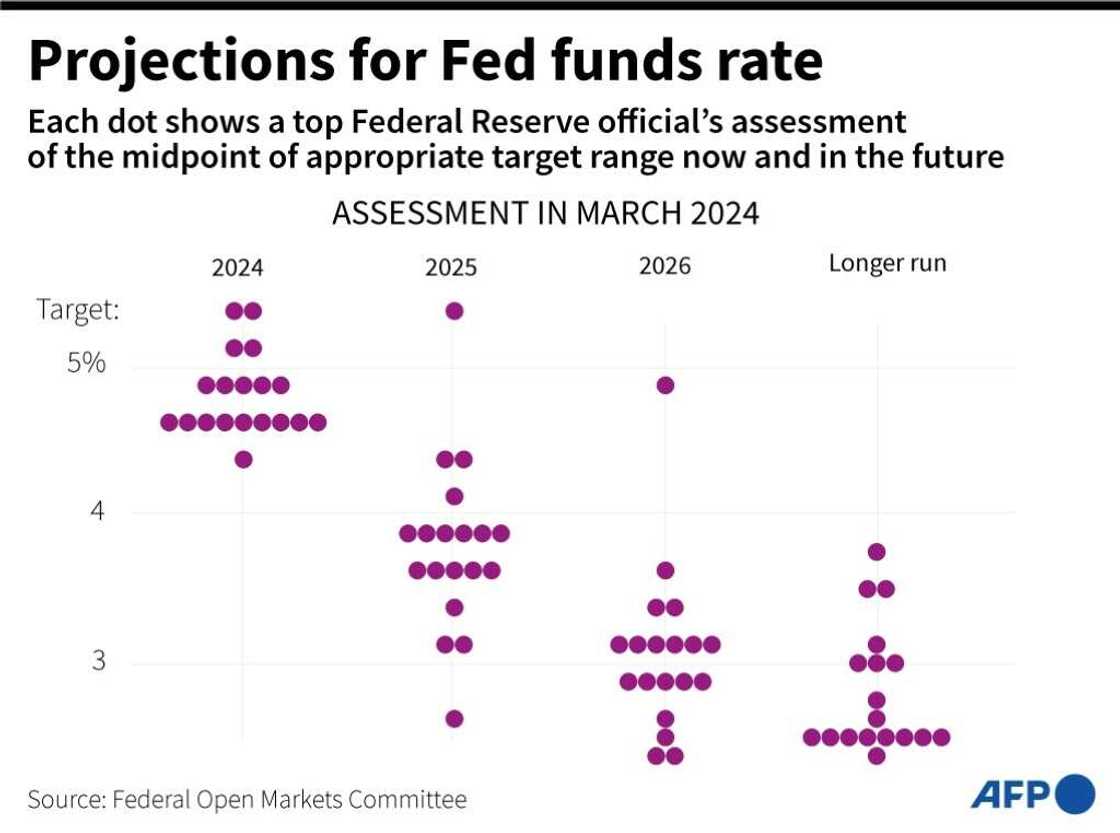

Most analysts expect the data since March will cause the FOMC's 19 members to lower the number of cuts they expect this year, bringing the median number down from three to two.

"At the June FOMC meeting, we see the Fed revising its outlook in favor of slower growth and firmer inflation," Bank of America economists wrote in an investor note published Friday.

"It should project two rate cuts this year and a cutting cycle that begins in September," they said, adding that the FOMC would likely need to see more evidence of disinflation before beginning to cut interest rates.

Fed chair Jerome Powell has repeatedly insisted that the Fed is "data-dependent" and will not be swayed by politics.

Nevertheless, a September start to rate cuts would thrust the Fed into the middle of a fractious presidential campaign between President Joe Biden and his Republican opponent, Donald Trump, who has previously questioned the US central bank's independence.

Cutting back

Source: AFP

Futures traders see almost no chance of a rate cut before September, according to data from CME Group.

In recent days, they have also sharply lowered their expectations of a September cut, assigning a probability of around 50 percent on Friday that the Fed would not start easing monetary policy before November.

This marks a dramatic shift from late last year, when the financial markets were pricing in as many as six interest rate cuts for 2024, with the first of them coming as early as March.

"At this juncture, there is little reason to think that the FOMC will prioritize downside risks to employment over the much more salient risk of sustained high inflation," economists at Barclays wrote in a recent investor note.

"As such, this should keep rates on hold for the next few meetings as the FOMC awaits evidence that (will) restore its confidence that inflation is moving sustainably toward the 2% target," they said, adding they still expect the Fed to make just one rate cut this year, most likely in December.

With the Fed almost certain to keep interest rates unchanged on Wednesday, analysts will closely scrutinize chair Powell's press conference after the decision is announced for any indication of when the first cut could come.

But with the data still painting a mixed picture, he is unlikely to rock the boat too much this week, according to Oxford Economics chief US economist Ryan Sweet.

"Powell will stick with the Fed's mantra that monetary policy is flexible and will respond as appropriate," he wrote in a recent investor note. "Therefore, it would be surprising if his presser altered our subjective odds of a cut in September."

PAY ATTENTION: Unlock the best of Legit.ng on Pinterest! Subscribe now and get your daily inspiration!

Source: AFP