“This Is Not a Good Time”: Expert Lists Reasons CBN’s 0.5% Cybersecurity Levy Is a Big Problem

- The CPPE has rejected the plans by CBN to impose a cybersecurity levy on bank customers' electronic transaction

- The move CBN believes will help provide the funds to build the necessary infrastructure to fight cybercrime

- Muda Yusuf, the CEO, told Legit.ng that the new levy will push more Nigerians into cash-based transactions

Legit.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

The Centre for the Promotion of Private Enterprise (CPPE) has described the newly introduced cybersecurity levy as another burden to Nigerian businesses that will impede economic growth, leading to job losses and inflation across the country.

Source: Facebook

In an interview with Legit.ng Muda Yusuf, the CEO of the CPPE, said the levy, in its present form, will cause hardship on citizens and a burden on investors.

He highlighted that businesses and investors are already burdened with many taxes, including education tax, value-added tax (VAT), company income tax (CIT), stamp duty, NITDA, and the Police Trust Fund. Additionally, impending levies such as the NYSC and tertiary health levies further compound the tax obligations.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Yusuf stressed that introducing the new levy contradicts the stance of the Presidential Committee on Fiscal Policy and Tax Reforms, which seeks to streamline taxes to foster a more favourable business environment.

His words:

“Businesses and the generality of citizens are yet to recover from the shocks of current reforms. Inflationary pressures have not abated, high cost of living is still a major worry, operating and production costs for businesses remain elevated, amidst weak consumer purchasing power. This is not a good time to impose an additional levy both on businesses and citizens.”

Read also

“Here are the issues”: Ammban speaks as deadline nears for banks to block accounts POS accounts

"Meanwhile, businesses are already saddled with the following federal taxes: Company Tax, Tertiary Education Tax, Stamp Duties, NITDA levy, Value Added Tax, NASENI Levy, Police Trust Fund Levy, among others. Still in works are NYSC Levy and Tertiary Health Levy. There are also a plethora of taxes and levies imposed by states and local governments.”

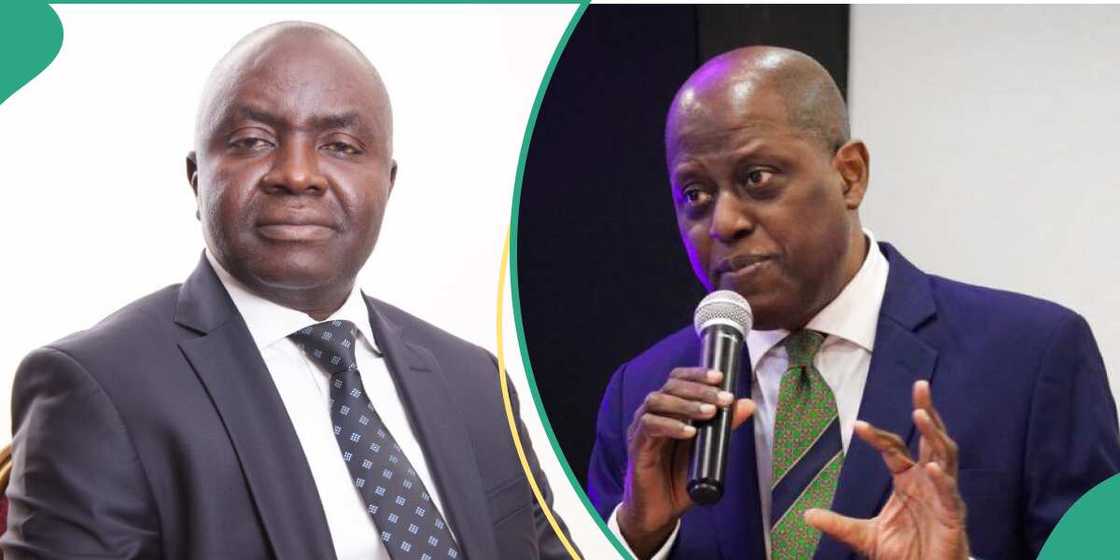

Muda Yusuf is not happy with the cybersecurity levy

Speaking further, Yusuf questioned the disproportionate magnitude of the levy compared to its intended objective.

He added:

"The cybercrime levy poses heightened concerns as it targets electronic transactions rather than profits, showing no consideration for the financial health of businesses. Even companies operating at a loss are subject to it, and it extends to all segments of society, regardless of their economic status, raising significant equity issues.

"Moreover, there's the issue of proportionality, which involves assessing the project's objectives against the revenue it aims to generate. For instance, in 2023, electronic payments on the Nigeria Interbank Settlement System (NIBSS) platform amounted to N600 trillion, with 0.5% of this totaling N3 trillion. Similarly, industry data from 2022, sourced from the CBN website, indicates electronic payments of N1550 trillion, with 0.5% equating to N7.75 trillion. Even after accounting for exemptions outlined in the law, the remaining figures remain substantial.

Read also

MSMEs struggle under high interest rates": CSED calls for efficiency through digital solutions

"Given these figures, it's challenging to justify allocating such a significant amount to combat cybercrime. This is particularly striking when compared to the total budget appropriation for defense and security (N3.2 trillion) and infrastructure (N1.32 trillion) in the 2024 budget, which are merely appropriations at this stage. Actual releases are often much less."

He also stressed that the cybercrime levy would affect CBN's cashless policy.

Man explains the CBN's 0.5% cybersecurity levy

Meanwhile, Legit.ng previously reported that a man explained the CBN's new 0.5% cybersecurity levy directive to commercial banks.

Sharing his thoughts on the new initiative, @OurFavOnlineDoc, a Nigerian medical professional in the diaspora, said it was "crazy at this point."

Lamenting on X, @OurFavOnlineDoc described it as mass financial stifling. He went on to break down what it meant for Nigerians.

PAY ATTENTION: Unlock the best of Legit.ng on Pinterest! Subscribe now and get your daily inspiration!

Source: Legit.ng