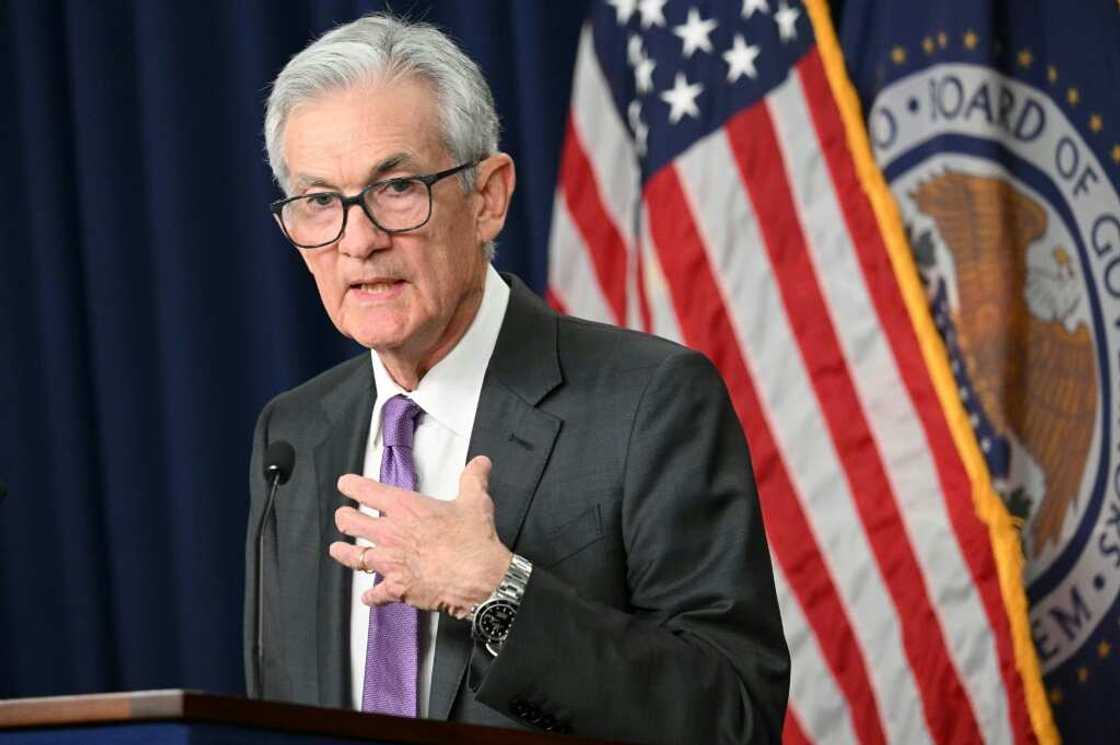

Cutting rates too soon could be 'quite disruptive': Fed's Powell

Source: AFP

The US Federal Reserve's high benchmark rate is "doing its job" against elevated inflation, chairman Jerome Powell said Wednesday, warning that lowering it too soon could be "quite disruptive" for the American economy.

The US central bank has held interest rates at a 23-year high of between 5.25 and 5.50 percent as it seeks to bring inflation firmly down to its long-term target of two percent.

Last month, Fed policymakers penciled in three rate cuts for this year, staying the course despite a recent uptick in inflation which has disrupted recent progress against rising prices.

Powell told a conference in California that the current risks to the US economy were "two-sided," with negative consequences for the economy if policymakers moved to cut rates too fast or too slow.

"The risk, though, of moving too soon, really is.. that inflation does move up," he said, adding it "would be quite disruptive if we were to have to then come back in."

But if the US economy continues to evolve as expected, most Fed participants still expect it will be "appropriate to begin lowering the policy rate at some point this year," he said.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

One cut in 2024?

Powell spoke shortly after Atlanta Fed President Raphael Bostic, who also sits on the central bank's rate-setting committee, told CNBC he now thinks policymakers should make just one rate cut this year, in the final quarter of 2024.

Bostic has been on a journey about the timing of cuts in recent months, moving from expressing reservations about early cuts to voicing cautious support for starting them by summer.

But the first few months of the year have seen an uptick in inflation, while both the economy and the labor market have shown signs of resilience, leading him to change his outlook once more.

"I've gone back to where I was before, because we've seen inflation kind of become much more bumpy in its trajectory," said Bostic, one of just 12 policymakers on the 19-person committee with a vote on monetary policy this year.

"We're just going to have to watch and wait and see how things evolve," he added.

If the economy continues to develop as expected, Bostic said it would be "appropriate" for the Fed to start cutting rates in the final quarter of this year.

"My outlook right now is that inflation is just really just going to drop incrementally through the course of 2024," he said, adding he did not expect the Fed to hit its long-term target of two percent before early 2026.

"I think we have time to be patient, and we can just watch the economy and see if that's how things actually play out," he said.

PAY ATTENTION: Donate to Legit Charity on Patreon. Your support matters!

Source: AFP